Investment and economic outlook, April 2024

.

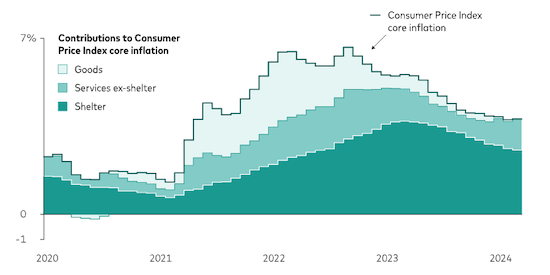

U.S. Consumer Price Index (CPI) data for March underscore the challenge faced by Federal Reserve policymakers as they try to guide inflation down toward their 2% target. Getting there would require a slower pace of growth for two especially sticky CPI components—shelter and services excluding shelter. Without progress on those fronts, the Fed may not be able to cut its benchmark interest rate target.

The "last mile" of inflation reduction will require progress on shelter and services

Note: The chart shows year-over-year rates of change in the core U.S. Consumer Price Index, which excludes food and energy prices, starting in January 2020 and ending in March 2024. It also breaks those rates of change into three sources. Last month, according to the core CPI, shelter prices were 5.7% higher than they had been one year earlier. Shelter accounted for more than two-thirds of the 3.8% rise in total core CPI.

Sources: calculations using data from Refinitiv, as of 31 March, 2024.

Price increases for services excluding shelter have accelerated since December, propelled by a tight labour market and strong wage growth. Meanwhile, a year-long slowdown in the pace of shelter inflation has not been sharp enough to comfort the Fed. “Shelter inflation is critical to core inflation reaching the Fed’s target,” said Ryan Zalla, an economist who studies price behavior. “If shelter inflation were to return to its prepandemic average of around 2.5%, core CPI would be approximately 2%.”

Stubborn shelter prices reflect heightened housing demand, supported by a strong labour market, and low supply, abetted by the reluctance of many homeowners to give up low mortgage rates by moving. “For shelter inflation to moderate, labour market conditions will have to materially weaken, or housing supply will have to increase,” Zalla said. “Meaningful changes in either appear unlikely to materialise soon.”

The views below are those of the global economics and markets team.

Outlook for financial markets

Our 10-year annualised nominal return and volatility forecasts are shown below. Equity returns reflect a range of 2 percentage points around the 50th percentile of the distribution of probable outcomes. Fixed income returns reflect a 1-point range around the 50th percentile. More extreme returns are possible.

Australian dollar investors

- Australian equities: 4.3%–6.3% (21.7% median volatility)

- Global equities ex-Australia (unhedged): 4.9%–6.9% (19.4%)

- Australian aggregate bonds: 3.7%–4.7% (5.5%)

- Global bonds ex-Australia (hedged): 3.9%–4.9% (4.8%)

Notes: These probabilistic return assumptions depend on current market conditions and, as such, may change over time.

Source: Investment Strategy Group.

IMPORTANT: The projections or other information generated by the Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modeled asset class. Simulations are as of 31 December, 2023. Results from the model may vary with each use and over time.

Region-by-region outlook

Australia

Sticky rent prices and a still-tight labour market position the Reserve Bank of Australia (RBA) to be among the last developed market central banks to ease policy rates. We expect the RBA to cut the cash rate by 50 basis points, to 3.85%, by year-end, and that the rate eventually will settle in the 3%–4% range, in line with our assessment of the neutral rate—the theoretical rate that would neither stimulate nor restrict the economy.

- We foresee both headline and core inflation falling to around 3% year over year by the end of 2024, down from 3.4% and 3.9% on a “trimmed mean” basis, respectively, in February. We expect inflation to fall to the midpoint of the RBA’s 2%–3% target range in 2025.

- We forecast a year-end unemployment rate of about 4.6%, as financial conditions tighten amid elevated interest rates. It was 3.7% in February.

