It’s tax time again!

Another financial year has passed and your 2012 income tax return is now due.

As with previous years, we have prepared this summary with the aim of making this annual event as efficient for you as possible. This summary should act as a checklist of items to consider before making an appointment to come in and see us. Whilst there have been no dramatic changes to our tax system from the previous year, there has been some tinkering.

Our 2012 fees are based on the amount of time it takes us to prepare your tax return. Our minimum standard fee will remain unchanged at $165 (including GST).

Income

PAYG Payment Summaries

Previously known as Group Certificates and issued by your employer. You should have a separate summary for each job you held during the year. These payment summaries should include any payments received in relation to the Paid Parental Leave (PPL) scheme which began on 1 January 2011.

Allowances, directors fees etc

Include consulting fees, short casual jobs where no tax was deducted, bonuses and allowances, income from income protection and sickness and accident insurance policies etc

Australian Government payments and allowances

Many Government payments are tax free though some will have tax implications including Newstart allowance, Austudy etc

Employment Termination Payments (ETPs), Pensions and lump sum payments

These are specific statements that will be issued by your employer on termination of employment or by your superfund

Interest

Include interest earned from all bank accounts you held during the year. You can usually find annual interest received on your June or July bank statement and/or your online banking facility.

Dividends

Include details of all dividends from public companies including dividends reinvested

Trust and partnership distributions

Include any distributions you may have received from managed funds, in particular the ‘annual tax summary’

Employee Share Schemes

Include details of any shares you received from the company you work for including the number, value and date of shares received. Also include copies of any tax advice provided by your employer when you received the shares.

Sale of investments

Did you sell any investments during the year? If so, please include details of the original purchase date, number of shares/units purchased, amount paid (including brokerage), additions to your investment i.e. dividends reinvested, and sale details. See section below for property investments

Foreign Income

Foreign income rules changed on 1 July 2009. Please include details of any income you received from overseas including investments, employment income, pensions etc.

Other income

Any other income received you think may be relevant. It is better to bring something you don’t need than have to drop it off later

Other items

Personal details changes

Please include any changes to your name, address, contact details marital status etc.

Private Health Insurance

You should receive an annual statement from your health insurance company (if applicable) which contains all relevant details for your return

HECS and HELP debts

You should receive an annual statement from the ATO detailing debts owing which we will need to include within your return

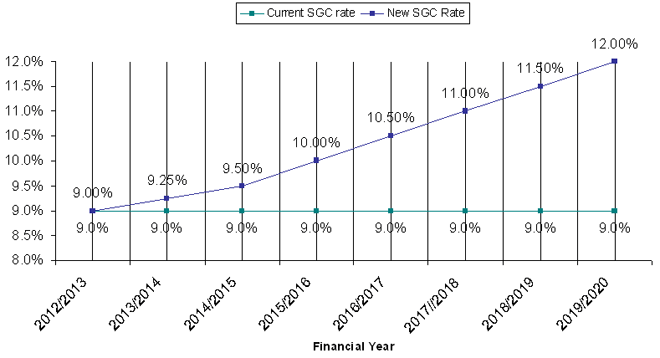

Superannuation

Please provide details of any extra superannuation contributions you made (or were made on your behalf) other than the standard 9% Super Guarantee by your employer.

Spouse Details

Tax rebates and governments benefits are now assessed on combined family income of you and your spouse. Please ensure we have all the relevant details of your spouses income when we complete your return.

Child Support

Please provide details of any child support you have paid during the year

Deductions

Motor vehicles

There are several methods for calculating motor vehicle deductions. By providing the following information, we can determine which is the best method for you:

- Details of actual expenses i.e. fuel, rego, insurance etc

- Details of work related trips i.e. frequency, distance travelled, where from and to, dates etc (please note, this should not include your daily commute to and from work)

- Make, model and purchase price and purchase date of your car

- Any log books you may have kept and/or or odometer readings taken during the year

Other travel

Include travel such as train fares, taxis, car hire, flights etc related to your work which you paid for (please note, this does not include the cost of your daily commute to and from work)

Clothing

Include details of the cost of any clothing with company logos, occupation specific clothing (e.g. nurses and chefs uniforms) and any protective clothing e.g. work boots, sun glasses, hard hats etc

Telephone & Internet

Include details of any work related use of your home phone, mobile phone and internet including any usage diaries

Self education

Include the cost of formal courses and qualifications from TAFE, university etc which are related to your work. Also include the cost of textbooks, stationery, computer, phone, internet and travel related to your education.

Tools and supplies

Include details of all tools, supplies and consumables you may think are relevant to your occupation which you have paid for personally. We can then decide which are deductible

Home office

If you work from home and have a dedicated office space, you may be able to claim a proportion of your household expenses such as heating, lighting etc as well as depreciation on home office furniture & equipment including computers

Donations

Include all donations of $2 or more to an approved organisation (your receipt will usually indicate whether or not you can claim a deduction).

Other items

Other common deductions you may wish to include union fees, subscriptions to professional or trade associations, seminars & conferences, reference material including books, magazines and journals, income protection insurance and tax agents fees (including travel to and from your tax agent’s office)

Tax Offsets

Education Tax Refund

As announced recently in the 2012/13 federal budget, The Education Tax Refund has been replaced by the School Kids Bonus. This new bonus will be automatically paid to eligible families through the family payments system and will no longer form part of your tax return. There is no need therefore to compile details and receipts for your children’s school expenses to complete your 2012 return.

Net medical expenses

Applicable if you incur out of pocket (i.e. after Medicare and/or health insurance reimbursement) medical expenses of more than $2,060 during the year.

Dependent based rebates

Various rebates are available which are based on your dependants i.e. spouse, children or people you care for i.e. your or your spouse’s parents or an invalid relative. In order to calculate if you are eligible, please include details of all dependants including dates of birth and any income your dependants earned during the year

Other tax offsets

Other tax offsets may be available in the following circumstances:

- You made super contributions on behalf of your spouse

- You live in a remote or isolated part of Australia

- You served as a member of the Australian Defence Force or a United Nations armed force

Rental Properties

Rental properties are a particular focus of the Australian Taxation Office and care must be taken to ensure all deductions are reported correctly. Our property experts can guide you through the various income and deductions you need to report if you can provide us with the following information:

Rent received and commissions paid

Include your annual rental summary from your real estate agent or property manager

Interest expenses

Include loan statements and/or online banking summaries showing total interest paid during the year

Council & water rates

Include statements issued annually or quarterly by local councils

Strata levies

Issued by the body corporate and may include annual levies and ‘sinking fund’ costs

Land tax

Issued annually by the Office of State Revenue on land holdings over a certain value

Repairs, maintenance, improvements

There are very specific tax rules related to repairs, maintenance, replacements, capital costs, renovations, improvements etc. The best approach is to provide as much detail as possible for each cost for which we can then determine the appropriate tax treatment

Travel

You can claim the cost of travel to your property for inspections and repairs

Property Purchases and sales

The most important information for property purchases are the sales contract and the settlement statement. Other information includes:

- Legal fees

- Inspection fees

- Sales commissions

- Advertising costs

- Stamp Duty

Important Note Important Note Tax Records Taxation legislation places the responsibility of keeping all records related to your income tax return with you the taxpayer. It is your responsibility to keep all receipts, statements and other records for a minimum of 5 years.

We trust that this checklist has been useful and we look forward to hearing from you soon. Please feel free to pass this summary onto your friends, family, colleagues and other people you think we may be able to assist.