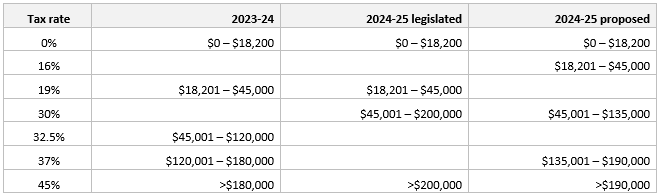

Stage 3 personal income tax cuts redesigned

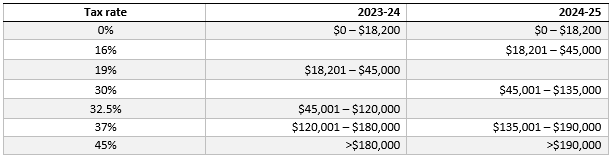

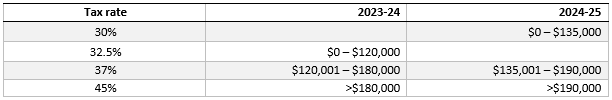

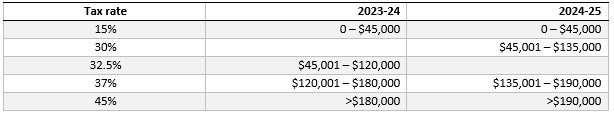

The personal income tax cuts legislated to commence on 1 July 2024 will be realigned and redistributed under a proposal released by the Federal Government.

After much speculation, the Prime Minister has announced that the Government will amend the legislated Stage 3 tax cuts scheduled to commence on 1 July 2024. Relative to the current Stage 3 plan, the proposed redesign will broaden the benefits of the tax cut by focusing on individuals with taxable income below $150,000. If enacted, an additional 2.9 million Australian taxpayers are estimated to take home more in their pay packet from 1 July.

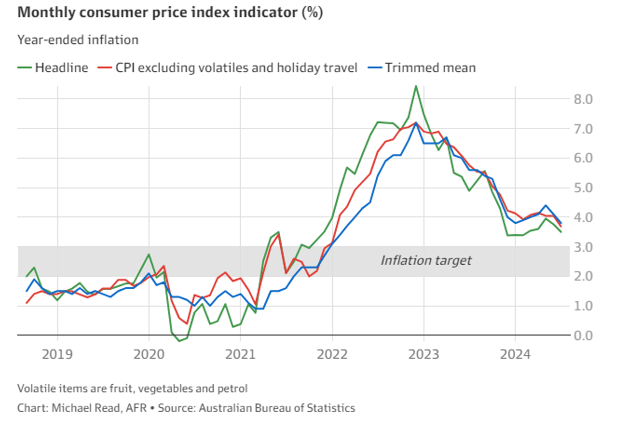

It’s not how Stage 3 of the 5 year plan to restructure the personal income tax system was supposed to work, but a sharp escalation in the cost of living has reshaped community sentiment. As the Prime Minister said, “we are focused on the here and now” and by default, not on long term structural change.

The redesign will increase Government revenues from personal income tax by an estimated $28 billion to 2034-35 as bracket creep takes its toll.

What will change?

The revised tax cuts redistribute the reforms to benefit lower income households that have been disproportionately impacted by cost of living pressures.

Under the proposed redesign, all resident taxpayers with taxable income under $146,486, who would actually have an income tax liability, will receive a larger tax cut compared with the existing Stage 3 plan. For example:

- An individual with taxable income of $40,000 will receive a tax cut of $654, in contrast to receiving no tax cut under the current Stage 3 plan (but they are likely to have benefited from the tax cuts at Stage 1 and Stage 2).

- An individual with taxable income of $100,000 would receive a tax cut of $2,179, which is $804 more than under the current Stage 3 plan.

However, an individual earning $200,000 will have the benefit of the Stage 3 plan slashed to around half of what was expected from $9,075 to $4,529. There is still a benefit compared with current tax rates, just not as much.

There is additional relief for low-income earners with the Medicare Levy low-income threshold increasing by 7.1% in line with inflation. It is expected that an individual will not start paying the Medicare Levy until their income reaches $26,000 and will not pay the full 2% until $32,500 (for singles).

