Casual Employee paid annual leave

Last month the Federal Court passed a ruling for a Queensland truck driver Paul Skene stating he was entitled to be paid accrued annual leave because he worked regular, predictable hours. This was despite him being paid casual loadings in lieu of those entitlements. This ruling is expected to be challenged by labour hire company Workpac.

“It is vital that parliament acts quickly to protect businesses, employees and the community from the huge potential cost impacts of the Federal Court’s decision in the WorkPac v Skene case,” Ai Group Chief Executive Innes Willox said.

The peak employer organisation warned this figure could blow out further with the inclusion of sick leave, redundancy pay and other entitlements, and called for urgent changes to national workplace laws to tighten the definition of a casual worker.

It would be very unfair to allow employees who have received a special loading as a casual to now be able to “double-dip” by also claiming annual leave and redundancy entitlements.

Tony Maher, the national president of the CFMEU, which brought the action on Mr Skene’s behalf, said the decision “underlines the extent to which Australian workers have been ripped off by the ‘permanent casual’ trend”.

Federal Labor has pledged to introduce a legal definition of casual employent, with leader Bill Shorten saying there would be “no such thing” as a permanent casual under a future Labor government.

Payroll tax grouping

Payroll tax grouping provisions cast the net very wide. Where entities are grouped, the members of the group will, effectively, have a single payroll tax threshold (currrently $850,000 in New South Wales) and, perhaps more significantly, be jointly and severally liable for the payroll tax debts of each member of the group.

Entities are grouped where they have specified common connections including:

- where the entities are ‘related bodies corporate’ as defined in the Corporations Act 2001;

- where the entities are commonly controlled – generally where a person or set of persons has a greater than 50% interest in different entities but in the case of companies, will include where the person or set of persons control the board;

- where an entity has a ‘controlling interest’ in another entity – a ‘controlling interest’ for this purpose includes an indirect interest and an interest aggregated with associates;

- where the entities use common employees; and

- where 2 payroll tax groups have common members, all of the entities in the 2 groups form a single “super” group.

There are special rules around discretionary trusts that have the effect of significantly increasing the scope of the grouping provisions. A person falling within the class of beneficiaries of a discretionary trust (whether or not named) is treated as having a ‘controlling interest’ in the business carried on by the trust.

All trusts are treated as carrying on a business. Accordingly, a dormant trust or trust that only holds passive investments can be included in a payroll tax group.

If you are not sure if grouping applies to you – seek advice.

Inherited Property

When someone inherits a dwelling there are some special rules contained within the main residence exemption provisions that can provide a full exemption if certain conditions are met. If the conditions are not met, the beneficiary might face a nasty capital gains tax (CGT) bill for their good fortune.

In some cases, these conditions require the inherited property to be sold within two years of the date of death to qualify for the exemption, although the Commissioner has the discretion to extend this period in some situations. To simplify the tax requirements for beneficiaries (and executors) and ensure that they don’t have the threat of a large tax bill hanging over their head, the ATO has outlined a safe harbour for inherited property.

The safe harbour allows beneficiaries and executors to apply the exemption if the property is sold more than 2 years after the date of death without having to seek approval from the ATO, as long as the property is sold within 3 years of the date of death and certain other conditions are satisfied. This could be relevant where there was a delay in selling the property because of factors beyond the control of the beneficiary or executor such as a challenge to the will or where the complexity of the estate delays the completion of the administration process.

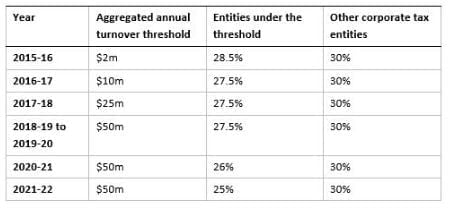

Company tax and franking rate

Legislation passed by Parliament late last month introduces a new test that will restrict some companies from accessing the lower company tax rate from the 2017-18 financial year.

Across a 3 year period, the company tax and franking rate changed, then the definition of what is a small business entity changed (from a $2 million to $10 million turnover) along with how the franking rates apply, and now we have a whole new set of definitions and rates that have come into play. Complicating the change is the issue of timing; the legislation was passed by Parliament after the end of the 2018 financial year and could impact on not only the tax rate that applies for the year ended 30 June 2018 but also the franking rate on dividends paid since 1 July 2017.

For the 2017-18 income year, the lower company tax rate of 27.5% is available to ‘base rate entities’. This means a company that had an aggregated turnover of less than $25 million and no more than 80% of its assessable income for the year was classified as “base rate passive income” (which includes things like rental income, interest and some dividends). While the new $25 million turnover threshold is good news for many companies, the new passive income test will create a problem for others and potentially move them from the reduced rate to the higher general 30% company tax rate. This also has an impact on the maximum franking rate that applies to dividends paid by companies in the 2018 income year onwards.

For the 2018-19 financial year onwards, the turnover threshold has been increased to $50 million.

The problem with the new passive income test is that it is not just a gross turnover test but a test that requires an analysis of the components of that turnover. The new test adds another layer of complexity going forward.

Maximum franking rate

The new rules also make changes to the maximum franking percentage rules. To determine a company’s maximum franking rate for a particular income year from the 2018 income year onwards, you need to look at the tax rate that would apply in the current year if the following assumptions are made:

- The company’s aggregated turnover in the current year is the same as in the previous year;

- The company’s assessable income in the current year is the same as in the previous year; and

- The company’s passive income in the current year is the same as in the previous year.

For example, if a company paid a franked dividend in the 2018 income year, its maximum franking percentage will be based on a 27.5% rate if:

- The company’s aggregated annual turnover in the 2017 year was less than $25m; and

- 80% or less of the company’s assessable income in the 2017 year was passive income.

If the company did not exist in the previous income year, then the maximum franking rate will be based on a 27.5% rate.

If a company paid a dividend in the 2018 income year and this was initially franked to 30% but the new rules mean that the maximum franking rate should have been 27.5%, then it will be necessary to inform the shareholders of the correct franking rate and ensure that the company’s franking account balance is adjusted accordingly.

All clear now? The company tax rate changes can be complex. If you are concerned about the impact of the new rules or would like our assistance to manage any dividend issues, please call us.

Quote of the month

“Most folks are about as happy as they make up their minds to be.”

Abraham Lincoln