- Leading indicators suggest that broad economic activity is marginally below our estimate of trend or sustainable growth. We expect rising real household income, a reflating housing market, and improving business and consumer sentiment to support a gradual acceleration in growth. We continue to expect that Australia will avoid recession in 2024, with below-trend GDP growth of about 1%.

United States

The latest inflation and labour market data imply that U.S. production of goods and services remains healthy and underscore our view that continued economic strength might prevent the Federal Reserve from cutting interest rates in 2024.

- Measured by the Consumer Price Index, services prices were 5.3% higher on a year-over-year basis in March. Headline inflation advanced 3.5% year over year. We expect the Fed’s preferred inflation gauge, the core Personal Consumption Expenditures (PCE) index, which excludes food and energy prices due to their volatility, to record full-year 2024 inflation of about 2.6%.

- The U.S. labour market remains irrefutably strong. Workers on private nonfarm payrolls earned an average of $34.69 per hour in March, up 4.1% year over year and above the 3%–3.5% annual rate that we view as noninflationary. We forecast a modest rise in the unemployment rate—from 3.8% to about 4%—by year-end.

- We expect real (inflation-adjusted) U.S. economic growth of about 2% in 2024, higher than our initial estimate of about 0.5%.

China

China’s economy appeared to have made a solid start to 2024. But already questions have arisen about the sustainability of its growth after the second quarter, when year-over-year comparisons will be relatively easy.

- Economic growth had softened by the second quarter of 2023, as the unleashing of strong, pent-up demand post-COVID couldn’t be maintained. That soft patch will flatter year-over-year performance in this year’s second quarter. Continued strong growth increases the prospect that, with its full-year growth target of “about 5%” well in sight, China may not address underlying economic imbalances.

- Structural imbalances are likely to remain given the government’s policy priorities for investment and manufacturing upgrades over more direct measures to support consumer spending. We expect resulting supply-and-demand imbalances to continue to add to deflationary pressure amid weak consumer demand. To mitigate deflationary pressure, we forecast that the People’s Bank of China will cut its policy rate from 2.5% to 2.2% in 2024 and trim banks’ reserve requirement ratios.

- We foresee elevated real (inflation-adjusted) interest rates continuing to weigh on prices. We recently lowered our forecast for full-year core inflation from a range of 1%–1.5% to 1% and our forecast for headline inflation from 1.5%–2% to less than 1%, well below the central bank’s 3% inflation target.

Euro area

Speaking on April 11, European Central Bank (ECB) President Christine Lagarde emphasised that the ECB would be “data-dependent, not Fed-dependent” in considering the appropriate policy rate. Her reference was to the risk that, by maintaining its current rate target for an extended period, the U.S. Federal Reserve could spur other central banks to leave their rate targets higher than they otherwise might. Cross-border gaps in policy rates can put downward pressure on currencies where rates are lower, increasing inflation risk.

- Expects the ECB to trim its interest rate target by 25 basis points at each of its five remaining 2024 policy meetings, but rising energy prices skew risks toward a slower pace of easing. (A basis point is one-hundredth of a percentage point.) In our baseline case, the ECB’s policy rate ends 2024 in the 2.5%–3% range.

- The euro area’s economy is showing tentative signs of having bottomed in the fourth quarter of 2023. We continue to expect 2024 economic growth of just 0.5%–1% amid still-restrictive monetary and fiscal policy and the lingering effects of Europe’s energy crisis.

- The confluence of moderating wage growth, inflation expectations that remain in check, and lackluster demand supports our expectation that headline inflation will fall to 2% by September 2024 and core inflation will reach that same target by December. Headline prices were up 2.4% on a year-over-year basis in March. Core prices, which exclude the volatile food, energy, alcohol, and tobacco sectors, were up 2.9%.

- We expect the unemployment rate to end 2024 around its current 6.5% level. The labour market may be softer than the unemployment rate would suggest, however; job vacancy rates, though still high, have receded, labour hoarding remains elevated, and the number of hours worked has stagnated.

