.

A labour market indicator that has reliably signaled the start of recession could appear in coming months. The Sahm rule (named after the former Federal Reserve economist who identified it) is triggered when the unemployment rate spikes, with its three-month moving average jumping half a percentage point above its 12-month trough. A 4.2% unemployment rate in the July jobs report, scheduled to be released 2 August, would do the trick. Would that mean a U.S. recession had started? Very doubtful, said Adam Schickling, a senior economist who studies the labour market.

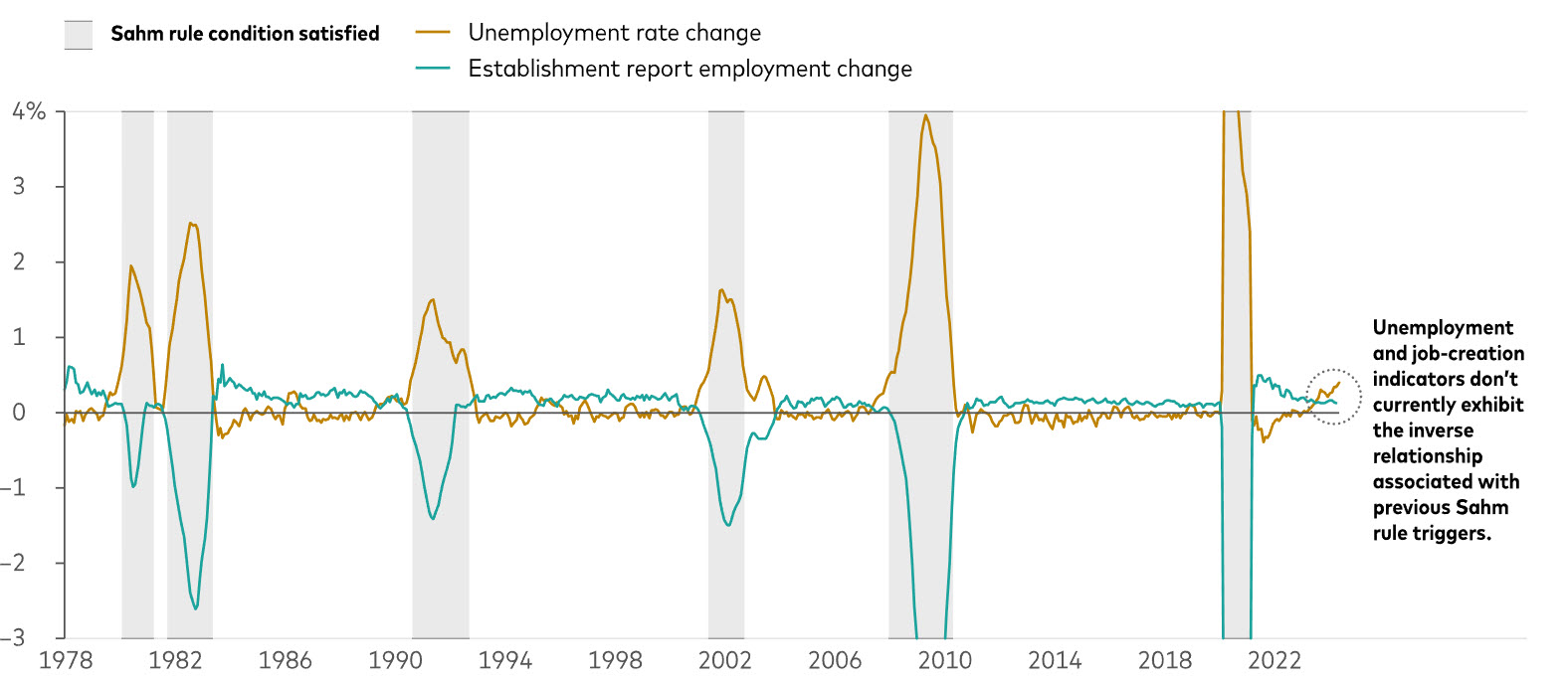

Notes: Unemployment rate change is measured as the three-month moving average unemployment rate minus the unemployment rate’s 12-month trough, as reflected in the monthly household survey conducted by the Bureau of Labour Statistics (BLS). Establishment report employment change is measured as the three-month moving average nonfarm employment level minus the nonfarm employment level 12-month maximum, as reflected in the monthly BLS establishment survey. Starting points for periods when the Sahm rule has been satisfied largely correspond to historical U.S. recessions. Historically, both the household and establishment surveys indicate labour market weakness during periods when Sahm rule conditions are met, with the unemployment rate rising and the number of jobs contracting, which isn’t the case currently.

Sources: Vanguard calculations using data as of 5 July, 2024, from the U.S. Bureau of Labor Statistics.

