Merry Christmas

What a year. Instead of a handful of bright, shiny material things all I really want for Christmas is an effective COVID-19 vaccine, a safe environment for my friends and family, the opportunity for every person to use their abilities and make a genuine contribution to the greater good, and a return to the days when leadership was about the capacity to bring people together and push forward, rather than simply the loudest or most consistent voice – surely not too much to ask!

This year has taught us resilience and patience. We have had a stark reminder of what is really important in life. We have learned the painful lesson of expecting life to be on a constant, consistent path and promise to approach life like an optimist but plan like a pessimist – personally and professionally.

So, here is to a fresh start with renewed energy and vigour in 2021. Stay safe, stay well and we’ll look forward to working with you again in the New Year to make the most of the opportunities available to you on your pathway.

Office Closure

Our office will close for the Christmas period at 1.00pm Wednesday 23rd December and re-open on Monday 11 January 2021.

We wish you and your family all the very best for the festive season.

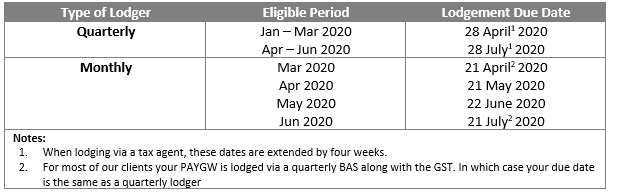

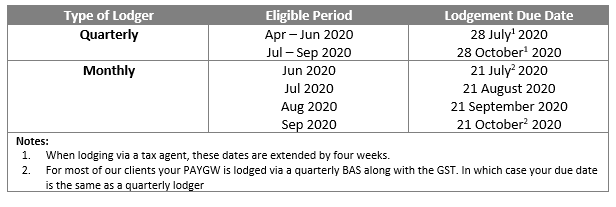

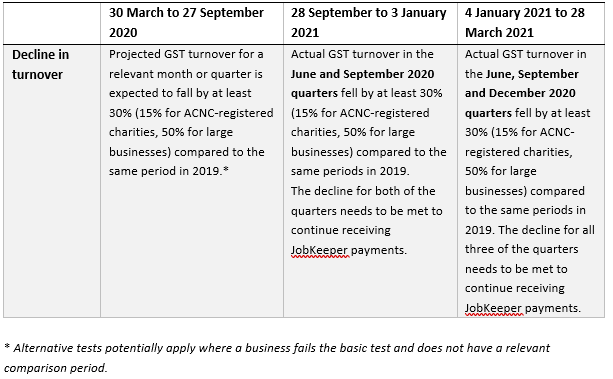

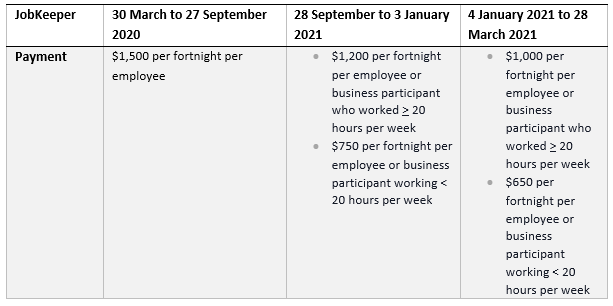

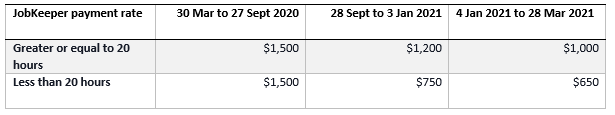

Extended December JobKeeper deadlines

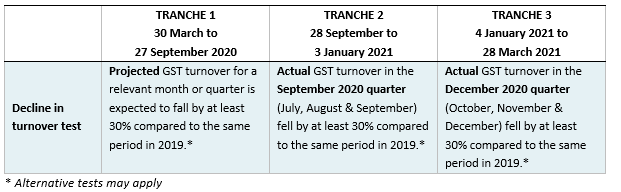

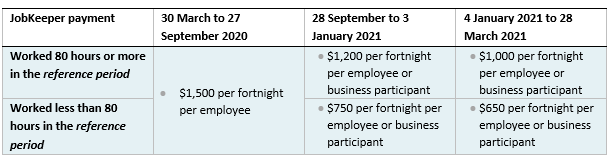

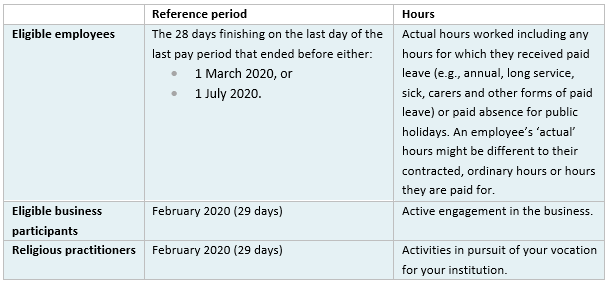

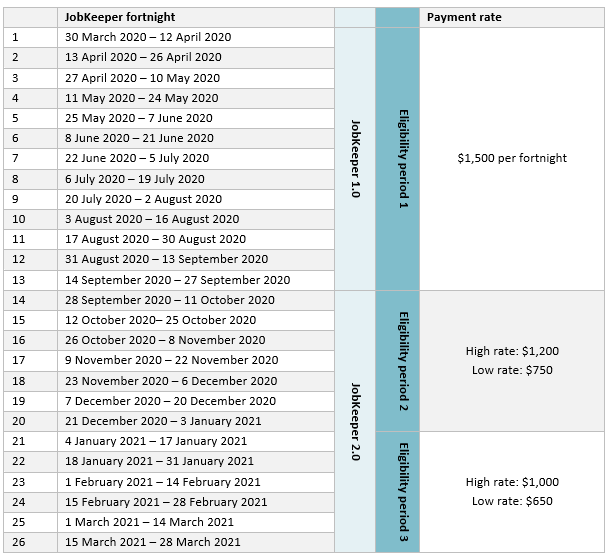

The ATO has extended the JobKeeper monthly business declaration deadline for the month of December until 28 January 2021 (from 14 Jan 2021). This applies to the JobKeeper fortnights ending on 6 December 2020 and 20 December 2020.

