Super gender divide to remain a challenge

.

The Federal Government’s just-released 296-page Intergenerational Report 2023 provides a detailed analysis of the factors expected to shape the Australian economy and fiscal position over the next 40 years.

It shouldn’t come as a great surprise that if Australia’s population reaches 40.5 million by 2062-63, as projected by Treasury, that there will be a substantial increase in the number of retired Australians. Treasury estimates that the number of people aged 65 and over will more than double from current levels, and the number aged 85 and over will more than triple.

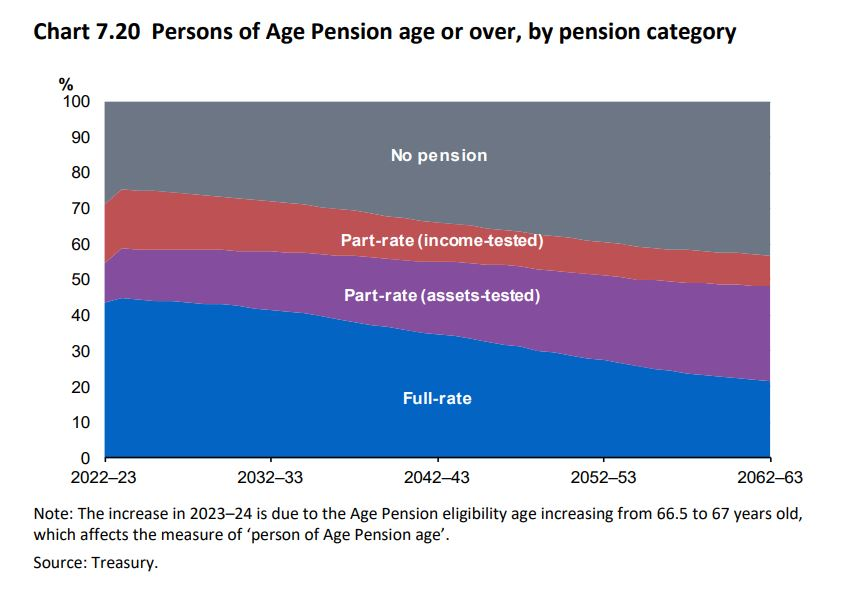

In tandem with this population growth, Treasury forecasts that the total number of Australians of Age Pension age and over will roughly double to around nine million by 2062–63.

Interestingly though, the Government also expects a smaller proportion of those older Australians will receive the Age Pension or other income support. It attributes this to the ongoing shift towards superannuation as a key source of retirement income and the role of compulsory Superannuation Guarantee payments by employers in reducing individuals’ reliance on the Age Pension.

Of those Australians who do receive the Age Pension, Treasury estimates that the shift towards more people receiving a part rate pension will continue and projects this to rise from 40% of retirees currently to 60%.

Super gender gap

The intent of the superannuation system – to empower Australians to fund the bulk of their retirement income needs – would appear to be on track, based on the forecasts contained in the latest Intergenerational Report.

But one key retirement issue it predicts won’t disappear over the next 40 years is the divergence between men’s and women’s average superannuation balances.

“The gender gap in superannuation balances is expected to persist reflecting the lower lifetime earnings of women because of greater part-time and casual work, time out of the paid workforce and the gender pay gap,” the report states.

“Women historically have a longer retirement to fund due to earlier retirement and longer life expectancy. This puts further pressure on women’s superannuation balances. This gap in the retirement period is expected to reduce as men’s life expectancy deficit, relative to women, reduces.”

The Government forecasts that average life expectancies will continue to rise. Life expectancies at birth are 81.3 years for men and 85.2 years for women in 2022-23 and are expected to be 87.0 years for men and 89.5 years for women by 2062-63.

Effectively this means longevity risk – the risk of running out of money before death – will be an issue for more Australians in the future (for women and men).

