ATO figures reveal final 2022 DPN tally

.

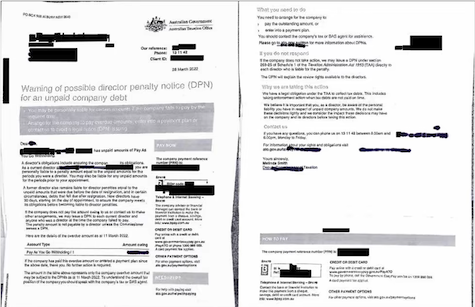

The ATO accelerated up through the gears on debt collection in 2022 to issue a total of almost 18,500 director penalty notices, figures released yesterday reveal.

The office also unsheathed a fresh weapon in its armoury by disclosing the tax debts of almost 500 businesses to credit referral agencies for amounts of $100,000 and above.

The final figures show that more than one in three directors failed to act after an April mail blitz by the ATO warned 52,000 directors about debts involving 30,000 companies.

By August, the ATO had issued 7,000 DPNs and was dispatching them at the rate of 120 a day. For the final five months of the year, it was also referring about 20 businesses a day to credit agencies after sending warning letters to more than 29,000.

The ATO said its debt recovery campaign, suspended during the pandemic, had been a success.

“We’ve seen an encouraging response to our letter campaigns, with a significant level of clients making payments or entering payment plans,” an ATO spokesperson said.

“The value of debt owed by clients at the start of the campaigns was $17.3 billion. As a result of these two campaigns, over $714 million has already been paid in full and a further $5.4 billion is now actively managed under payment arrangements.

“For those that have not responded we have progressed to issuing DPNs and disclosing the tax debt information of eligible businesses.

“In the 2022 calendar year, we issued almost 18,500 DPNs to individual directors in respect of more than 13,500 companies for unpaid GST, income tax withholding, and superannuation guarantee charge.

“In relation to Disclosure of Business Tax Debt, we disclosed nearly 500 businesses in 2022 to credit reporting agencies.”

The result of the ATO campaign also showed up in final insolvency figures for 2022, released by ASIC.

They revealed 4,806 total appointments over companies for the second half of 2022, a rise of 51 per cent of the corresponding period in the previous year.

Philip King

19 January 2023

accountantsdaily.com.au