The deadline for meeting the minimum wage condition for the JobKeeper fortnight ending on 3 January 2021 has been extended to Monday, 4 January 2021.

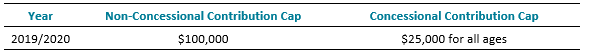

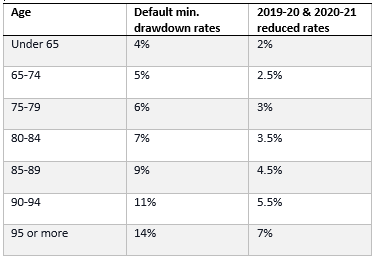

Last chance to access COVID-19 early access to super

31 December 2020 is the last day you can apply to access your superannuation early under the COVID-19 early access measures. The ATO has warned that those wanting to access their superannuation pre-Christmas will need to complete the application by 11 December 2020.

The ability to access up to $10,000 of your super is available to those that have been made redundant, have had their working hours reduced by more than 20%, and have been adversely financially impacted by COVID-19. If you are not in financial hardship you should not access your superannuation. The application process through myGov is a self-assessment process that you are responsible for. Penalties of up to $12,000 may apply for providing false or misleading information.

2021 Risks & Opportunities

With the borders between the State and Territories all but open and 2021 in sight, there is a hunger for a return to ‘normal’. The recent Westpac-Melbourne Institute Index of Consumer Sentiment articulates this desire to ‘get on with things’; sentiment reached its highest level since November 2013 and Christmas spending is expected to be consistent with previous years.

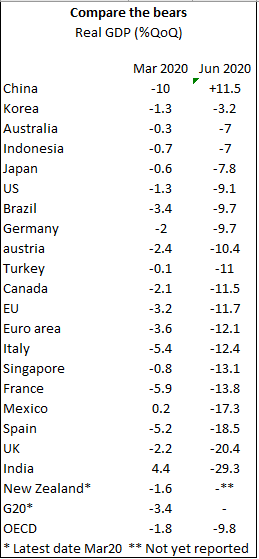

However, the Reserve Bank of Australia cautions that the recovery will be uneven and drawn out and GDP is not expected to return to pre-pandemic levels until the end of 2021. The risks are not limited to the pandemic but Australia’s geopolitical relationships, notably with our largest trading partner, China.

