Investment and economic outlook, October 2023

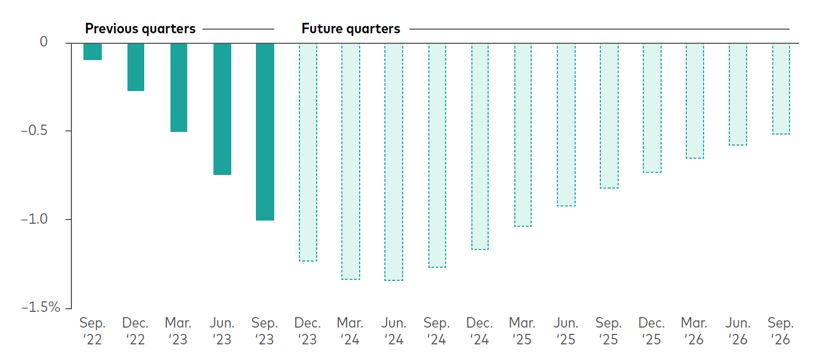

The peak drag on consumption caused by European Central Bank (ECB) monetary policy will likely occur in the first two quarters of 2024, according to Vanguard research.

.

It will be an important development in a region where consumption accounts for 50%–55% of economic activity. Our research model assumes that the ECB holds its current, 4% deposit facility rate steady through the end of our forecast horizon in September 2026.

Estimated impact of 4% ECB policy rate on euro area consumption

Notes: The simulation estimates the impact of the European Central Bank’s current tightening cycle to euro area consumption and assumes the deposit facility rate stays at the current 4% level for the entire forecast horizon. It uses a proprietary error-correction model that predicts euro area consumption using a combination of short- and long-term drivers, including disposable income, unemployment rate, household wealth, and short-term interest rates.

Sources: Vanguard calculations through September 30, 2023, using data from Bloomberg.

A lowering of the ECB’s deposit facility rate would ease the drag of policy on consumption, but we don’t expect the central bank to cut interest rates until at least the second half of 2024.

“The ECB will want to maintain the progress it has made in the inflation fight, and that will likely require holding interest rates at their current high level well into 2024,” said Shaan Raithatha, a Vanguard senior economist. “We may not see a ‘painless disinflation’ where growth and employment are unaffected by higher rates.”

The views below are those of the global economics and markets team of Vanguard Investment Strategy Group as of October 19, 2023.

Region-by-region outlook

Australia

The Reserve Bank of Australia (RBA) left its cash rate unchanged at 4.1% for a fourth consecutive policy meeting early this month. The bank is balancing concerns that inflation remains too high, especially in the services sector, with growing economic uncertainty.

- Vanguard believes the RBA will hike rates once or twice more, reaching a peak rate of 4.35%–4.6%. The latest inflation reports seem to support a more hawkish stance and, as such, the chances of a November hike are growing.

- Headline inflation jumped to 5.2% year-over-year in August, driven by a sharp rise in automotive fuel prices. The jump ended three consecutive months of slower price increases. We expect headline inflation to fall to about 4.5% by year-end—as higher interest rates dampen demand—and to reach the RBA’s 2%–3% target in late 2024 or 2025.

- “Despite the mixed signals, we are seeing signs that the labour market is gradually loosening,” said Alexis Gray, a Vanguard senior economist. “In recent months, the number of job vacancies has been falling, illustrating that firms are scaling back hiring plans.”

- We expect gross domestic product to grow 0.75%–1.25% for all of 2023 and assess the probability of a recession over the next 12 months to be about 40%.

United States

The first reading of third-quarter gross domestic product (GDP), due to be released October 26, may reflect continued economic resilience. Vanguard’s proprietary economic tracking model suggests that the quarter’s GDP growth could be roughly twice our original expectation of 1.5%, annual ised. Consumption continues to drive gains; resilience has broadened and remains diversified across sectors.

- Between June and August, the Federal Reserve’s preferred inflation gauge rose at an annualised rate of 2.16%. It was the lowest such reading of the core Personal Consumption Expenditures (PCE) index, which excludes volatile food and energy prices, since early 2021. Continued deceleration in the core PCE would increase the likelihood of the Fed reaching its 2% inflation target in 2024.

- Surprisingly strong job creation obscured what was, on balance, a neutral labour market report for September. Wage growth, the number of long-term unemployed, and private companies’ employment growth suggest the labour market continues to soften gradually.

