Market Review

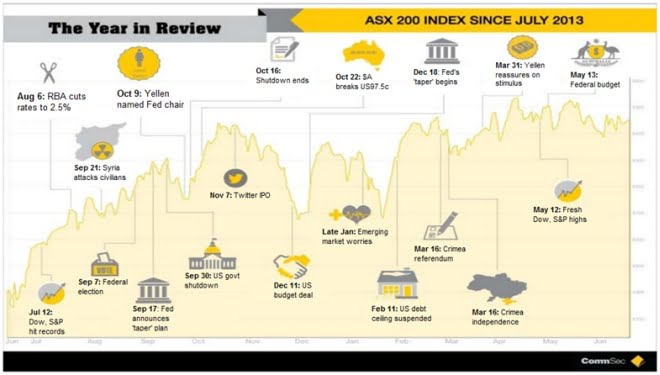

The first quarter for the 2014 / 2015 financial year was negative with the ASX/200 closing at 5,292.80 on 30 September 2014. The ASX/200 finished the previous quarter (30/06/2014) at 5,395.70 which is a loss of 102.90 points or -1.91%.

Whilst July was very positive for the ASX/200 (up 4.23%) August was flat (up 0.04%) and September saw the Australian share market record its worst month in more than two years (down 5.92%). The drop was sparked by a heavy sell-off in the big four banks and the mining sector. September 2014 was the biggest monthly loss for the ASX 200 since it dropped 7.3% in May 2012.

The Australian share market is now trading below the level at which it started in 2014. The dramatic falls in the value of the dollar and iron ore have combined to pull the Australian Share Market down.

The Australian dollar dropped nearly 7% to end the month around US87.5¢, or below the key psychological threshold of US90¢.

The iron ore price sunk to a new five-year low on 29th September closing the session at $US77.70 a tonne, down 1.1% from its previous close of $US78.60 and its lowest level since September 2009. September saw the iron ore price drop 11.5% from $US87 a tonne on September 1. The iron ore price is now down about 43% for 2014.

The increasing expectation that the United States Federal Reserve will start lifting interest rates in 2015 saw foreign investors taking money from the local market. This saw yield stocks (in particular the banking sector) and the Australian dollar fall. The government’s Financial Services Inquiry also provided uncertainty for the banking sector which basically created a perfect storm.

All of the Big 4 banks are now down more than 10% from their recent peaks. September was the worst month for bank stocks since May last year, when the US Federal Reserve first revealed its intentions to tapering its $US80 billion per month stimulus program.

But it’s not all bad news.

For months we’ve been hearing that a correction is overdue and here it is. For the long term investor now is the time to drip money in to the market.

At 30th September 2014 the yields for the Big 4 banks were as follows:

| Stock | Grossed Up Dividend Yield at 30/09/2014 |

|---|

| ANZ | 8.06% |

| CBA | 7.61% |

| NAB | 8.63% |

| Westpac | 7.93% |

In comparison the average 6 month term deposit rate is 3.30%. Obviously there is more risk involved in investing in shares than there is in term deposits however the income reward is significant and hence yield stocks will still be sought after investments.

The falling iron ore price is not affecting the big miner’s expansion plans. Rio Tinto is set to push ahead with a new mine expansion at its flagship Pilbara iron ore division. Rio has sought permission from federal regulators in recent days to build a new brownfields mine next to its Yandicoogina iron ore mine in the Pilbara. Named the Yandicoogina Pocket and Billiard South mine, the project is expected to last for 16 years and produce about 70 million tonnes per year during that period. The proposed mine would begin production in 2017 if approved.

The move comes amid a supply glut in iron ore markets, after several years of rapid expansion by Rio, BHP Billiton, Fortescue Metals Group and Brazilian mining giant Vale.

BHP’s marketing president Mike Henry has said that “what is unfolding in the iron ore sector was exactly as the major miner had predicted. It’s less about the demand side drivers than it is about supply side drivers. Over the past year you have seen a lot of new low cost supply come to market and as that happens, as production does a better job of keeping up with demand, we are seeing prices revert back to more normal levels.

Japanese trading house Mitsui is also firmly backing the expansion of high quality iron ore and coal projects in Australia despite the negativity sweeping the industry. Mitsui Australia chairman and chief executive officer Yasuhi Takahashi has also flagged excess supply as the reason for the fall in commodity prices and not the waning in demand. They expected prices to rebound from this low point in the cycle.

Economic Update

The cash rate has again remained steady at 2.5% with The Reserve Bank of Australia once again implying a long term period of stability in interest rates.

Since the first of September the Australian dollar has fallen from US93.29¢ to as low as US86.84¢. That is close to 7% for the month. The Singapore dollar, Canadian dollar, Swiss franc, European euro, British pound, South African rand, Malaysian ringgit, Chinese yuan, Japanese yen and Thai baht have all strengthened against the Aussie for September to date, with only the New Zealand dollar and Brazilian real weakening.