Here’s our key risks and opportunities as we head into 2021:

Opportunities

Employers & job building

Reducing unemployment is a national priority. While the unemployment rate is expected to decline in 2021, further rises are expected as businesses restructure in response to the pandemic. Wage growth will also be subdued with excess capacity in the market.

New analysis from the Reserve Bank of Australia suggests one in five jobs were saved by JobKeeper. The November 2020 analysis states, “one in five employees who received JobKeeper (and, thus, remained employed) would not have remained employed during this period had it not been for the JobKeeper Payment. Given that 3½ million individuals were receiving the payment over the period from April to July 2020, this implies that JobKeeper reduced total employment losses by at least 700,000 over the same period.”

The number of businesses accessing JobKeeper reduced by around 450,000 in October 2020 with the transition to more stringent eligibility requirements. The shift now is to create jobs, not just keeping them. There are a number of incentives for employers to grow employment and skills:

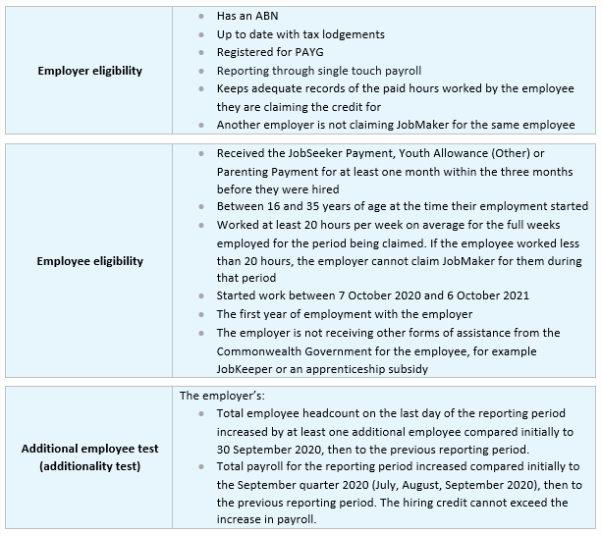

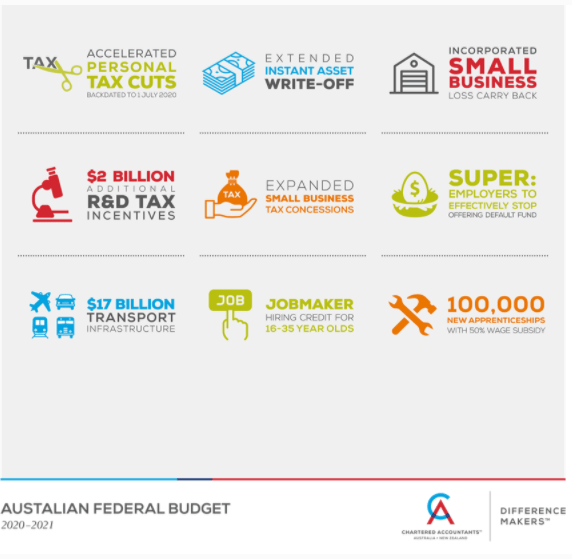

- JobMaker – A 12 month “hiring credit” available for jobs created from 7 October 2020 until 6 October 2021 that provides a payment to employers of $200 per week for eligible new employees aged between 16 and 29, and $100 per week for eligible employees aged between 30 to 35 years. Eligibility restrictions apply to the business and the employee. Employees need to have been out of work and receiving Government support for at least one month within the three months before they were hired.

- Apprenticeship subsidies – subsidies of 50% of an apprentice’s wage (up to $7,000) are available for new and existing apprentices to keep them employed. The schemes apply to the wages of new apprentices from 5 October 2020 and 30 September 2021, and existing apprentices from 1 January 2020 to 31 March 2021. Eligibility requirements apply to the business and the apprentice.

