.

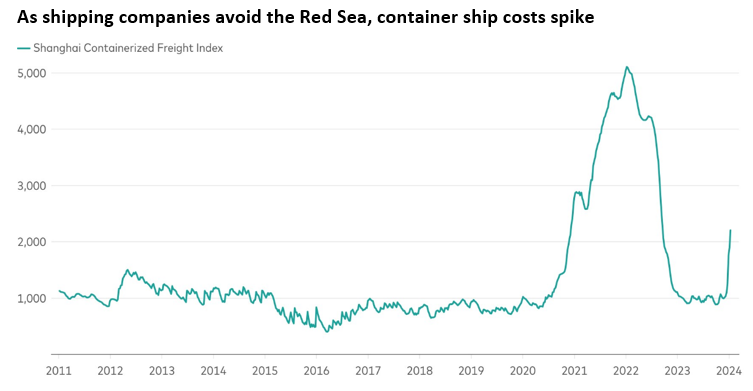

What might shipping detours of more than 3,000 nautical miles mean for goods prices and broad inflation rates? Not a lot, for now. Shipping contracts are typically locked in for a year or more, and shipping costs account for only about 1% of core goods prices. That said, freight rates for ships to move immediately out of Chinese ports have doubled in recent weeks, and Middle East-related risks to the global inflation outlook remain elevated.

Notes: The Shanghai Containerised Freight Index is based on spot rates, or rates for immediate payment and delivery, in U.S. dollars per 40-foot-equivalent units for U.S. destination ports and 20-foot-equivalent units for other global destination ports.

Sources: Shanghai Shipping Exchange and Bloomberg as of January 12, 2024.

“The steady decrease in the pace of inflation around the world in recent months is encouraging for policymakers,” said Shaan Raithatha, a Vanguard senior economist. “However, should the tensions in the Middle East escalate or continue for an extended period, the risk does increase for an upswing in inflation through higher goods prices, as well as through the potential for energy supply disruption.”

Vanguard expects central banks in developed markets to cut policy interest rates in 2024, though only in the second half of the year. We believe that market expectations for earlier cuts don’t acknowledge the challenges of bringing inflation down that last mile to many central banks’ 2% targets, given stickier wage-related services inflation. The risk of a new advance in goods prices due to protracted geopolitical tensions could give central bankers something else to consider.

Our 10-year annualised nominal return and volatility forecasts are shown below. Equity returns reflect a range of 2 percentage points around the 50th percentile of the distribution of probable outcomes. Fixed income returns reflect a 1-point range around the 50th percentile. More extreme returns are possible.

| 5th percentile | 25th percentile | 50th percentile | 75th percentile | 95th percentile | Volatility | |

| Australian Equities | -3.3% | 2.1% | 5.6% | 9.1% | 14.4% | 21.5% |

| U.S. equities (unhedged) | -4.0% | 1.3% | 5.0% | 8.8% | 14.6% | 19.9% |

| Emerging markets equities (unhedged) | -4.1% | 2.9% | 7.3% | 11.6% | 18.3% | 28.0% |

| Global ex-Australia equities (unhedged) | -2.3% | 2.7% | 6.1% | 9.7% | 15.1% | 19.4% |

| Global equities (unhedged) | -2.2% | 2.7% | 6.1% | 9.6% | 15.0% | 19.2% |

| Australian REITs | -3.7% | 1.9% | 5.4% | 8.9% | 14.2% | 5.5% |

| Australian aggregate bonds | 3.5% | 4.2% | 4.8% | 5.3% | 6.1% | 5.5% |

| Australian government bonds | 3.2% | 4.0% | 4.5% | 5.1% | 5.9% | 5.8% |

| Australian Linkers | 1.9% | 3.1% | 4.0% | 4.9% | 6.4% | 5.5% |

| Australian Credit | 4.4% | 5.1% | 5.6% | 6.1% | 6.9% | 4.4% |

| Global bonds (hedged) | 3.1% | 4.2% | 4.9% | 5.7% | 7.0% | 4.7% |

| Global government bonds (hedged) | 2.8% | 3.9% | 4.6% | 5.4% | 6.6% | 4.9% |

| Australian cash | 2.8% | 3.7% | 4.4% | 5.2% | 6.2% | 1.9% |

| Australian inflation | 0.1% | 1.3% | 2.1% | 2.9% | 4.1% | 2.4% |

Notes: These probabilistic return assumptions depend on current market conditions and, as such, may change over time.

Leading indicators suggest that Australia’s economy has improved somewhat since mid-2023. But they also suggest that economic growth is below trend, and inflation risks that skew to the upside mean that further monetary policy rate hikes aren’t off the table.

We expect the core Personal Consumption Expenditures index—the Fed’s preferred inflation measure, which excludes food and energy prices—to fall to 2.3% on a year-over-year basis by the end of 2024. It was 3.2% in November. The last mile of the journey back to 2% inflation will be challenging, however, owing to the “sticky” nature of services inflation.

Amid weak domestic consumption and private investment, stimulus will need to play a role in the revival of China’s economy. An indication of the government’s approach came on January 2, when the People’s Bank of China (PBOC) announced it had issued CNY 350 billion (USD 49 billion) in loans in December. The government chose to stimulate via its “pledged supplementary lending” facility, which provides support during property downturns. Vanguard expects the funds will be used toward supply-side projects, such as social housing construction and urban village renovation.

High-frequency data suggest that a further mild contraction occurred in the euro area economy in the fourth quarter. A preliminary estimate of fourth-quarter GDP, scheduled to be released January 30, could confirm that the economy fell into recession in the period after GDP contracted by 0.1% on a seasonally adjusted basis in the third quarter.

As in the euro area, economic growth in the U.K. continues to hover near zero. After modest growth in the first half of 2023, the U.K. economy contracted by 0.1% in the third quarter, a second GDP estimate showed. That was a revision from a preliminary estimate of 0% growth. High-frequency data suggest the economy stagnated or contracted minimally in the fourth quarter, in line with our outlook for a mild recession.

Some central banks in Latin America, including those in Chile and Brazil, have already begun to cut policy interest rates, and we expect further cuts in 2024. But the gaps between high rates of monetary policy and receding rates of inflation are wide, particularly in Latin America, meaning that monetary policies are restrictive. We expect them to remain so even amid rate cuts.

Core inflation has gone sideways in recent months, complicating the calculus for the Bank of Canada (BOC), which we expect to be among the first developed market central banks to cut policy interest rates this year.

Important information:

The projections and other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

All investing is subject to risk, including the possible loss of the money you invest.

Investments in bonds are subject to interest rate, credit, and inflation risk. Investments in stocks and bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. These risks are especially high in emerging markets.

This article contains certain 'forward looking' statements. Forward looking statements, opinions and estimates provided in this article are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of current market conditions. Forward-looking statements including projections, indications or guidance on future earnings or financial position and estimates are provided as a general guide only and should not be relied upon as an indication or guarantee of future performance. There can be no assurance that actual outcomes will not differ materially from these statements. To the full extent permitted by law, Vanguard Investments Australia Ltd (ABN 72 072 881 086 AFSL 227263) and its directors, officers, employees, advisers, agents and intermediaries disclaim any obligation or undertaking to release any updates or revisions to the information to reflect any change in expectations or assumptions.

By Vanguard

January 2024

vanguard.com.au

Hot Issues

January - March 2024 archive