While the proposed redesign is intended to be broadly revenue neutral compared with the existing budgeted Stage 3 plan, it will cost around $1bn more over the next four years before bracket creep starts to diminish the gains.

It’s not a sure thing yet!

The Government will need to quickly enact amending legislation to make the redesigned Stage 3 tax cuts a reality by 1 July 2024. This will involve garnering the support of the independents or minor parties to secure its passage through Parliament – Parliament sits from 6 February 2024.

How did we get here?

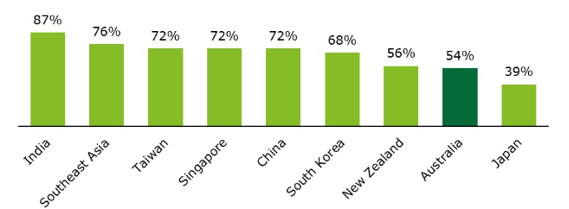

First announced in the 2018-19 Federal Budget, the personal income tax plan was designed to address the very real issue of ‘bracket creep’ – tax rates not keeping pace with growth in wages and increasing the tax paid by individuals over time. The three point plan sought to restructure the personal income tax rates by simplifying the tax thresholds and rates, reducing the tax burden on many individuals and bringing Australia into line with some of our neighbours (i.e., New Zealand’s top marginal tax rate is 39% applying to incomes above $180,000).

The three point plan introduced incremental changes from 1 July 2018 and 1 July 2020, with stage 3 legislated to take effect from 1 July 2024.

What now?

If you have any concerns about the impact of the proposed changes, please call us to discuss.

For tax planning purposes, for those with taxable income of $150,000 or more, the redesigned Stage 3 tax cuts offer less planning opportunity than the current plan. But, any change in the tax rates is an opportunity to review and reset to ensure you are taking advantage of the opportunities available, and not paying more than you need.

More information

- Tax cuts to help with the cost of living

- Tax cut calculator

- Treasury: Advice on amending tax cuts to deliver broader cost-of-living relief

- Government: Fact sheet

Can my SMSF invest in property development?

Australians love property and the lure of a 15% preferential tax rate on income during the accumulation phase, and potentially no tax during retirement, is a strong incentive for many SMSF trustees to dream of large returns from property development. We look at the pros, cons, and problems that often occur.

An SMSF can invest in property development if trustees ensure the investment complies with the rules. And, there are a lot of rules. A key is the sole purpose test. Trustees need to ensure the fund is maintained to provide benefits for retirement, ill health or death. Breaches of this fundamental tenet are serious and include the loss of the fund’s concessional tax treatment and civil and criminal penalties.

By its nature property development is high risk and fund trustees need to ensure that the SMSF is not simply a handy cash-cow for a pipe dream, particularly when the developers are related parties.

There are multiple ways an SMSF can invest in property development if the investment strategy of the fund allows:

- Directly developing property

- An ungeared unit trust or company (the parties can be related)

- Investment in an unrelated entity

- A joint venture

Directly developing property from fund assets

An SMSF can purchase land from an unrelated party and develop the property in its own right. Common issues that often arise include:

Acquiring the land from a related party – An SMSF cannot purchase land from a related party (unless it is business real property used wholly and exclusively in a business). This means that the lovely block of land inherited by one of the members, or owned by a family trust, that is perfect for development cannot be purchased by the SMSF.

An SMSF cannot borrow to develop property – An SMSF can borrow money to purchase land using a limited recourse borrowing arrangement but it cannot use a loan to improve the asset. That is, borrowings cannot be used to develop the land. And, where the SMSF has borrowed to purchase land, it cannot change the nature of that asset until the loan has been repaid. That is, no development.

Who will develop the property? – Problems often occur when the property developers are related to the fund members. Whilst it is possible to engage a related party builder to undertake the work, there are strict rules that mean that the work and materials must be acquired at market value. That is, there is no advantage from “mates rates”. If you are using a related party builder, ensure that the paperwork is pristine, any transactions are at market value, and all interactions are documented.

GST might apply – Goods and services tax might apply to the development and the sale of any developed property. If the ATO considers that an SMSF is in the business of developing property or is undertaking a one-off development in a commercial manner then GST could potentially apply.