In addition, subsidies are available for employers engaging apprentices in key industries with skills shortages including carpenters and joiners, plumbers, hairdressers, plasterers, bakers and pastrycooks, vehicle painters, wall and floor tilers, arborists, bricklayers and stonemasons and air-conditioning and refrigeration mechanics.

There is also additional support for adults reskilling and undertaking an apprenticeship and for apprentices with a disability.

- State based incentives – Tax breaks to encourage employers to employ more workers are big right now. The Victorian government recently announced a New Jobs Tax Credit for SMEs of ten cents for every dollar of increased taxable Victorian wages. NSW has reduced payroll tax to 4.85% from 5.45% from 1 July 2020. There are also a myriad of incentives targeted to specific areas like the NSW regional growth fund. WA has an Employer Incentive Scheme with a base payment of $8,500 for employing apprentices. It’s worth seeing what is available in your region and in your industry.

Federal Government incentives generally do not overlap. That is, your business cannot receive incentives for JobKeeper and JobMaker, or JobMaker and an apprenticeship subsidy.

First JobMaker deadline looms

6 January 2021 is the final day of the first JobMaker Hiring Credit period and the deadline for enrolling in the scheme to access payments for this period. While the ATO has the ability to extend this deadline, there has not been any advice on this to date. Enrolments are not open as yet but because of the tight turnaround times, if your business would like to access JobMaker for the first period, it will be important to assess eligibility.

For individuals, JobTrainer offers those aged between 17 and 24 the ability to upskill or reskill and minimal cost.

HomeBuilder & the housing industry

The HomeBuilder scheme provides a tax-free grant to those building a new home or renovating. To date, around 27,000 homes are expected to be covered by the scheme. The highest number of applications so far have come from Victoria (7,636), followed by Queensland with 5,954. New South Wales property prices mean that many homes exceed the eligibility threshold (4,350).

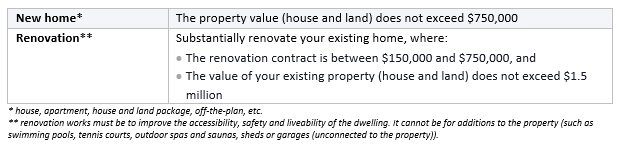

The Assistant Treasurer recently announced an extension of the HomeBuilder scheme from 1 January 2021 to 31 March 2021. For all new build contracts signed between 1 January 2021 and 31 March 2021:

- Eligible owner-occupier purchasers will receive a $15,000 HomeBuilder grant (down from $25,000); and

- The property price caps for new builds in New South Wales and Victoria will be increased to $950,000 and $850,000 respectively (from $750,000).

In addition, the construction commencement deadline will be extended from three months to six months for all eligible contracts signed on or after 4 June 2020 (applications for HomeBuilder can be submitted up to 14 April 2020).

There is also a change in the licensing requirements and registration for builders and developers:

- Where an eligible contract is signed on or after the 29 November 2020, the builder or developer must have a valid licence or registration before 29 November 2020.

- Where an eligible contract is signed before 29 November 2020, the builder or developer must have a valid licence or registration before 4 June 2020.

The eligibility criteria to access HomeBuilder remains the same. To be eligible you need to be an individual owner occupier, 18 years of age or more, an Australian citizen, and pass the income test. The income test for individuals is $125,000 and $200,000 for couples (based on your 2018-19 or later tax return).

The grants are available if you build a new home where the value of the house and land does not exceed the threshold ($750,000 to $950,000 depending on when the contract was signed and the State you live in), or a renovation where the value of the property is $1.5m or less.

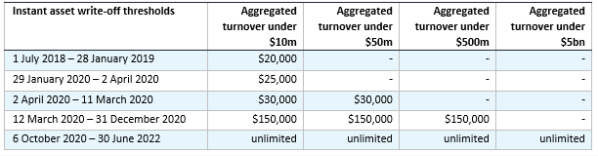

Extended rules for writing off assets: Australian subsidiaries of global companies to benefit

In the 2020-21 Federal Budget, the Government introduced a measure that allows businesses with turnover under $5bn* to immediately deduct the cost of new depreciable assets and the cost of improvements to existing assets in the first year of use. This means that an asset’s cost will be fully deductible in the year it’s installed ready for use, rather than being claimed over the asset’s life. And, there is no cap on the cost of the asset.

