Markets

Local:

The ASX200 index had a strong gain of 5.47% over January.

Global:

The S&P 500 rose 2.8% over the month.

The Dow Jones Industrial Average performed well advancing 4.8%.

The Nasdaq Composite added 1.7%.

Large-cap Value had the best month among Russell 1000 and Russell 2000 equity styles, increasing 4.5% in January.

The pan-European STOXX 600 Index closed 0.9% higher in January, logging its 10th advance in the past 12 sessions.

Gold:

The price of gold surged 7.8% in January to US $2,812.10 per ounce in US Dollars amid intensification of a potential multinational trade war.

Iron Ore:

Iron ore price has remained steady since the end of 2024. Finishing the month at US $101.59 per/Mt.

Oil:

Brent crude oil rose 3.6% in January to $77.30 per barrel as of January 27th.

Property

Housing:

National dwelling values were steady in January (-0.03%) with the headline result weighed down by the capital cities, where values fell 0.2% as capital growth across the cities remains diverse. Monthly gains were led by a 2.0% increase in Perth, followed by strong rises of 1.4% in Adelaide and 1.1% in Brisbane. Monthly growth in Sydney was a mild 0.3%. Four capital cities saw a monthly decline in home values, led by a -0.4% dip in Canberra, -0.2% in Melbourne and Darwin, and a mild -0.1% fall in Hobart.

Dwelling values across the combined regional areas of Australia rose a further 0.4% in January, reaching new record highs. Three of the eight capitals recorded a decline in home values in January, with Melbourne recording the sharpest decline (-0.6%), followed by the ACT (-0.5%) and Sydney (-0.4%). Hobart home values were steady in January. Brisbane and Perth have continued to record growth in home values, but there has been a clear and steady loss of momentum in these markets.

Economy

Interest Rates:

At its December 2024 meeting the RBA decided to leave the cash rate target unchanged at 4.35%. Inflation has fallen substantially since the peak in 2022, as higher interest rates have been working to bring aggregate demand and supply closer towards balance.

Retail Sales:

Real retail sales rose 1.0% in Q4 2024, the second consecutive lift. Sales also rose in real per capita terms. Nominal sales fell -0.1% in December to finish the quarter up 1.4%.

Bond Yields:

Turning to the Australian bond market, even though hopes of a cash rate cut from the RBA as soon as February are growing, Australian government bond yields were relatively sticky in January with the 10-year bond yield rising by 7bps to 4.43%.

US 10-year Government bond yield continued to rise in January finishing the month at 4.58%.

Bitcoin:

Major cryptocurrencies had mixed performances in January. The price of Bitcoin surged 13.1% in January, breaking through the $100,000 barrier again to settle at $104,781.50 at the end of the month. Ethereum, on the other hand, slipped 3.3% to $3,248.51.

Exchange Rate:

The Aussie dollar fell slightly at the start of 2025 against both the American dollar, at $0.623, and the Euro at $0.614.

Inflation:

Australia: Quarterly consumer price inflation rose by 0.2% in the December quarter 2024, resulting in an annualised inflation rate of 2.4% over the twelve months to December 2024. The most significant price rises this quarter were Recreation and culture (+1.5%) and Alcohol and tobacco (+2.4%).

USA: The US inflation rate inched higher for the third straight month to 2.89%, while core inflation decreased slightly to 3.24%. The US Consumer Price Index rose 0.39% month over month, and US Personal Spending increased by 0.66%.

EU: The annual inflation rate in the Euro Area edged up to 2.5% in January 2025 from 2.4% in December, slightly above market expectations of 2.4%, a preliminary estimate showed. It was the highest inflation rate since July 2024, driven primarily by a sharp acceleration in energy costs (1.8% vs 0.1% in December).

Consumer Confidence:

The Westpac–Melbourne Institute Consumer Sentiment Index declined -0.7% to 92.1 in January, from 92.8 in December. The consumer mood has soured for two months in a row and remains on the pessimistic side. The survey results were also weaker later in the survey period than in the first two days. However, sentiment is still less negative than a year ago and some components suggest that consumers expect things to continue to improve from here.

Employment:

Australia: The seasonally adjusted unemployment rate remained unchanged in December 2024 at 4.0%. The participation rate also remained unchanged at 67.1%, with employment increasing to 14,573,800.

