Share Market Review

The Australian share market has suffered its worst quarter in four years, with the ASX/200 closing at 5,021.60 points on 30th September 2015. The ASX/200 finished the previous quarter (30/06/2015) at 5,459 which equates to a drop of 437.4 points or 8.01%. It marks the worst quarter since the European debt crisis in 2011, when the share market fell 13%. The downfall has been led by the global themes of China and US interest rates.

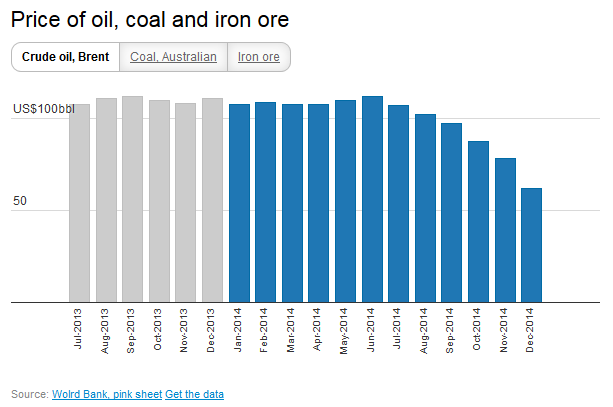

Fears of a steep economic slowdown in China hit resources stocks particularly hard, as global commodity prices fell. Energy was the local market’s worst performing sector in the third quarter, plunging 26%, followed by materials, down 12.8%. Financials dropped another 9.1%, extending a sell off that began in the second quarter.

Just two sectors posted gains over the three months: industrials rose 2.4%, buoyed by a sinking Australian dollar, while utilities gained 1.3%, as investors sought the refuge of comparatively safe earners.

The dismal three months to 30th September is shared by global peers, with both the S&P 500 and Dow Jones Industrial Average down more than 8%. London’s FTSE 100 was down 9% and the German DAX index also fell by 13%.

The main cause of negativity to global markets has been concerns over growth in China. The unpredictability of policymakers’ actions has created some concerns. This follows additional cuts to the country’s benchmark lending rate.

The second theme was the US Federal Reserve’s decision not to raise interest rates as was anticipated at its meeting in September. Federal Reserve Chair, Janet Yellen, indicated that the committee considered a rate increase in September, but it was judged appropriate to “wait for more evidence” to ensure the impact from recent global developments were not more pronounced than anticipated – essentially highlighting concerns about the global growth outlook. Interestingly, the Fed still continues to favour an interest rate hike this year.

Within our local market, changes have been occurring within the banking sector which has caused a negative impact to share prices. APRA has introduced a number of measures to increase the resilience of the banking system. These include: increasing mortgage risk weights, moving towards “unquestionably strong” capital ratios, enforcing minimum mortgage serviceability criteria and limiting investment property loan credit growth to 10% per annum. In addition to tightening underwriting criteria and raising equity, the banks have also repriced their investment property lending books and reclassified many mortgages.

Our outlook for equity markets is positive although we expect volatility will continue but believe this presents buying opportunities for investors. We believe a more severe correction would require a material downturn in earnings, which there is not enough evidence of at this stage.

Over the 2015 calendar year the market has traded just short of the 6,000 point mark and dipped just below the 5,000 point mark just recently. We note that the Australian share market closed at 5,021.60 points on 30th September 2015 and is still 26.94% below the market high on 1st November 2007 of 6,873.20, which is now almost eight years ago.

Economic Update

The Reserve Bank of Australia (RBA) has kept the cash rate steady at 2% over the last quarter.

RBA Governor Glenn Stevens stated after their most recent meeting “The global economy is expanding at a moderate pace, with some further softening in conditions in China and East Asia of late, but stronger US growth. Key commodity prices are much lower than a year ago, in part reflecting increased supply, including from Australia. Australia’s terms of trade are falling.”

We expect this low interest rate environment to remain the state of play for some time to come.

Employment growth has been surprisingly robust especially considering the economy has been growing at a pace below its trend. The current strength is not believed to be sustainable, with persistently weak revenue and profit growth meaning firms will be reluctant to take on more people, suggesting that employment growth will reduce over the next year or so.

The unemployment rate increased from 6% in May to 6.3% in July, but retreated back to 6.2% in August. This volatility is expected to persist over the coming months, with the unemployment rate expected to remain around 6.3% until mid-2016 at least. This is largely due to the loss of employment from the falling resources construction not being fully absorbed into the non-mining sector.

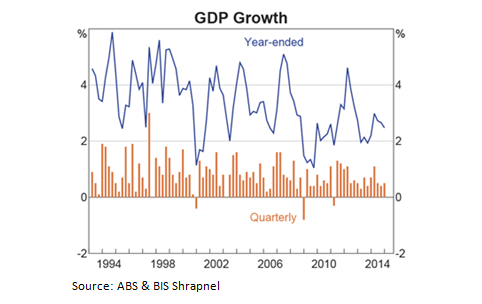

Australia’s real GDP grew by 0.2% in the June 2015 quarter (seasonally adjusted), bringing the through-the-year growth (June 2015 compared to June 2014) to 2.0%.