Last month the Government announced it will modify the rules again enabling a broader range of businesses to access the instant write-off.

The amended rules will enable businesses with an aggregated annual turnover of $5bn or more (the current maximum threshold) to access the measures if they can satisfy an alternative test. Entities are able to pass this test if they have:

- Less than $5 billion in total statutory and ordinary income in either the 2019 or 2020 income year; and

- Incurred more than $100 million in expenditure on tangible depreciating assets between the 2017 and 2019 income years.

- This will allow some Australian businesses that are connected with large global groups to access the measure.

In addition, the Government will enable businesses to opt-out of using the new instant asset write-off and accelerated depreciation rules on an asset by asset basis. Currently, the rules apply automatically if certain conditions are met, which for some businesses is not an effective use of the deduction. However, at this stage, it appears the choice to opt out of the instant asset write-off might not be available to small business entities that choose to apply the simplified depreciation rules.

*Aggregated turnover. Aggregated turnover is your turnover plus the annual turnover of any business connected with you or that is your affiliate.

The Risks

COVID-19 rules and regulations

Despite feeling like we are emerging from the pandemic, the promise of a widely available vaccine is still over the horizon and the risk of another wave remains very real. For business, it will be essential to ensure that COVID-19 safe conditions are maintained. Aside from the obvious health risks of not maintaining a safe environment, a lockdown risks your business’s survival and the fines for breaching public health orders are hefty. The ABC reports that “more than $5.2 million has been raked in nationwide since pandemic laws came into effect in March this year.” In most regions, fines of around $1,000 apply to individuals and $5,000 for businesses and in Queensland, fines of up to $13,345 and prison might apply to individuals and business operators flagrantly defying the heath order.

Australia’s relationship with China

There is a scene in the movie Love Actually where the British Prime Minister (played by Hugh Grant) is asked about his views on the Britain-US relationship following a particularly disappointing trade negotiation:

“I love that word relationship; covers all manners of sins, doesn’t it? I fear this has become a bad relationship. A relationship based on the President taking exactly what he wants, and casually ignoring all those things that really matter to Britain.

“We may be a small country, but we’re a great one too. A country of Shakespeare, Churchill, The Beatles, Sean Connery, Harry Potter, David Beckham’s right foot, David Beckham’s left foot.

“A friend who bullies us is no longer a friend. And since bullies only respond to strength, from now onward I will be prepared to be much stronger. And the President should be prepared for that.”

In the movie, the only reaction from the US was a stern look from the President (played by Billy Bob Thornton). However, the reality of megaphone diplomacy is very different.

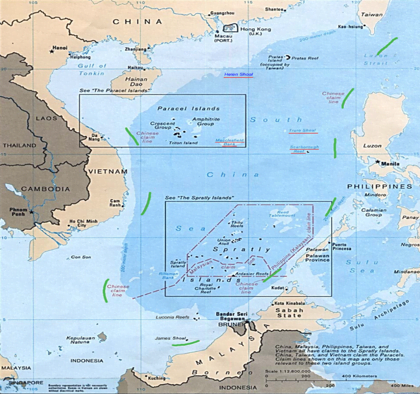

Non-compliance with China’s political will comes at a cost. In response to Australia’s public positioning, China has flexed its economic muscle through the disruption of Australian exports.

- April – Australia pushes for a formal WHO inquiry into the origins of COVID-19.

- May – 80.5% tariff on Australian barley on the basis that barley is undervalued and subsidised. China imports approximately 70% of Australia’s barley crop.

- May – Suspension of beef exports from four Australian processing plants relating to a 2019 investigation regarding inconsistencies with labelling and consignment certificates for some frozen and chilled beef products. China is the largest importer of Australian beef at 24%. Japan is second at 23% and the USA at 20%.

- September – China states that Australian exports of wheat will face “enhanced inspection.” At the same time, wheat imports from the US to China have increased.

