DGZ Chartered Accountants

We take pride in the professional delivery of tax advice, business consultancy, auditing and compliance services through superior customer service and advice to all clients large or small.

What do we offer?

- Tax Planning & Compliance

-

Don't get lost under the paperwork. We can organise your accounting and tax returns in an efficient and effective manner, compliant with the ATO.

- SMSF & Superannuation Services

-

Assistance with managing the compliance of your superannuation to secure your retirement future.

- Business Advisory Services

-

We like to understand what your business is trying to achieve so that our input maximises your outcomes. We are here to help your business grow efficiently and effectively.

- Corporate Compliance

-

It's important to ensure that your business recording and reporting is well structured and documented. We provide a broad range of compliance services so that you can focus on running your business.

- Audit & Assurance Services

-

Our skilled professionals provide a comprehensive range of audit and assurance solutions to meet the needs of businesses, not-for-profits, and individuals, ensuring compliance with regulatory requirements and enhancing stakeholder trust.

- Estate & Succession Planning

-

Our tax planning services are designed to address potential tax implications and maximize the value of your estate.

Latest Accounting News

Why Might a Lease Dispute Occur?

A lease dispute can arise for various reasons during the lease term and even after it...

$20,000 instant asset write-off

This is a great scheme for small businesses and runs until the 30 June...

ASIC have recently issued the new scam warning regarding Bunnings and issuing of investment...

The Largest Empires in the World's History

Check out the Largest Empires in the World's...

All the documents, fact sheets and downloads to do with this year’s 2025-26 Federal Budget

Federal Budget 2025-26 – Papers and Fact...

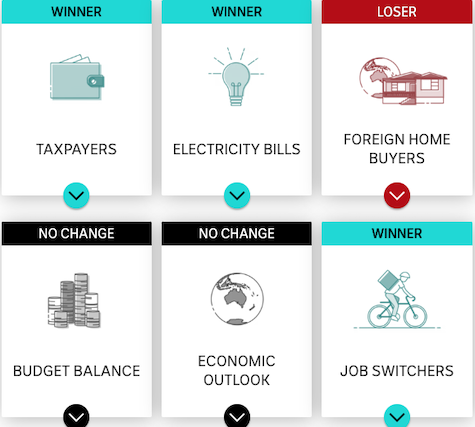

Winners and Losers - Federal Budget 2025-26

Treasurer Jim Chalmers has handed down his fourth federal budget, laying the groundwork for a federal election...

Building Australia's future and Budget Priorities

Building Australia's future and Budget...

ATO outlines focus areas for SMSF auditor compliance in 2025

The ATO has issued guidance on what it will focus on regarding auditor compliance for...

Contact Us

Get in Touch

DGZ Chartered Accountants welcomes your enquiry. To book an appointment or simply ask us a question, fill in your details and we'll be in touch soon!

Office Location

- 24 Barolin St, Bundaberg QLD 4670

Office Hours

- By appointment:

- Monday - Friday: 8.24am – 5.00pm

- Saturday & Sunday: Closed

Mail Address

- PO Box 1935, Bundaberg QLD 4670