Whilst Australian exporters are jumping for joy, end of year holiday makers are looking on in dismay. Unless of course you are jumping the ditch or fancy a South American sojourn.

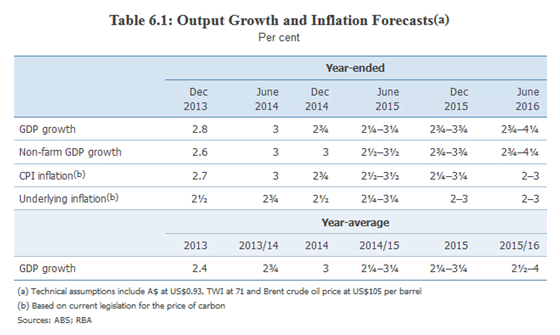

Over the quarter Australia’s GDP rose 0.5%, beating market expectations and driven by consumption and private investment amid weakening exports.

Compared with the second quarter of 2013, our economy advanced 3.1% in the April to June period of 2014. Mining (1.2% points), financial and insurance services (0.6% points) and construction (0.5% points) were the largest contributors to total trend of growth. Professional, scientific and technical services (-0.3% points) and transport, postal and housing (-0.2% points) were the largest detractors in trend terms.

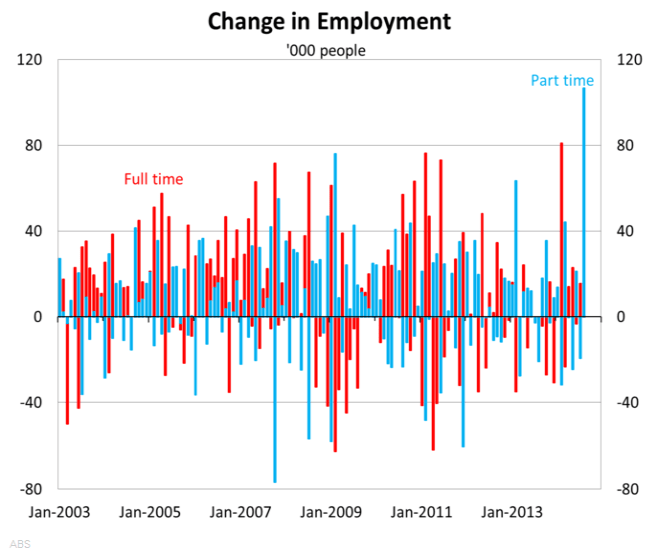

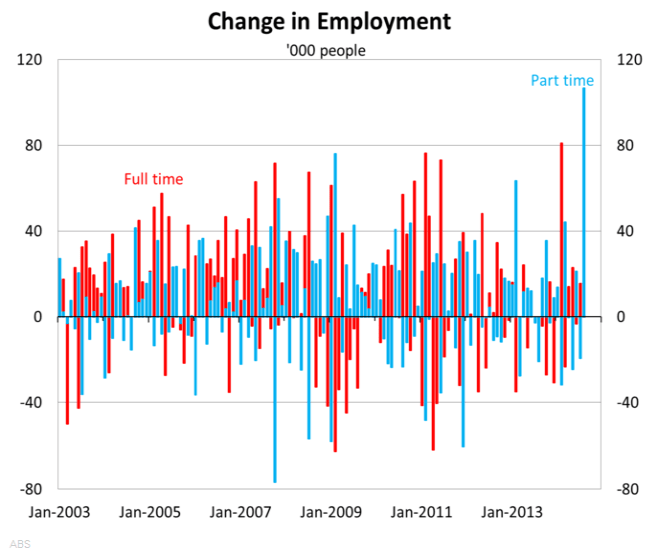

Unemployment across the quarter was a little volatile, surprising some economists; with July increasing to 6.4%, August falling to 6.1% and September closing out at 6.1%. The Australian Bureau of Statistics suggests that the labour market remains weak and unemployment is likely to remain around or above 6% for months to come.

The unemployment index has been a closely monitored macroeconomic indicator over the past year for many Australians as confidence across household sectors is impacted by job security and availability.

The volatility in the unemployment rate can be explained somewhat as we have seen the largest surge in part-time employment arrangements since the mid-1980s during August. The increase was so large that the Australian Bureau of Statistics extensively checked their figures before releasing its result. The main drivers behind this shift are our ageing population and acceptance of more flexible working arrangements. More mature workers are reducing their employment hours, rather than just ceasing work altogether in the lead up to retirement. Similarly, the workforce is becoming more adaptable and accepted of job sharing which is proving an increase in the utilisation of persons aged 25 and over.