Real GDP growth is forecast at 2.6% for 2015/16. This is 0.6% lower than forecasted last quarter as some revision needed to be made to individual expenditure forecasts, particularly:

• Plant and equipment investment is expected to decline by 6.6% as opposed to -4.8% forecasted last quarter. The latest forecast takes into account a more pessimistic outlook by the ‘other’ (mainly service) industries although we think the pessimism may be slightly overcooked.

• Imports have been revised down in line with expected lower plant and equipment expenditure, largely offsetting the negative contribution from equipment investment.

Notwithstanding the aberration last quarter, we believe dwellings investment, which has been a key driver of growth over the past two years, has another year of growth before running out of steam. New dwellings will continue to drive this growth but it is being joined by strong alterations and additions activity.

The mining investment boom is now ancient history. This financial year will be the second year of an expected four year decline in resources construction. The trough in 2017/18 is estimated to be 60% lower than the peak of $60 billion reached in 2014/15 (in constant prices). Consequently, mining construction will make negative contributions to growth for the next three years, at least.

The decline in mining investment will swamp modest increases in private non-dwelling building and the recovery in intellectual property products, keeping overall business investment lower, on average, over the next two years.

Private non-dwelling building is likely to experience solid growth over the next two years. A healthy pipeline of projects in the office, retail accommodation, warehouse, aged care and entertainment and recreation segments will push overall building higher this year (+2.2%) and in 2016/17 (+1.9%).

The Australian dollar has come under pressure over the last few months. It has fallen over 12% from a recent peak in May against the US dollar, and on the 7th September, the AUD hit a six-year low of US$0.6896. The Australian dollar is buying around US$0.73 at present after a recent rally. Monthly forecasts for the remainder of 2015 are relatively flat with the dollar expected to fall to around US$0.70 by year end.

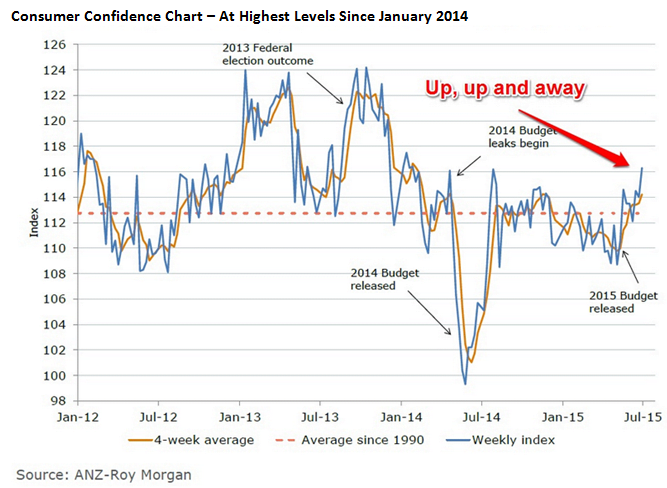

There has been a bit of talk of a recession from some in the industry given the soft June quarter outcome. Australia won’t have a recession as the underlying fundamentals for ongoing growth remain in place. We expect exports to rebound strongly and make a significant positive contribution to growth this year. We believe dwellings building, a key driver of growth over the past two years, has another year of growth particularly from the alterations and additions segment before it runs out of puff. Consumer demand is robust and will build momentum over the next two years supported by relatively low interest rates and improved wealth effects from recent house price gains across most capital cities. In addition, a significant pent up demand for non-mining business investment exists.

Nonetheless, growth will be soft this year before recovering strongly next year.

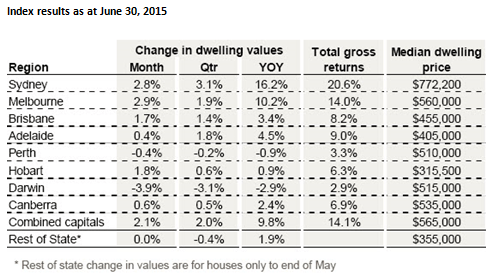

Property Market Update

As subscribers to CoreLogic RP Data research we outline below an article by Cameron Kusher on what’s happening in the Sydney Housing market:

What is going on in the Sydney housing market?

There’s been a number of articles over the last few months about the peak of the Sydney market. It does look as if the market is at or slightly past its peak however, it is important to thoroughly investigate how the market is tracking currently.

Values

Sydney home values have increased by 17.6% over the 12 months to August 2015 and by 14.0% over the first 8 months of 2015. Sydney home values have been trending higher since they reached a low point in May 2012 and since that time Sydney home values have increased by a total of 49.5%. To put that growth in perspective, a home worth $500,000 in May 2012 would now be worth $747,704. The data presented shows that home values have been trending higher at a fairly rapid pace however more recent data may point to a slowing of the rate of growth. Home values rose by 1.1% over the month of August however, data for September is showing a much more sluggish rate of growth in home values with values -0.3% lower over the twenty eight days to 20th September.

