.

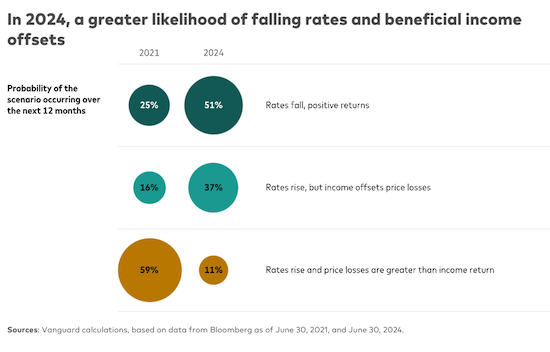

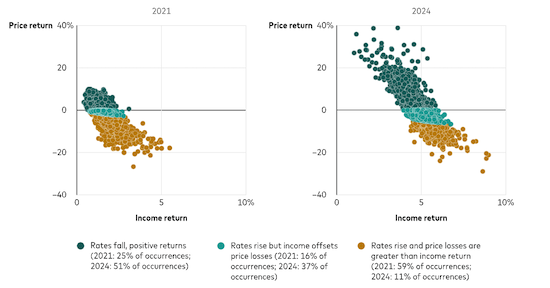

This month, we take a closer look at interest rates and the changed anatomy of bond returns. They’re simple enough dynamics: Interest rates rise, bond prices fall; interest rates fall, bond prices rise. But what happens when you factor in the income that bonds generate? The conditions at the start of an investment matter. And as the charts suggest, initial conditions were far more favourable to bond investors at midyear 2024 than they were at midyear 2021, underscoring Vanguard’s assertion that bonds are back!

Notes: The charts show the 1-year-ahead price and income return projections from the Vanguard Capital Markets Model® for the Bloomberg U.S. Aggregate Bond Index as of June 30, 2021, and June 30, 2024. The forecasts are sorted by positive price returns (interest rates fall) and two scenarios under negative price returns (interest rates rise): income returns from coupons offset price losses, and income returns do not offset price losses, leading to negative total returns.

Sources: Vanguard calculations, based on data from Bloomberg as of June 30, 2021, and June 30, 2024.

Bond yields at midyear 2021 were a paltry 0.25% for the 2-year and 1.45% for the 10-year, compared with midyear 2024 yields of 4.71% for the 2-year and 4.36% for the 10-year. Although it is always difficult to predict short-term outcomes, our simulations as of June 30 of each year showed that the likelihood was much higher in 2024 than in 2021 that interest rates would fall (and bond prices rise). In addition, the likelihood that rates would rise (and bond prices fall) but that income would offset price losses more than doubled in 2024. And as for the prospect of the worst of both worlds—that rates would rise and price losses would be greater than returns from income? It was the most likely outcome in 2021. But in 2024, that scenario was less than 20% as likely to occur as in 2021, our Vanguard Capital Markets Model® (VCMM) projections show.

“Bonds are back, but the prospect of falling rates isn’t the only reason—yield income is higher, too,” said Ian Kresnak, an investment strategy analyst on the VCMM team. “It's the return to sound money, the broad scenario that we laid out in the Vanguard economic and market outlook for 2024. Bonds always play an essential role in a portfolio because they balance out more volatile equities. With coupon payments higher, as they are now, bonds can also withstand some price declines if rates were to rise.”

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modeled asset class. Simulations are as of June 30, 2021, and June 30, 2024. Results from the model may vary with each use and over time. For more information, please see the Notes section.

We have updated our forecasts for the performance of major asset classes, based on the June 30, 2024, running of the Vanguard Capital Markets Model®. Detailed projections, including annualised return and volatility estimates covering both 10- and 30-year horizons, are available in interactive charts and tables.

The views below are those of the global economics and markets team of Vanguard Investment Strategy Group as of August 16, 2024.

Emphasising that it will be “some time yet before inflation is sustainably in the target range,” the Reserve Bank of Australia (RBA) on 6 August left its policy rate unchanged at 4.35%. Vanguard expects the RBA to remain on hold for the rest of the year before beginning a gradual easing cycle amid an anticipated weakening in both inflation and the labour market.

Recent data suggest that the labour market is softening, and the Federal Reserve appears to be taking notice. The Fed gave a strong signal in July that it was prepared to cut the federal funds rate target by 25 basis points in September. (A basis point is one-hundredth of a percentage point.) We are anticipating an additional second 25-basis-point cut this year and a target range of 3.25%–3.5% at the end of 2025.

Softening growth in the labour market and the broader economy amid continued disinflation has led us to lower our year-end 2024 forecast for Canada’s policy interest rate, which the Bank of Canada cut for a second time to 4.5% on July 24. We foresee the equivalent of two to three additional quarter-point rate cuts this year, which would put the overnight rate target in a range of 3.75%-4% at year-end.

The euro area’s economy grew by 0.3% in the second quarter compared with the first, according to a flash estimate. An unexpected drag from Germany, where a manufacturing sector rebound remains elusive, was offset by tourism bolstering growth in Spain and France. We foresee full-year GDP growth around 0.8%.

The most recent growth and inflation data suggest the U.K. economy is moving into a better balance. Inflation was softer than expected in July and second-quarter growth was only minimally less than that of the first quarter, when the U.K. exited a brief recession.

Recent broad economic data pointed to a tepid start to the third quarter and a continued imbalance in supply and demand. Fixed asset investment surprised notably to the downside and manufacturing investment slowed. Retail sales provided a bright spot amid increased summer travel and online sales.

Progress in the inflation fight is increasingly allowing central banks to focus on economic growth and labour market vitality in their policy-setting considerations. But risks remain that progress in the inflation fight can stall.

Notes:

All investing is subject to risk, including the possible loss of the money you invest.

Investments in bonds are subject to interest rate, credit, and inflation risk.

Investments in stocks and bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. These risks are especially high in emerging markets.

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

This article contains certain 'forward looking' statements. Forward looking statements, opinions and estimates provided in this article are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of current market conditions. Forward-looking statements including projections, indications or guidance on future earnings or financial position and estimates are provided as a general guide only and should not be relied upon as an indication or guarantee of future performance. There can be no assurance that actual outcomes will not differ materially from these statements. To the full extent permitted by law, Vanguard Investments Australia Ltd (ABN 72 072 881 086 AFSL 227263) and its directors, officers, employees, advisers, agents and intermediaries disclaim any obligation or undertaking to release any updates or revisions to the information to reflect any change in expectations or assumptions.

© 2024 Vanguard Investments Australia Ltd. All rights reserved.

Vanguard

August 2024

vanguard.com.au

Hot Issues

July - September 2024 archive