At issue, Schickling said, are the mixed signals being sent by the two surveys that make up the jobs report. “A significant and persistent deviation between the household and establishment surveys has created a unique paradox of the unemployment rate rising 60 basis points since July 2023 even as job creation in the establishment survey has more than offset an increase in the labour force.”

Declining response rates since the COVID-19 pandemic have affected all labour market surveys, Schickling said, but the effect on the household survey of workers and job candidates has been especially pronounced given that the survey was relatively small to begin with. Additionally, Vanguard believes that the separate establishment survey of workplaces is quicker than the household survey to reflect immigration dynamics that have fueled recent job growth. Because the Sahm rule uses unemployment rate metrics, it is based on the household survey, which we see as less reliable than it traditionally has been.

While its momentum has slowed, the labour market remains strong, and any imminent recession signal is likely to be a false one.

Our 10-year annualised nominal return and volatility forecasts are shown below. They are based on the 31 May, 2024, running of the Vanguard Capital Markets Model® (VCMM). Equity returns reflect a range of 2 percentage points around the 50th percentile of the distribution of probable outcomes. Fixed income returns reflect a 1-point range around the 50th percentile. More extreme returns are possible.

Notes: These probabilistic return assumptions depend on current market conditions and, as such, may change over time.

Source: Vanguard Investment Strategy Group.

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modelled asset class. Simulations are as of 31 May, 2024. Results from the model may vary with each use and over time.

The views below are those of the global economics and markets team of Vanguard Investment Strategy Group as of 17 July, 2024.

Lacklustre GDP growth in the first quarter suggests that restrictive monetary policy has curbed demand. Yet low productivity growth has kept unit labour costs growing at a rate well above that which is consistent with the 2%–3% inflation target set by the Reserve Bank of Australia (RBA). As such, the RBA may be one of the last developed markets central banks to ease monetary policy.

We believe that if inflation returns to more sustainable levels, Australia’s slow growth will open the door to monetary policy easing. Despite sticky inflation, we don’t foresee a rate hike by the RBA, whose dual mandate is to promote price stability and economic growth.

The productivity and labour supply gains that drove U.S. economic growth in 2023 lately show signs of subsiding, joining retail sales, capital expenditure, and other data that previously suggested a slowdown.

Given progress in the inflation fight and below-trend economic growth, the Bank of Canada (BOC) on 5 June became one of the first developed markets central banks to cut policy interest rates. The BOC cut its rate target by 0.25 percentage points, to 4.75%. We expect another 0.25–0.50 points in rate cuts this year.

The euro area is growing again, with real GDP increasing by 0.3% in the first quarter compared with the fourth quarter of 2023, leaving behind five quarters of stagnation. We expect modest growth the rest of the year, supported by rising real incomes and lower inflation-adjusted borrowing costs. We foresee full-year GDP growth of 0.8%.

Increased activity in the services sector drove a greater-than-expected gain in the last monthly GDP reading. GDP grew by 0.4% in May compared with April, the Office for National Statistics reported 11 July. Services output, the largest contributor to the monthly gain, increased by 0.3% month over month for a second straight month.

As its leadership convened for a twice-a-decade economic policy meeting known as the 3rd Plenum, China released data 15 July showing the economy hit a soft patch. GDP grew by 0.7% in the second quarter compared with the first and by 4.7% year over year. Consumption lost momentum, reflecting weak domestic demand, sluggish imports, and subdued inflation.

The central banks of Romania, the Czech Republic, and Hungary all cut rates in their last policy meetings as inflation in emerging Europe has moderated. In contrast, some Latin American central banks have—for now, at least—put rate cuts on hold.

Amid continued U.S. economic strength, we recently upgraded our forecast of GDP growth in Mexico. U.S. demand for Mexican goods has remained strong, and domestic wages and consumption are holding up. However, amid restrictive monetary policy, we foresee below-trend 2024 GDP growth of 1.75%–2.25%.

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

This article contains certain 'forward looking' statements. Forward looking statements, opinions and estimates provided in this article are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of current market conditions. Forward-looking statements including projections, indications or guidance on future earnings or financial position and estimates are provided as a general guide only and should not be relied upon as an indication or guarantee of future performance. There can be no assurance that actual outcomes will not differ materially from these statements. To the full extent permitted by law, Vanguard Investments Australia Ltd (ABN 72 072 881 086 AFSL 227263) and its directors, officers, employees, advisers, agents and intermediaries disclaim any obligation or undertaking to release any updates or revisions to the information to reflect any change in expectations or assumptions.

© 2024 Vanguard Investments Australia Ltd. All rights reserved.

July 2024

Vanguard

vanguard.com.au

Hot Issues

July - September 2024 archive