If your SMSF is not undertaking a property development project in its own right, there are a few ways for an SMSF to invest in property development projects:

Related ungeared trust or company

An ungeared company or trust is often used (under SIS Regulation, section 13.22C) when related parties want to invest in a property development together. The SMSF can invest in a company or trust that is undertaking a property development as long as the company or trust:

- Does not lease to a related party (unless business real property)

- Does not borrow money or have borrowings (must be ungeared)

- Does not conduct a business

- Conducts any dealings at arm’s length

- And, the assets of the unit trust or company:

- Do not include an interest in another entity (i.e., cannot have shares in a company)

- Do not have a charge over them (i.e., mortgage over any asset)

- Are not purchased from a related party (or was ever an asset of a related party) unless the asset is business real property acquired at market rates.

See section 13.22C for full details.

Profits from the company or trust are then distributed to the SMSF according to its share.

Using the provisions of 13.22C means that the SMSF can invest in property development with a related party without the development being considered an in-house asset. However, if the criteria are not met (at any point), the in-house asset rules apply, and the SMSF might have to sell the units in the trust or shares in the company to return to the maximum 5% in-house asset limit. Generally, this means the sale of the underlying property or a significant restructure.

Problems arise with 13.22C arrangements where the trust or company:

- Needs more money to complete the development and borrows money, or issues more units and sells them (is in business)

- Accepts a loan from a member of the SMSF

- Overdrafts (may be considered loans and breach 13.22C)

- Uses a related party builder who either under charges for the work completed or overcharges and strips the profits that should have been returned to the SMSF.

Warning on conducting a business

One of the criteria for the exemption in 13.22C to apply is that the trust or company cannot be conducting a business. This requirement may prevent short-term property developments that are built and sold for profit.

Typically, 13.22C arrangements are used for long term investments where the development enables the creation of an asset that is then leased by the trust or company. This could be commercial premises leased to a related or unrelated party (e.g., premises for a child care centre or manufacturing), or residential premises leased to unrelated parties (e.g., townhouses or small developments).

Unrelated property developments

Investing in unrelated entities for a property development is attractive as there is no limit to how much of the fund’s assets can be invested (subject to the investment strategy and trust deed allowing the investment), and unlike ungeared entities, the entity is able to borrow money/place charge over the assets.

Where related parties are investing in the same entity, there are rules governing the percentage of ownership the SMSF and their related parties can hold. To meet the definition of unrelated entity for in-house asset purposes, the SMSF and their related parties must not own more than 50% of the units available. This is because the SMSF cannot control or hold sufficient influence over the entity and remain an unrelated entity. If the ATO considers the entity is related to the SMSF, then it would become a related party and the investment an in-house asset.

Joint venture arrangements

An SMSF can potentially invest in a joint venture (JV) property development, but the criteria are necessarily strict and there are a range of issues that need to be considered carefully. One of the issues that needs to be considered up-front is determining the substance of the arrangement between the parties, because the term JV can be used to describe a variety of arrangements. The ATO confirms that care must be taken to ensure that arrangements with related parties are true JVs.

Under a JV, the SMSF invests in and has a share of the property being developed (not the entity undertaking the development). Each party bears the costs (time and/or money) of the JV and receives this same proportionate contribution from the returns. If the arrangement is not structured properly then the SMSF’s stake in the JV could be treated as an investment in or loan to a related party and be treated as an in-house asset. For example, this could be the case if the SMSF only provides a capital outlay for the arrangement and has no rights other than a contractual right to a return on the final investment.

It is also necessary to consider whether the arrangement between the parties could be treated as a partnership for tax, GST and legal purposes. For example, this could be the case if the arrangement involves the sharing of income, sale proceeds or profits, rather than sharing the output from the project.

It’s essential to get advice well in advance – tax, legal and financial – before pursuing a JV.

Is your SMSF the best vehicle for property development?

Trustees need to carefully consider any investment decisions and have a sound rationale for the investment.

Any advice on a property development needs to be from a licensed financial adviser. A lawyer should be used for any contracts or agreements between parties. And, compliance assistance from a qualified accountant.

Contractor or employee?

