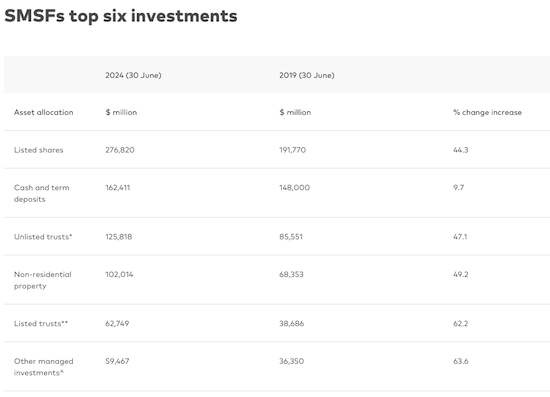

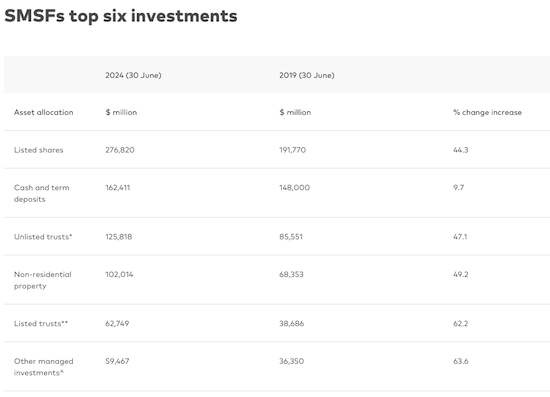

The biggest assets growth areas for SMSFs

.

vanguard.com.au

.

Latest News

Article archive

October - December 2024 archive

Level One Financial Advisers Pty Ltd. AFSL 280061. The information contained on this website is general information only. You agree that your access to, and use of, this site is subject to these terms and all applicable laws, and is at your own risk. This site and its contents are provided to you on an “as is” basis, the site may contain errors, faults and inaccuracies and may not be complete and current. It does not constitute personal financial or taxation advice. When making an investment decision you need to consider whether this information is appropriate to your financial situation, objectives and needs. Liability limited by a scheme approved under Professional Standards Legislation. Disclaimer and Privacy Policy

As founder of the firm Doug has over 30 years of experience advising families, businesses and professionals with commercially driven business, taxation and financial advice.

Doug’s advice covers a wide variety of areas including wealth creation, business growth strategies, taxation, superannuation, property investment and estate planning as well as asset protection.

Doug’s clients span a whole range of industries including Investors; Property and Construction; Medical; Retail and Hospitality; IT and Tourism; Engineering and Contracting.

Doug’s qualifications include:

Christine has over 25 years of extensive experience advising clients principally on taxation and superannuation related matters and was a founder of the firm when it began in 2004.

Christine’s breadth and depth of knowledge and experience provides clients with the comfort that their affairs are in good hands.

Christine currently heads up the firm’s SMSF division and oversees a team that provide tailored solutions for clients and trustees on all aspect of superannuation including:

Christine’s qualifications include:

Michelle has been with the firm in excess of 13 years and is an Associate in our Business Services Division.

Michelle and her team provide taxation and business advice to a wide variety of clients. Technically strong Michelle can assist with all matters in relation to taxation covering Income and Capital Gains Tax; Land Tax; GST; Payroll Tax and FBT.

Michelle is an innovative thinker and problem solver and always brings an in-depth and informed view to the discussion when advising clients.

Michelle has considerable experience with business acquisitions and sales as well as business restructuring.

Michelle’s qualifications include:

Joanne commenced with Level One in 2004 and has developed into one of our Senior Financial Advisers.

With over 20 years of experience, Joanne and her team provide advice across a wide variety of areas including: Superannuation; Retirement Planning; Centrelink; Aged Care; Portfolio Management and Estate Planning.

A real people person Joanne builds strong long term relationships with her clients by gaining an in-depth knowledge of their personal goals and aspirations while providing tailored financial solutions to meet those needs.

Joanne’s qualifications include:

The information contained on this web site is general information only. You agree that your access to, and use of, this site is subject to these terms and all applicable laws, and is at your own risk. This site and its contents are provided to you on “as is” basis, the site may contain errors, faults and inaccuracies and may not be complete and current.

It does not constitute personal financial or taxation advice. When making an investment decision you need to consider whether this information is appropriate to your financial situation, objectives and needs.

Level One makes no representations or warranties of any kind, expressed or implied, as to the operation of this site or the information, content, materials or products included on this site, except as otherwise provided under applicable laws. Whilst all care has been taken in the preparation of information contained in this web site, no person, including Level One Taxation & Business Advisors Pty Limited, accepts responsibility for any loss suffered by any person arising from reliance on the information provided.

Level One highly values the strong relationships we have with our clients. The collection of data at Level One is being handled with full and proper respect for the privacy of our clients. The data we collect is handled sensitively, securely and with proper regard to privacy laws. Level One does not disclose, distribute or sell the data we collect from our clients to third parties.