Share Market Update

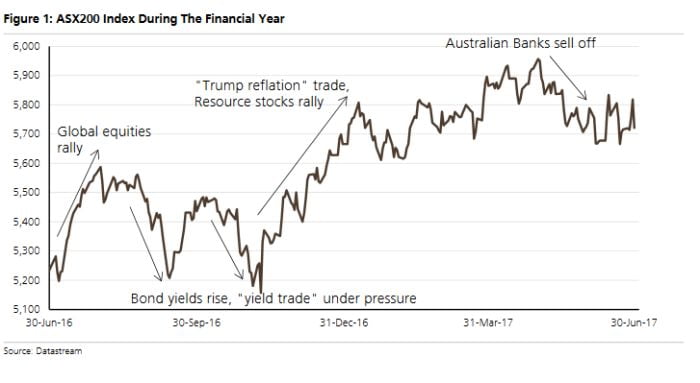

After a volatile start to the December quarter the ASX200 performed strongly to close the 2016 year at 5,665.80, up 229.9 points on the 30 September 2016 close of 5,435.90. This represents a gain of 4.23% for the December quarter.

Overall the 2016 calendar year was positive with the market increasing from 5,295.90 at 31st December 2015 to 5,665.80 on 30th December 2016 – a gain of 369.90 points or 6.98% for the twelve month period.

The overall positive performance of Australian and international equity markets this year belies high levels of volatility including the aftermath of the US presidential election and Brexit.

Brexit was the first major market mover in 2016. With financial markets pricing in a “remain” vote, the outcome of the British poll led to a violent sell-off in global equities. Similarly, with markets as well as bookies and pollsters anticipating Hillary Clinton would be the next US president, Donald Trump’s surprise win caught investors off guard and equity markets again plummeted.

Despite the markets’ initially negative response to these events, sustained and dramatic declines did not transpire as expected. Instead, equity markets went on to stage strong recoveries. Notably, in the US the “Trump bump” propelled the market to hit record highs.

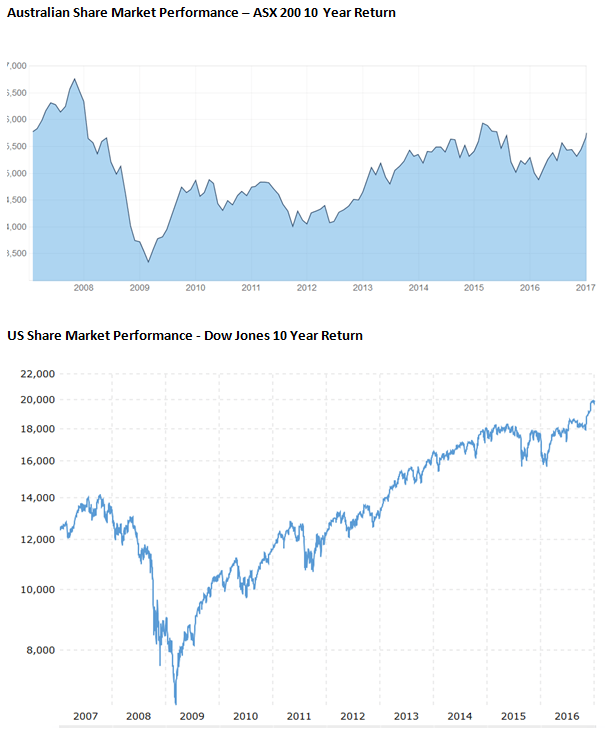

The US share market has run very strongly over the past 9 years. On 9th October 2007 before the Global Financial Crisis (GFC) the Dow Jones Index was 14,164.53 points. The market returned to this level again in March 2013. The Dow Jones hit a record high 19,974.62 on 20th December 2016 which is 41% above its pre-GFC high.

In comparison our market is currently still 21.31% below the market high when the ASX200 Index hit a record high of 6,873.20 on 1st November 2007, which is now over nine years ago. Refer to the ASX200 & Dow Jones 10 year performance graphs below.