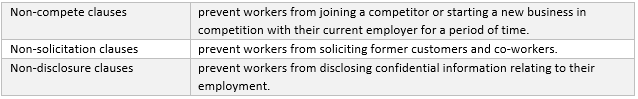

Just because an agreement states that a worker is an independent contractor, this does not mean that they are a contractor for tax and superannuation purposes, new guidance from the ATO warns.

Where there is a written contract, the rights and obligations of the contract need to support that an independent contracting relationship exists. The fact that a contractor has an ABN does not necessarily mean that they have genuinely been engaged as a contractor. The ATO says that “at its core, the distinction between an employee and an independent contractor is that:

- an employee serves in the business of an employer, performing their work as a part of that business

- an independent contractor provides services to a principal’s business, but the contractor does so in furthering their own business enterprise; they carry out the work as principal of their own business, not part of another.”

Contracts over time

The ATO points out that a contracting agreement at the start of a relationship may not continue to be one over time. For example, if the project the contractor was engaged to complete has finished, but the worker continues working for the company then the classification needs to be revisited.

What happens if there is no contract?

If no contract exists, then it’s important to look at the form and substance of the relationship to come to a reasonable position about whether an employment or contractor relationship exists.

The problem when the evidence doesn’t match what the taxpayer tells the ATO

A recent case before the Administrative Appeals Tribunal (AAT) highlights the importance of ensuring that the evidence supports the tax position you are taking.

The case involves heritage farmland originally purchased for $1.6m that sold 7 years later for $4.25m and the GST debt that the ATO is now pursuing on the sale.

In 2013, the taxpayer purchased Sutton Farms in Western Australia – 1.47 hectares consisting of an uninhabitable homestead, large barn and quarters.

Over the course of 7 years, the taxpayer rezoned the property, obtaining conditional subdivision approval to subdivide the property into four lots with plans for a further subdivision into approximately 15 lots, as well as undertaking sewerage, water and electrical works. The work was supported by a $1m loan from a bank and a further $1.5m from his brother-in-law.

While the property was never used for this purpose, the taxpayer’s stated intention was to use the property as their home, gift the subdivided lots to his daughter and son for use as their own respective residences, and use the last subdivided lot as a memorial dedicated to another child who had passed away.

Without being subdivided, the property was eventually sold at a profit as a single lot in 2020 for $4.25m.

When the ATO audited the transaction and issued an assessment notice for GST on the sale transaction, the taxpayer objected. The taxpayer’s argument was that Sutton Farms was intended to be used as a family home and the subdivision application had no commercial purpose. Therefore, GST should not apply as the sale was not made in the course of an enterprise. However, there were a number of factors and inconsistencies working against the taxpayer’s argument:

- Local media articles that outlined the taxpayer’s plan to commercialise the property, “with the plans to lease it out as a restaurant, wine bar or coffee house, turn the barn into an art studio and add 8 – 10 finger jetties in the canal adjacent.”

- Statements made to the ATO during the objection stage of the dispute indicating that the taxpayer intended to subdivide the property to sell some of these lots to repay loans owed to the taxpayer’s brother-in-law; and

- GST credits were claimed on the original development costs. The taxpayer’s accountant also made representations to the ATO stating that the GST credits were claimed because the intended subdivision and sale of the several lots within the property amounted to an enterprise.

The problem for the taxpayer is that although he did not develop the property in the way he originally intended and ended up selling the property as one lot, through the ownership period he acted as if the project was a commercial venture with a stated commercial outcome.

The importance of objective evidence

Determining the tax treatment of a property transaction can sometimes be a difficult exercise and there are a number of factors that need to be considered. This will often include the intention or purpose of the taxpayer when acquiring a property. However, merely stating your intention isn’t enough, it needs to be supported by objective evidence. This might include loan terms, correspondence with advisers and real estate agents, the way expenses have been accounted for, or the conversation you have with a journalist.

Quote of the month

“…no matter what life throws at you, seek out opportunities to contribute, to participate and to action change….have a crack, and as I like to say, don’t just lean in, leap in.”

Joint Australian of the Year 2024 Richard Scolyer

Note: The material and contents provided in this publication are informative in nature only. It is not intended to be advice and you should not act specifically on the basis of this information alone. If expert assistance is required, professional advice should be obtained.