The age pension provides key benefits to retirees. It pays an income stream until death that is adjusted for inflation, providing a bulwark against poverty and higher prices in our later years.

Even though age pension benefits may sometimes be quite small, the fact that they continue until death can help manage the risk that you may live longer than planned for in retirement. For example, a male/female couple both aged 67 today has a 50 per cent chance that at least one of the couple makes it to age 90 and a 5 per cent (1 in 20) chance that one of them makes it to age 99 (ii).

Because the age pension is means tested and personal situations and goals vary so much, this is one of the occasions when it makes sense to consider using a financial advisor to help understand the rules and factor the age pension into your broader retirement financial plan.

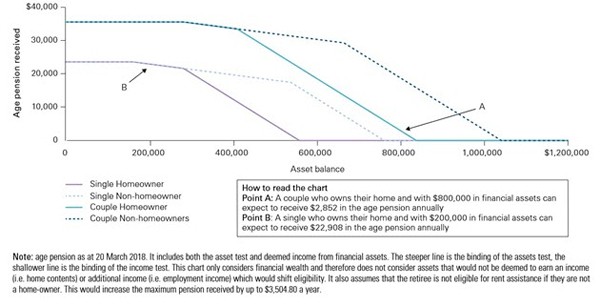

To decide how much age pension you are entitled to receive, the government considers your assets and your income. The level of pension received is based on which of those means tests produces the lower benefit.

On a basic level, the lower your assets and income, the more age pension you will be entitled to as its role as a safety net kicks in up to the maximum amount of $843.60 a fortnight for a single pensioner and $635.90 each for a couple, as at March 2019.

A financial advisor experienced in the interaction of the social security and superannuation systems can help you understand how these rules work and in particular the key break points where benefits reduce.

As you can see from this chart, the benefits drop off quite steeply at certain asset levels.

Understanding the impact of wealth on the age pension received

An advisor can also help you make decisions about how these breakpoints interact with your financial goals.

For example, consider the couple at Point A in the chart. If they start drawing down their assets to increase their annual spending or make a one-off purchase, they will also increase their yearly age pension benefit. This might be a wise move for some couples but not for others. Let's say this couple had identified leaving money to their children or setting aside funds for aged care as a financial goal. In those cases, the couple might do best to preserve and possibly grow, rather than spend, their assets, to achieve the goal.

Financial advisors can also guide you through other key considerations, including:

Rules on the treatment of annuities for means testing

Pension loan schemes to increase age pension using home equity

Links between age pension and related benefits, such as the Commonwealth Seniors Health Card

To learn more on the age pension and on creating financial security in retirement, check out our latest research on the topic.

i According to the Australian Institute for Health and Welfare

ii "The role of the Age Pension in your Retirement Plan," p. 3.

Robin Bowerman

Head of Corporate Affairs at Vanguard.

09 April 2019

25th-May-2019 |