The changes in full-time and part-time rates are illustrated below:

Property Market Update

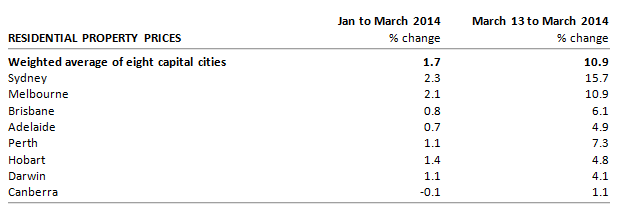

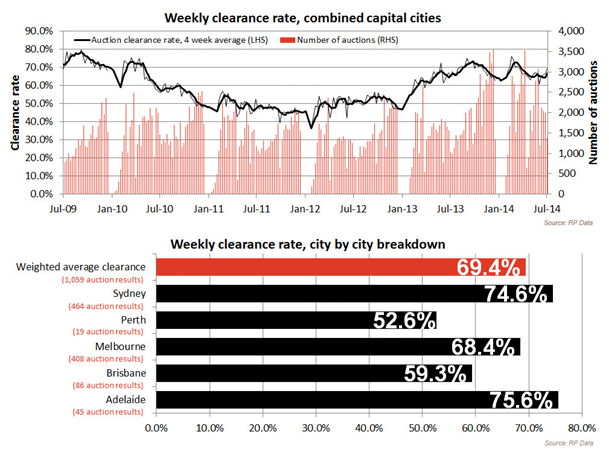

The first six months of 2014 have shown a mixed performance across Australia’s capital city housing markets. According to the RP Data–Rismark Home Value Index, values across the combined capital cities have increased by a cumulative 3.3% over the first half of the year. The first quarter was substantially stronger than the second quarter, with values up 6.5% over the three months ending March 2014 compared with a 0.2% fall over the June quarter.

Based on data for the most recent quarter it appears that capital gains across the housing market are slowing down following two years of growth. The market started its growth phase back in 2012 and over the past two years we have seen a cumulative capital gain of 15.5% across the nation.

To date, the most substantial growth conditions have been recorded across the Sydney housing market where dwelling values have moved 23.1% higher since June 2012 and 5.5% higher over the first half of 2014. Sydney’s long-term growth cycle has been relatively weak, with dwelling values rising by just 3.4% per annum over the past decade.

Housing affordability in Sydney remains an issue, with the median house price now around the $800,000 mark.

The second highest capital gain over the first half of 2014 was recorded in Hobart, where dwelling values have moved 4.2% higher. The rise in values across Australia’s most affordable capital city come after a substantial correction; even with the recent capital gain, Hobart dwelling values remain 8.3% below their previous 2009 peak.

Melbourne’s housing market has recorded the third highest capital gain over the first half of 2014, with dwelling values up 2.9%. The six-monthly rate of growth is a substantial slowdown from the frothy conditions of 2009 and 2010 where the rolling six-monthly rate of capital gain peaked at 12.2% in November 2009. Melbourne’s long-term growth cycle has been much stronger than Sydney’s with dwelling values rising by 5.8% year-on-year over the past decade. Such strong value gains at a time when rental rates aren’t rising anywhere near the same pace has compressed rental yields substantially where houses are returning a typical gross yield of just 3.4% and units are providing a slightly higher 4.3% yield.

Brisbane’s housing market has recorded the fourth highest rate of capital gain so far this year with dwelling values moving 2.3% higher. Brisbane’s housing market has been a relatively soft performer since the end of 2007 with the rate of capital gain substantially underperforming the capital city average over the past two growth cycles. The weak performance has seen a substantial valuation gap open up between Brisbane and the other major capital cities. Additionally, rental yields are much healthier than what is being recorded in Melbourne and Sydney, with houses returning an average gross yield of 4.5% and units providing a higher 5.4% gross yield.

Darwin dwelling values have risen by 1.9% over the first half of the year, the fourth highest gain across the capital city markets. Over the long term, the Darwin housing market has provided the highest annual rate of capital gain, with values rising, on average, by 8.4% per annum over the past decade. Despite the strong long-term capital gains, Darwin rental yields remain the highest of any capital city at 6.1% gross for houses and 5.9% gross for units.

Canberra’s housing market has slowed substantially over the second half of 2013 and first half of 2014. Dwelling values were 1.5% higher over first half of 2014 and rental markets have started to track backwards.

Adelaide dwelling values have been virtually flat over the 2014 year to date, up by just 0.8%.

Perth’s housing market moved through the peak of its growth phase late last year, with dwelling values moving 0.1% lower over the first half of 2014. Despite the recent slowdown, the Perth market has seen one of the strongest cumulative rates of capital gain over the current cycle, with dwelling values up 15.2% since bottoming out in late 2011.

RP Data’s view is that the rate of capital gain will continue to taper over the second half of 2014. Perth and Canberra have already moved through the peak of their growth cycle, while Melbourne and Sydney are also likely to have recently moved through the peak of their cycle. The capital city markets to watch are likely to be Brisbane and Hobart where growth conditions have been comparatively sedate, rental yields are much healthier and affordability hurdles are less of an issue.

Interestingly market gains have been significantly driven by a lack of supply and foreign buyers. The foreign buyers are getting a lot of attention in the press but nationally we still have a shortage of approximately 100,000 dwellings for people to live in. Of this number New South Wales makes up over 50%. Hence the growth in the Sydney and surrounding markets.

Source RP Data