United Kingdom

A continued moderation in wage growth and encouraging inflation news could set the stage for policy interest rate cuts this summer. Growth in average regular pay, which excludes bonuses, slowed to 6.0% between December and February, a sixth consecutive moderation in the rolling, three-month measure.

- A reduction in the maximum price that energy suppliers can charge for a unit of energy should support falling headline inflation. Ofgem, Great Britain’s independent energy regulator, reduced its energy price cap for the April-June 2024 period by 12% following recent falls in wholesale energy prices. However, we’re watching crude oil prices amid heightened tension in the Middle East. We foresee headline inflation falling to just below 2% and core inflation falling to about 2.6% by year-end. The latest year-over-year readings, for March, were 3.2% and 4.2%, respectively.

- Encouraging wage and inflation data underscore our view that the Bank of England will begin a series of interest rate cuts beginning in August, with the bank rate falling by a percentage point to 4.25% by year-end.

- GDP data for January and February suggest the U.K. economy is emerging from a brief recession in the second half of 2023. We recently lowered our forecast for 2024 GDP growth to about 0.3%, down from an initial range of 0.5%–1%.

- As in the euro area, the labour market’s gradual loosening appears mainly driven by reduced vacancies and fewer hours worked, rather than an increase in unemployment. We recently lowered our year-end 2024 unemployment rate forecast from 4.5%–5% to 4%–4.5%.

Emerging markets

Amid continued strength in the U.S. economy, we have upgraded our 2024 GDP growth forecast for Mexico. U.S. demand for Mexican goods has remained strong, and domestic wages and consumption are holding up. Our revised forecast is for 1.75%–2.25% growth, up from 1.5%–2% but still below trend amid restrictive monetary policy.

- We continue to expect the world’s emerging markets to deliver economic growth of about 4%, on average, this year, led by growth of about 5% for emerging Asia.

- We forecast growth in the 2%–2.5% range for emerging Europe and Latin America, though U.S. growth could have positive implications for Mexico and all of Latin America.

- We expect that Mexico’s core rate of inflation will fall to 3.6%–3.8% and that the Banco de México will cut the overnight interbank rate to 9%–9.5% by year-end.

Canada

Canada’s economy avoided recession in the fourth quarter of 2023, thanks to the strongest population growth since 1957, which fueled consumption, and U.S. economic resilience, which buoyed exports. We continue to foresee below-trend growth in 2024 but have increased our growth forecast from about 1% to a range of 1.25%–1.5%. Risks skew to the downside amid the continued bite from restrictive monetary policy.

- We expect that the Bank of Canada (BOC) will trim its overnight rate by 50 to 75 basis points this year, to a year-end range of 4.25%–4.5%. (A basis point is one-hundredth of a percentage point.) The first cut is likely to be announced on June 5, after the next central bank policy meeting.

- As in the U.S., the “last mile” of inflation reduction could be the most challenging. We continue to foresee core inflation falling to a year-over-year pace within the BOC’s target range of 2%–2.5% by the end of 2024, with house prices moderating in response to declining affordability. Shelter prices, up 6.5% on a year-over-year basis last month, remain an upside risk amid immigration-fueled population growth.

- Amid weak economic growth, we forecast that the unemployment rate will end 2024 in the 6%–6.5% range. It was 6.1% last month.

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

This article contains certain 'forward looking' statements. Forward looking statements, opinions and estimates provided in this article are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of current market conditions. Forward-looking statements including projections, indications or guidance on future earnings or financial position and estimates are provided as a general guide only and should not be relied upon as an indication or guarantee of future performance. There can be no assurance that actual outcomes will not differ materially from these statements. To the full extent permitted by law, Vanguard Investments Australia Ltd (ABN 72 072 881 086 AFSL 227263) and its directors, officers, employees, advisers, agents and intermediaries disclaim any obligation or undertaking to release any updates or revisions to the information to reflect any change in expectations or assumptions.

Vanguard

April 24

vanguard.com.au