Looking to the year ahead, we expect the Australian economy will continue to show signs of growth, albeit modest. We anticipate the Australian share market will be heavily influenced by global events including how and when the UK exits the European Union and how uncertainty surrounding the implementation of President-elect Trump’s election policies will playout.

Economic Update

Happy new (calendar) year! We hope that you had a great Christmas season and are ready to jump into 2017. Well, 2016 was interesting: Brexit, Trump and the biggest shake up in superannuation legislation we have seen since the 1990’s.

Over the course of 2016, the Australian economy continued to expand at a moderate pace, as transition drivers, particularly strong growth in dwelling investment, helped offset declines in mining investment.

While none of the growth factors, individually or concurrently, suggests that we are on the cusp of a return to the type of growth rates seen before 2008, they do suggest that the economy continues to rebalance from the downswing in the commodities boom. In particular, it is estimated that mining investment is approximately half way down from its peak of 8% of GDP and should reach pre-boom levels of 1.5% of GDP by late 2018. Consistently, while mining investment is still expected to subtract from growth over the near term, it is estimated that the trajectory after 2017 should be no steeper than what we have been accustomed to in recent years. Against this backdrop, the Australian economy is expected to centre on its current long-term potential growth of 2.7% in 2017.

In the labour market, the unemployment rate has declined a little further over recent months. While this suggests that labour market conditions have continued to improve, broader measures of labour market utilisation have indicated otherwise. In particular, following strong growth in late 2015, employment growth has slowed to a more modest pace and the increase in employment since then has been heavily skewed towards part-time jobs, reflecting the rebalancing of activity towards the services sector. Approximately 45% of employment in household services is part-time while the share for business services is 25%. This compares with a share of just 3% in the mining sector.

Consequently, the weakness in wage growth could imply that underlying inflation will remain below target for some time.

In the housing market, dwelling investment, particularly the construction of higher-density dwellings (apartments), continues to grow at an above-average rate. While the pipeline of residential work is expected to support a high level of dwelling investment for some time, the rate of growth in dwelling investment is expected to moderate over the next two years.

From a monetary policy perspective, the Reserve Bank of Australia (RBA) is expected to remain data dependent as they gauge the impact of the two rate cuts delivered in 2016.

Although the heat in the housing market has largely been confined to Sydney and Melbourne, the record high household gearing levels still counts strongly against the RBA providing further cuts until they feel more confident in their judgments around the housing and labour market. The RBA kept rates on hold throughout the last quarter of 2016 and won’t meet again until February 2017. Governor Philip Lowe echoed his predecessor and remained consistent in the watch and wait strategy adopted throughout much of 2015 and 2016.

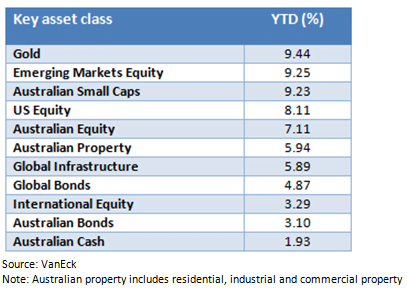

Despite the political complexities globally, 2016 was largely a positive year for markets with key asset classes experiencing positive returns (see below). Although we expect the volatility in markets to continue we believe this presents some good buying opportunities for long term investors.