Challenges for how Australian women retire

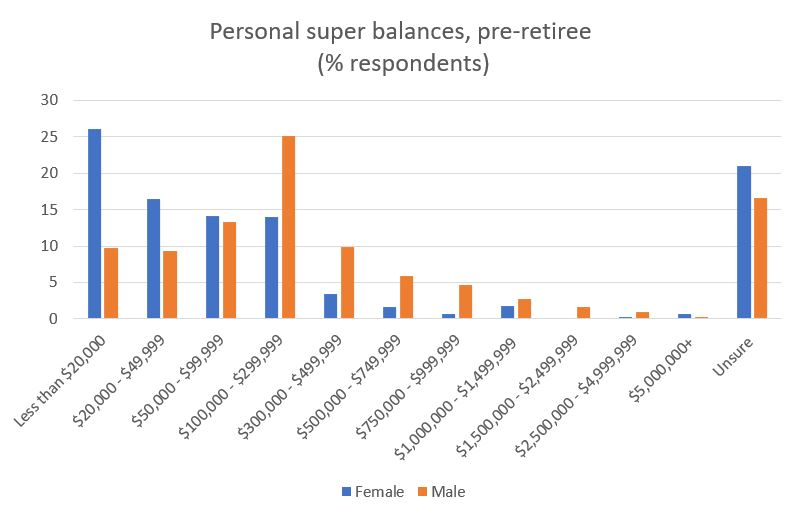

New analysis from Vanguard’s How Australia Retires study of over 1,800 working and retired Australians, released in May 2023, shows many women face substantial gender-based differences.

These include in homeownership, personal super balances, personal investments, annual income, and in overall confidence levels, leading up to retirement.

“There’s a whole spectrum of circumstances that mean women aren’t on equal footing when it comes to being able to prepare for retirement or to retire well,” says Vanguard’s Shannon Nutter.

“On average, Australian women earn 13% less than their male counterparts, often work in industries with lower wages, take time off to manage home-related issues, care for children, and live longer.

“All this means that women need to save or invest more to retire well, but have less assets to start with.”

Source: Vanguard

The How Australia Retires report found Australian men are more likely to be confident and optimistic about both their decision-making abilities and their retirement plans in contrast to their female counterparts.

50% of men surveyed ranged from “very” to “extremely confident” about making decisions related to managing their finances, while only a third of female respondents (33%) indicated the same. Likewise, only 11% of men surveyed indicated “slightly” and “not at all confident” about their financial decision-making, in comparison to 23% of women surveyed.

Financial literacy comparisons

The research showed a much higher proportion of women responded that they feel “not at all confident” in understanding investing products and services like stocks and bonds (47% and 64% female vs 22% and 37% male) while a higher proportion of men felt moderately or very confident across a wide range of products and services from ETFs to annuities, the Age Pension and property. Women are more than twice as likely to feel not at all confident in their understanding of Superannuation compared to men (20% female vs 8% male).

The research also showed that in the main, female Australians do not have a clear plan for retirement in comparison to their male counterparts. Regardless of retirement status, women were less likely to have a strong plan for retirement.

Nearly 46% of women survey said they “had no plan” or “did not know what they needed for retirement”. The opposite is true for men with 73% stating they have a “general”, “good” or “exact plan” for how they will financially prepare to reach the retirement lifestyle they want.

“We all need to take ownership of our financial futures and take actions that will help us retire the way we envision,” Nutter says.

“This might mean women, whether single or partnered, take time to understand the different aspects that contribute to retirement.

“For instance, being aware of their household finances, getting smart about debt, planning and seeking advice, investing regularly, making additional contributions to super and getting comfortable with negotiating better compensation.”

General advice warning

This information has been prepared by Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263). We have not taken your objectives, financial situation or needs into account when preparing this information so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for any financial products before making any investment decision. Before you make any financial decision regarding Vanguard’s financial products, you should seek professional advice from a suitably qualified adviser. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This publication was prepared in good faith and we accept no liability for any errors or omissions.

©2023 Vanguard Investments Australia Ltd. All rights reserved.

Tony Kaye

August 2023

vanguard.com.au