USA: Total nonfarm payroll employment rose by 143,000 in January, and the unemployment rate edged down to 4.0%. Job gains occurred in health care, retail trade, and social assistance. Employment declined in the mining, quarrying, and oil and gas extraction industry.

Purchasing Managers Index:

The S&P Global Australia Manufacturing PMI was revised higher to 50.2 in January 2025 from a preliminary of 49.8 and compared to 47.8 in December. The reading pointed to the first expansion in the manufacturing sector in a year, as output returned to growth, marking the first rise in production since November 2022. Results above 50 points indicate expansion, with higher results indicating a faster rate of expansion.

US Services PMI:

The S&P Global US Services PMI fell to 52.8 in January of 2025 from 56.8 in the previous month, missing market expectations of 56.5 to mark the softest pace of expansion in US manufacturing activity since April of last year, according to a flash estimate. Output expanded the least in nine months, as a contraction in export orders drove new business to rise at the softest pace in three months.

US Global Manufacturing PMI:

The seasonally adjusted S&P Global US Manufacturing Purchasing Managers’ Index™ (PMI®) moved back above the 50.0 no-change mark for the first time in seven months during January. At 51.2, the PMI was up from 49.4 in December and pointed to a modest improvement in the health of the sector at the start of the year.

Adviser Numbers:

Wealth Data recorded an increase of 22 advisers on the Financial Advisers Register in the week ending 23 January 2025, with adviser numbers now at 15,516.

Sources: ABS, AFR, AWE, BLS, CoreLogic, IFA, Macquarie MWM Research, RBA, TradingEconomics, UBS, Wealth Data

Comments

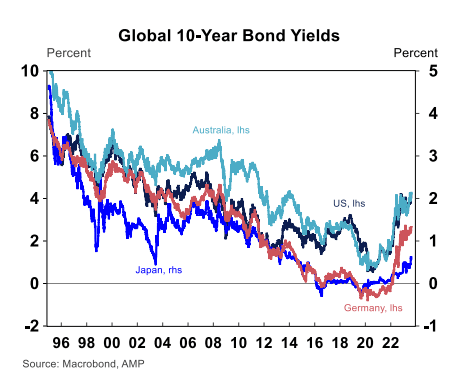

What the divergence in bond yields is showing for our biggest economies

The gap between the US and China’s borrowing costs has grown to its widest level in more than a decade, in a sign of the sharp divergence in the bond market’s expectations for the world’s two largest economies.

China’s 10-year bond yield plunged to a record low this month, while the Chinese currency traded in Hong Kong hit its weakest level against the U.S. dollar in more than a year.

The People’s Bank of China is “trying to cool down the market by suspending government bond buying,” said Larry Hu, chief China economist at Macquarie.

This has widened the gap between the two to more than 2.5 percentage points — the biggest since at least 2011. The move reflects concern that China’s economy has entered a deflationary spiral and the belief that US President-elect Donald Trump will enact aggressive fiscal measures to boost the US economy, which could increase its deficit.

This is the result of US-China decoupling,” said Ju Wang, head of China FX and rates at BNP Paribas, adding that the diverging economic performance of the two countries was partially explained by deglobalisation.

At the long end, the move has been particularly striking. In November 2024, the yield on 30-year Chinese government bonds fell below that of their Japanese counterparts. This drop in Chinese yields takes them below those of the country that has long been the benchmark for deflation and economic stagnation. The fear is that China may be on its way to a form of ‘Japanization’ – a repeat of the long period of weak growth and deflation that Japan suffered and only now seems to be emerging from.

As seen in the US, UK bond yields have also soared to multi-decade highs. Yields on UK government bonds have reached levels not seen in decades, with 10-year gilts reaching 4.90% – the highest since July 2008 – and 30-year yields climbing to 5.40%, a peak last recorded in August 1998. The pound also tumbled to a 14-month low against the dollar, falling below $1.23.

While some draw parallels to the market panic during Liz Truss’s short-lived premiership, analysts remain divided on whether this episode signals a broader crisis or a passing storm.

Rising inflation, increased fiscal spending, and a global bond sell-off have all contributed to higher yields. The 30-year gilt, in particular, has been hit hard, reflecting investor concerns about long-term inflationary risks and the sustainability of the UK’s public finances.