Sales transactions

Unfortunately sales transactions are not a timely indicator of the market’s performance due to delays in receiving the full population of settled sales transactions. Furthermore, off-the-plan sales are entered into sales counts at their contract date however the record is not received until settlement which could be several years down the track for large projects. As a result, when you have heightened off-the-plan sales activity as we currently do, unit sales in particular are inclined to be undercounted. The latest sales data to June 2015 shows that over the second quarter of the year there were 23,432 sales. Compared to the same quarter in 2014, the volume of house sales were -5.5% lower and unit sales were -16.5% lower.

Time on market

At the end of July 2015 the typical Sydney home was selling after just 25 days. CoreLogic RP Data has been tracking the time on market since the beginning of 2005 and this is the quickest rate of sale recorded over this period. The combination of strong value growth and a rapid rate of sale suggests that demand is still quite strong across the city.

Auction clearance rates

The preliminary auction clearance rate for Sydney last week was 73.2% which was virtually unchanged from the final auction clearance rate the previous week. Importantly, in most instances the final auction clearance rates are revised lower. Auction clearance rates have shifted from their peak of almost 90% in April of this year to their current level. At the same time a year ago clearance rates were recorded at a higher 78%. It is important to note that over recent weeks the number of properties being taken to auction has been significantly higher than the number taken to auction a year ago. Nevertheless it is clear that the auction market which represents slightly more than a quarter of all Sydney home sales has weakened over recent months and has not rebounded so far during the Spring Selling Season.

Property listings

The latest weekly listings data which tracks houses, units and vacant land for sale across Sydney shows that over the past 4 weeks there were 8,525 new listings and 20,121 total listings. New listings are now at their highest level since the week ended 30th November 2014 and total listings are at their highest level since the week ended 14th December 2014. Comparing listings to levels at the same time a year ago shows that new listings are currently 19.0% higher and total listings are up 5.0%. In the early part of the Spring Selling Season there is much more stock available for sale in Sydney than there was at the same time a year ago. Heightened stock levels at a time when auction markets are softening and value growth has shown some early signs of slowing may contribute to a further slowdown in the rate of capital gain over the coming months. This is due to the fact that active buyers are afforded more choice and may not have to pay such a price premium to secure a home.

Mortgage Activity

The CoreLogic RP Data Mortgage Index tracks pre-purchasing activity and has shown some clear weakness over recent weeks. While the Index remains at quite high levels it has fallen by -2.0% over the past couple of weeks at a time when, seasonally, the trend should typically be rising. At the same time last year the index had risen by 1.2% over the previous two weeks. With mortgages, particularly investment mortgages becoming more difficult to obtain, we are potentially seeing the first signs that this segment of the market is starting to slow resulting in an easing of demand.

Building approvals

The latest building approvals data for July 2015 shows that there was a record high 5,159 dwelling approvals over the month. This was comprised of 1,655 house approvals and 3,504 unit approvals. Over the 12 months to July 2015 there have been 15,213 house approvals and a record high 30,921 unit approvals. Sydney has consistently approved more units for construction than houses since early 1993. With a record pipeline of new housing stock it is going some way to alleviating housing shortages across the city. It also affords buyers much more choice when they are looking to purchase a new home

Housing finance

The latest housing finance data for New South Wales to July 2015 shows that demand from the owner occupier segment is starting to ramp-up while investor demand is starting to wane. Importantly, owner occupier demand includes refinances so if we look exclusively at new lending (excluding refinances) we also see owner occupier demand ramping up while investor demand seems to be waning. Investors still account for the greatest proportion of new lending (58.0%) however, two months ago investors accounted for a record-high 62.4% of all new mortgage lending in NSW.

Rents and yields

Over the 12 months to August 2015, rental rates across Sydney have increased by 2.3% which is the slowest annual rate of rental growth since May 2013. With rental growth sluggish and value growth remaining very strong, gross rental yields across Sydney have shifted to record low levels. Yields were recorded at 3.3% in August 2015 which is the softest yields on record. We’ve already mentioned that investor activity across NSW has recently hit record highs and remains elevated. It appears that many investors are having little regard for rental returns and are largely focussing on the future capital growth potential and the subsequent benefits from a negative gearing strategy.

Although the data is still generally undoubtedly strong, it appears there are signs that the market could be showing the first sign that growth rates are peaking. Record high new housing supply at a time when mortgage demand is seemingly slowing along with auction clearance rates and listings are rising points to potentially softer value growth conditions for the city. While we expect the rate of growth will likely start to slow, the significant stimulus of low mortgage rates is expected to ensure that home values continue to rise albeit at a more moderate pace.

Source RP Data