- October – Chinese importers unofficially instructed to stop buying seven types of Australian exports – coal, barley, copper ore and concentrate, sugar, timber, wine and lobster. Goods in transit at the time the ban was imposed have been in limbo – $2m of rock lobsters were left on the tarmac unable to clear customs at Shanghai airport.

- November – 107% to 212% “provisional” tariff imposed on Australian wine on the accusation that Australian wine is being dumped on the Chinese market causing “substantial” damage to Chinese wine manufacturers. Treasury Wine Estate, that make Penfolds, and represent an estimated 40% of the total annual wine export market to China, went into a trading halt after China’s announcement.

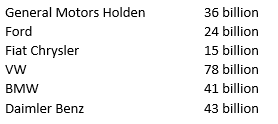

China is Australia’s largest trading partner by a margin that dwarfs trade with any other single nation (Europe $118bn, ASEAN $110bn and Japan $77bn). The value of exports to China has doubled in the five years since the signing of the China-Australia Free Trade Agreement from $75b in 2014-15 to $150b in 2019-20; imports have also grown significantly up 42% over the same period.

Iron ore remains Australia’s top export to China (in 2019-20, exports of iron ore accounted for 56% of all Australian goods exported to China) and a high demand resource to fuel the expansion of China’s economy – China is the world’s largest steel producer. The South China Morning Post reports that Australian iron ore makes up 60% of China’s supply.

It is not the first time China has undertaken a concerted campaign to use its economic might to secure its policy goals. Canada, India, the UK and New Zealand have all faced some form of retribution in the past. When Sweden banned Huawei from its 5G network the foreign ministry spokesman Zhao Lijian reportedly called on Sweden to correct its “wrong decision” and avoid a “…negative impact on China-Sweden economic and trade cooperation, and on the operations of Swedish companies in China.” Economic threats and oppressive rhetoric are commonplace.

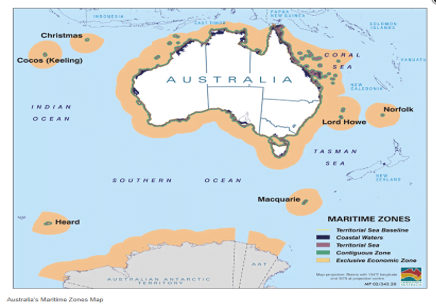

During a speech to the Press Club in August, Minister Wang Xining stated that any long term relationship is based on “mutual respect”. Australia’s perceived lack of respect was highlighted by the 14 grievances leaked by a Chinese diplomat to Channel 9. The grievances are wide ranging from the banning of Huawei from Australia’s 5G networks on “unfounded” national security concerns (as have all members of the 5 eyes intelligence alliance except Canada – US, UK, and New Zealand, and France and Sweden), foreign interference laws (initiated with the establishment of the Counter Foreign Interference Taskforce focussed on democratic institutions, education and research, media and communications, diverse communities, and infrastructure), calls for an inquiry into COVID-19 and siding with the US anti-China campaign, speaking out on the contested South China sea territories (and supporting US gunboat diplomacy), and “thinly veiled” allegations against Chinese cyberattacks.

So, what does 2021 hold? There is conciliatory language from the Australian Government with both the Prime Minister and the Defence Minister acknowledging China’s economic success lifting millions out of poverty and our strong ‘people to people’ relationship. But Australia has not publicly backed down or been any less vocal with the announcement of a new defence pact with Japan and a continued pro-democracy stance on Hong Kong. There is likely to be more pain to come for Australian exports to China and no short-term resolution or conciliation.

Cashflow crunch

Australian economists are fairly united that there are a number of “zombie businesses” that are being kept alive by JobKeeper. These are the businesses that are only surviving because salary and wages are propped up by the subsidy. The danger with these businesses is that they are continuing to take on debt. JobKeeper ends in March 2021, which coincides with one of the traditionally worst cashflow months of the year. It will be important to ensure that your business stays on top of its debtors and doesn’t become a bank for your customers. It will also be important to understand your cashflow position, don’t over commit, and stay on top of labour costs.

Quote of the month

“There is no such thing as work-life balance. Everything worth fighting for unbalances your life.”

Alain de Botton, philosopher and author