Home is where the super is for many Australians

.

Home ownership is still the great Australian dream for many people.

But, for a growing number of older Australians, it is also about selling the home eventually so they can use some of the proceeds to top up their superannuation balance and help make their retirement plans a reality.

That’s borne out by recent Australian Tax Office (ATO) data showing almost 13,000 individuals collectively added around $3.38 billion into their super in the 2023-24 financial year by taking advantage of the federal “downsizer measure”.

The downsizer measure allows eligible individuals aged 55 and over to contribute up to $300,000 from the proceeds of the sale (or part sale) of their principal place of residence into their super fund. Couples can each contribute $300,000.

The ATO, which administers the measure, has an extensive list of eligibility criteria (and exclusions) on its website. They include a requirement that a home must have been owned for 10 years or more prior to selling, with ownership calculated from the date of settlement when it was purchased.

A downsizer contribution is a personal -post-tax super contribution, but doesn’t count towards your non-concessional contribution cap. It will be reflected in your total superannuation balance when it is next calculated (on 30 June). Downsizer contributions cannot be greater than the proceeds from the sale or part sale of a home.

A key advantage of making a downsizer contribution is that once some of the freed-up cash from a home sale is in super, any income earned on that money after the age of 60 is tax-free in pension phase.

Since the measure was rolled out in the 2018-19 financial year, the ATO’s data shows that around 78,600 Australians had used the proceeds of home sales by the end of 2023-24 to contribute a total of $19.88 billion into super funds.

The fear of running out of money in retirement remains a key issue for many Australians.

Moving from home to retirement

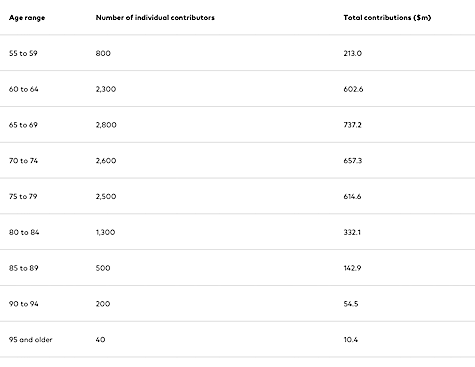

The ATO’s 2023-24 data breaks down the use of the downsizer measure by age bands, and it’s evident that the number of people “selling for super” started to accelerate after the age of 60.

While downsizer contributions can be made from 55 onwards, the numbers are much lower in the 55 to 59 age band.

The peak age band in the last financial year was between 65 and 69, with 2,800 individuals downsizing to contribute just under $740 million into their super.

The next-biggest age band was from 70 to 74, with a further 2,600 individuals contributing $657.3 million.

2023-24 downsizer numbers by age

Source: Australian Taxation Office

Note: Individual contributor numbers are rounded to the nearest 100, or the nearest 5 for individuals aged 95 and older. Contribution values are rounded to the nearest $100,000.

Where downsizers are downsizing

The ATO data also breaks down the location of downsizer measure users, and it’s not surprising that the numbers are higher in the more populous states.

NSW, Victoria and Queensland make up the top three regions for downsizer contributions by percentage of individuals, although the average super contribution sizes across states and territories have been relatively similar at around $250,000 per individual.

NSW accounted for 4,300 downsizer contributions in 2023-24, and a total contributions value of $1.17 billion.

Victoria was second, with 3,100 contributions and a total contributions value of $807 million, while Queensland accounted for 2,900 contributions and a total contributions value of $737.7 million.

2023-24 downsizer location demographics

Source: Australian Taxation Office

Note: The total number of individuals is rounded to the nearest 100, or the nearest 5 for the Northern Territory. Contribution values are rounded to the nearest $100,000.

Opening the door for retirees

The fear of running out of money in retirement remains a key issue for many Australians.

Vanguard’s How Australia Retires research shows just how real, and prevalent, that fear is among many Australians who are still working, or who have already retired.

Australia’s downsizer measure has effectively opened the door for many Australians to strengthen their super balance (either before retiring or after retirement).

People considering making a home downsizer contribution into super – especially those already receiving a partial or full government Age Pension – should do proper due diligence.

It’s important to seek out professional financial advice, especially with respect to social security means testing.

General advice warning

Vanguard is the product issuer and the Operator of Vanguard Personal Investor. Vanguard Super Pty Ltd (ABN 73 643 614 386 / AFS Licence 526270 is the trustee of Vanguard Super (ABN 27 923 449 966) and the issuer of Vanguard Super products. We have not taken your objectives, financial situation or needs into account when preparing this report so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs and the disclosure documents of any relevant Vanguard financial product before making any investment decision. Before you make any financial decision regarding a Vanguard financial product, you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard’s financial products can be obtained at vanguard.com.au free of charge and include a description of who the financial product is appropriate for. You should refer to the TMD of a Vanguard financial product before making any investment decisions. You can access our IDPS Guide, Product Disclosure Statements, Prospectus and TMD at vanguard.com. au or by calling 1300 655 101. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This report was prepared in good faith and we accept no liability for any errors or omissions.

Tony Kaye

19 February 2025

vanguard.com.au