Implications of rising bond yields

Investors with accounts heavily weighted toward the stock market based on historically low bond yields may decide to shift more of their assets to bonds. Individual investors who purchased bonds when yields were lower may experience a negative impact on their personal accounts based on the declining bond market value.

Mortgage lenders often price their loans based on long-term treasury bond yields, making it harder for individuals and families to buy or refinance homes when bond yields are up. High yields also impact other common forms of personal debt like credit cards, auto loans, and small business loans, eating into disposable income and savings accounts at a time when inflation may already be reducing their buying power.

In conclusion, what this recent trend in bond yields has told us is that the Global economy is still on a tipping point, the news of higher than expected bond yields, would suggest that inflation continues to remain sticky and further dampens the hopes of rate cuts throughout 2025 for many of our largest economies.

Sources: AMP, DWS, Euro News, Financial Times, Macrobond

Future of Jobs Report 2025: global trends are shaping labour markets

As we enter 2025, the landscape of work continues to evolve at a rapid pace. Against this backdrop, the World Economic Forum’s Future of Jobs Report 2025 provides a comprehensive analysis of the interconnected trends shaping global and national labour markets. Drawing on insights from over 1,000 employers representing more than 14 million workers across 55 economies, the report identifies the major forces expected to redefine the global labour market by 2030.

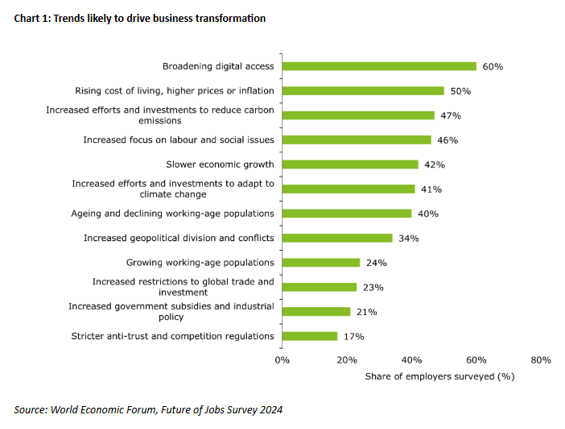

According to the report, broadening digital access is predicted to be the most transformative trend, with 60% of employers expecting it to impact their business by 2030. Within this trend, artificial intelligence (AI) and information processing are expected to be the most transformative technologies, with 86% of businesses anticipating their influence to be significant, followed by robotics and automation at 58%. These advancements will create demand for roles in AI, big data, and cybersecurity, with technological literacy emerging as one of the fastest-growing skills. However, for some roles nearly 40% of existing skills could become outdated by 2030, underscoring the urgency of upskilling and reskilling initiatives.

Economic pressures, including the rising cost of living, rank as the second-most transformative trend, with half of businesses highlighting its impact. While inflation is expected to ease, slower economic growth puts the growth potential of some sectors at risk. These challenges are increasing the focus on resilience, creativity, and adaptability as essential workforce attributes.

The green transition is also a major driver of change, with climate-change mitigation and adaptation influencing nearly half of businesses. This trend is driving demand for renewable energy engineers, environmental scientists, and electric vehicle specialists. In Australia, mandatory Environmental, Social and Governance (ESG) reporting requirements being phased in from 2025 will place a larger emphasis on environmental stewardship.

The report found Australia’s business leaders are particularly focused on addressing critical skills shortages, with 65% of employers identifying skills gaps as a key barrier to business transformation, just above the global average of 63%.

Additionally, 45% of Australian employers cite their inability to attract talent to the industry as another major challenge, higher than the global average of 37%. To address the increasing need for skilled talent, 45% of Australian respondents indicated they are hoping for changes to immigration policies to attract more global talent, compared to a global average of 26%.

The report’s findings are in line with The Australian Financial Review’s annual Chanticleer CEO Poll, which reveals that the country’s top chief executives are urging the government to overhaul its skilled migration program to meet labour market demands. This sentiment, however, stands in contrast to the platforms of both major political parties in the lead-up to the election.

As global megatrends unfold, Australia’s labour market will undergo significant transformation over the next five years. Businesses that prioritise innovation, flexibility, and collaboration may be best positioned to navigate these challenges.

Sources: Deloitte Access Economics, World Economic Forum

The information in this document is general advice only. Before acting on any of the general advice you should consider if it is appropriate for you based on your personal circumstances. Level One Financial Advisers Pty Ltd AFSL 280061.