Investment and economic outlook, September 2024 The latest forecasts for investment returns and region-by-region economic outlook.

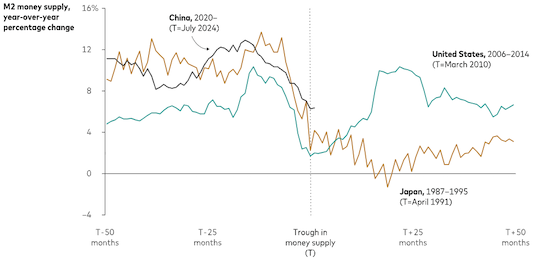

. A recent rapid decline in its money supply highlights deflationary concerns in China. The GDP deflator, a broad, inflation-adjusted measure of economic output, has been negative for five consecutive quarters. Judging by recent experiences in the United States and Japan, China will be challenged in its efforts to lift barely positive consumer inflation closer to the People’s Bank of China’s 3% target. Grappling with a property-driven slowdown, China has introduced several stimulative measures this year. Most have been aimed at the supply side. “Policy aimed at stoking demand to boost confidence among China’s consumers is likely required in addition to the supply-side measures,” said Grant Feng, a Vanguard senior economist who studies the Asia-Pacific region. “People won’t spend on goods and services if they expect that prices will be lower next month. That would mean further downward pressure on prices and a harder road back toward potential growth.”

Sources: Vanguard calculations, based on data from CEIC Data through July 31, 2024. Our chart reflects a relatively swift return to previous M2 money-in-circulation levels in the United States following the global financial crisis, which was aided by timely consumer-focused stimulus. “A quick and decisive policy response is critical to fighting deflationary risk,” said Qian Wang, Vanguard chief economist for the Asia-Pacific region. “The U.S. after the global financial crisis offers a good example of this, whereas Japan in the 1980s and 1990s lacked a swift and sufficient response. There is a good lesson for China in these experiences.” Outlook for financial marketsOur 10-year annualised nominal return and volatility forecasts are shown below. They are based on the 30 June, 2024, running of the Vanguard Capital Markets Model® (VCMM). Equity returns reflect a range of 2 percentage points around the 50th percentile of the distribution of probable outcomes. Fixed income returns reflect a 1-point range around the 50th percentile. More extreme returns are possible. Australian dollar investorsAustralian equities: 4.7%–6.7% (21.7% median volatility) Global equities ex-Australia (unhedged): 4.3%–6.3% (19.1%) Australian aggregate bonds: 4.1%–5.1% (5.6%) Global bonds ex-Australia (hedged): 4.3%–5.3% (4.9%)

Source: Vanguard Investment Strategy Group. IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modelled asset class. Simulations are as of 31 May, 2024. Results from the model may vary with each use and over time.

Region-by-region outlookThe views below are those of the global economics and markets team of Vanguard Investment Strategy Group as of September 19, 2024.

United StatesThe Federal Reserve cut its policy interest rate by 0.5 percentage point on 18 September, to a range of 4.75%–5%, but did so in the context of economic resilience rather than concerns about a material slowdown. We expect:

AustraliaThe economy is growing at its slowest pace in decades, but inflation that is falling only gradually is likely to keep the central bank from cutting its policy interest rate this year. We expect:

ChinaSluggish domestic demand highlights the risk that China’s target of 5% economic growth this year may not be met. Increased government loan issuance in August provides hope, but more of the same will likely be required in the months ahead. We expect:

CanadaOn 4 September, for a third consecutive meeting, central bank policymakers cut their overnight interest rate target by 0.25 percentage point. We expect:

Euro areaOn 12 September, the central bank announced the second cut to its policy interest rate of the new policy cycle that began in June. We expect:

United KingdomAlthough services inflation, pay growth, and GDP data have all recently undershot expectations, an 8-1, 19 September vote by central bank policymakers to maintain their 5% policy interest rate acknowledged that risks to resurgent inflation remained. We expect:

JapanJapan imported inflation through higher food and energy prices during the COVID-19 pandemic. The result has been a virtuous cycle of higher prices and even faster-rising wages in a country that had struggled through decades of little to no inflation and even deflation. We expect:

Emerging marketsServices inflation remains sticky in most emerging markets, but that hasn’t stopped a cycle of interest rate cuts as broader inflation readings approach central bank targets. Since our economic survey last month, policy rates have been reduced by 0.25 percentage point in such markets as Chile, the Philippines, the Czech Republic, and Mexico. A notable exception is Brazil, where the central bank raised its policy rate to 10.75% on 18 September, reversing a cutting cycle that began in August 2023. Brazil’s currency, the real, has depreciated by 13% against the U.S. dollar since the start of the year, through 17 September. In Mexico, we expect:

Notes: All investing is subject to risk, including the possible loss of the money you invest. Investments in bonds are subject to interest rate, credit, and inflation risk. Investments in stocks and bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. These risks are especially high in emerging markets. IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time. The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based. The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time. This article contains certain 'forward looking' statements. Forward looking statements, opinions and estimates provided in this article are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of current market conditions. Forward-looking statements including projections, indications or guidance on future earnings or financial position and estimates are provided as a general guide only and should not be relied upon as an indication or guarantee of future performance. There can be no assurance that actual outcomes will not differ materially from these statements. To the full extent permitted by law, Vanguard Investments Australia Ltd (ABN 72 072 881 086 AFSL 227263) and its directors, officers, employees, advisers, agents and intermediaries disclaim any obligation or undertaking to release any updates or revisions to the information to reflect any change in expectations or assumptions.

24 Sep 2024 |

Latest Financial Planning News