Property Market Update

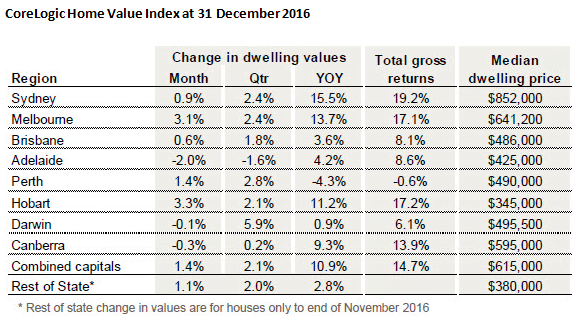

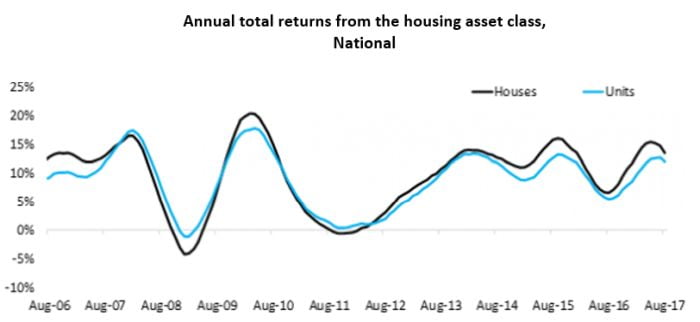

Capital gains accelerated over the past year, taking the calendar year growth rate to the fastest pace since 2009. December 2016 saw capital city dwelling values rise by 1.4%, taking the annual capital gain for 2016 to 10.9%; the highest growth rate for a calendar year since 2009. Factoring in gross rental yields and capital gains, housing as an asset class, earned a total annual return of 14.7% based on the combined capital cities index results.

Across Australia’s capital cities, the annual change in dwelling values for 2016 ranged from -4.3% in Perth to 15.5% in Sydney, with Melbourne and Hobart also showing annual capital gains higher than 10%.

Capital city growth rates have also shown a growing divergence between the broad housing product types. Over the past twelve months capital city house values have risen by 11.6%, while unit values have increased by roughly half the pace at 5.9%.

The divergence in growth rates is the most distinct in Melbourne and Brisbane, where concerns around unit oversupply have eroded buyer confidence. Melbourne house values are up 15.1% over the year compared with a 1.7% rise in unit values, while Brisbane house values are 4.0% higher over the year, with unit values falling by -0.2%.

Australia’s regional housing markets generally did not experience the same growth conditions as the capital cities, with annual growth to November recorded at 2.8% across the combined regional markets. Regional New South Wales showed the strongest growth conditions, with non-capital city house values rising 7.3% over the 12 month period to November 2016. The remaining rest-of-state regions showed relatively sedate conditions, with values rising by half a per cent across regional Victoria, 1% across regional Queensland and 1.1% across regional South Australia. Regional Western Australia recorded a 7% fall in house values over the year.

Regional areas with intrinsic ties to the mining and resources sector have continued to record weaker housing market conditions since the end of the mining infrastructure boom, with Perth and Darwin recording the weakest housing market conditions across the capital cities.

Since values peaked in these markets during 2014, values have fallen by a cumulative 7.9% in Perth and 5.9% in Darwin. More recently both these markets have shown signs of moving through the low point of their respective downturns, with values rising by 2.8% and 5.9% respectively over the final quarter of 2016.

Based on the annual housing market results, it is clear that housing markets across Australia have responded to regional differences in economic and demographic trends; strong population growth and economic activity have driven value growth in Sydney and Melbourne, however, more recently strong growth trends have spread to Hobart and Canberra, as well as many of the coastal and lifestyle markets where values are now also rising swiftly.

Post Global Financial Crisis, the CoreLogic index results show that Sydney’s dwelling values have almost doubled, rising by 97.5% since January 2009, whilst Melbourne dwelling values have increased by 83.5% over the same time frame. Every other capital city has seen dwelling values rise at substantially lower rates over this period, highlighting just how strong the Sydney and Melbourne housing market conditions have been over the past 8 years.

Sydney-siders saw dwelling values increase by approximately $10,000 per month over the past year, creating a significant boost in wealth for home owners; at the same time we’ve seen mounting affordability challenges for aspiring home owners.

The recent CoreLogic Housing Affordability Report shows Sydney dwelling prices were 8.3 times higher than annual household incomes and households were dedicating an average of 44.5% of their income to service a mortgage (based on an 80% loan to valuation ratio and the average discounted variable mortgage rate).