- The Federal Reserve affirmed last month its 5.25%–5.5% target range for short-term interest rates. We remain modestly hawkish, expecting one to three additional increases in the Fed’s policy rate in the coming months and no rate cuts until mid-2024 at the earliest.

China

Last month, the People’s Bank of China (PBOC) cut the reserve requirement ratio by 25 basis points (0.25 percentage point) for all financial institutions with ratios above 5%. Vanguard sees the move as intended to boost sentiment and to meet a demand for liquidity amid an acceleration in local government bond issuance.

- We expect the PBOC to cut that ratio further in the coming quarters and to trim the policy rate by 10-20 basis points. Rising U.S. Treasury yields and a strengthening U.S. dollar may limit the room for immediate monetary support.

- We remain cautious about deflation risks, as household fundamentals remain weak. Mortgage repricing could provide some support to income, and if consumer confidence improves, a solid rebound in inflation could follow.

- Third-quarter growth in China’s gross domestic product surprised investors on the upside, though it aligns with our expectation of growth regaining momentum, largely due to the step-up in policy support.

- Despite some improvement thanks to easing measures, the contraction in property sector investment may persist and intensify. Funding constraints among developers persist, and a contraction in sales is unlikely to reverse. Policy measures introduced in late August may not help immediately, and issues of supply and business confidence remain unresolved.

- Nevertheless, Vanguard is above consensus with a full-year overall growth forecast of 5.25%–5.75%. Our forecast is highly dependent upon reviving confidence in the private sector and households.

Euro area

The European Central Bank (ECB) raised its deposit facility rate by 25 basis points (0.25 percentage point) in September, to a record high of 4%. The monetary policy statement appeared to confirm our view that the bank’s rate-hiking cycle, which began in July 2022, is over. We expect the bank to maintain its 4% rate at least until the second half of 2024.

- Headline inflation slowed more quickly than expected last month, supporting the view that ECB rate hikes are over. Broad consumer prices rose 4.3% on a year-over-year basis—the slowest pace of increase in 23 months.

- Vanguard expects the gross domestic product, set for release October 31, to show a third-quarter contraction in the euro area economy. Another decline is likely in the fourth quarter, which would signify an economy in recession. A second consecutive inflation-adjusted decline in retail sales, in August, demonstrated continued economic weakness.

- As noted, we’re sceptical that there will be a soft landing or painless disinflation. Vanguard veers from consensus and believes a contraction is likely for the second half of 2023, and that unemployment will also be higher for the rest of 2023 and in 2024.

United Kingdom

A better-than-expected August inflation report allowed the Bank of England (BOE) to hold the bank rate at 5.25% last month. The pause, like that of the Federal Reserve, reflects the bank’s progress in its inflation fight and its desire not to restrict growth more than necessary, as discussed in Winding down the monetary tightening cycle, a commentary with Vanguard senior economists Shaan Raithatha and Josh Hirt.

- Other investors may believe the BOE is done raising rates, but we think one or two more hikes remain possible, with the policy rate peaking at 5.5%–5.75%. Rate cuts are unlikely to arrive before mid-2024.

- Gross domestic product is estimated to have grown by 0.2% in August, having fallen by a revised 0.6% in July. Like our assessment of the euro area, we believe the U.K. will slip into a recession in late 2023.

- We believe both headline and core rates of inflation will fall close to 5% by the end of 2023, primarily from drops in the prices of commodities and core goods. Service prices may stay elevated.

Emerging markets

Slowing inflation and slower growth have allowed emerging market (EM) central banks to pause rate hikes; some have even started cut rates. Chile, Poland, and Brazil were among those that cut rates in recent months.

- For EMs in general, both core and headline inflation seem to be moderating and past their peaks, partly because of cooling developed market economies. But commodities remain a big upside risk, particularly for economies more vulnerable to food and energy price fluctuations.

- Financial markets have priced rate cuts for 2024 for many EMs outside of Asia, and this is consistent with Vanguard’s view of materially slowing growth in 2024. Asia will likely have relatively robust GDP growth among EMs.

- The U.S. dollar’s strength relative to other major currencies moderated in recent weeks, but it’s still higher than it was in mid-2023. The direction and magnitude of the dollar’s strength will have an impact on EMs’ import/export prices, inflation, interest, and ultimately growth rates.

Canada

Real gross domestic product (GDP) contracted in the second quarter (–0.2% quarter-over-quarter, annualised) and was revised downward for the first quarter (to 2.6%). Consumer spending retrenched. Housing activity also weighed on GDP growth for the fifth straight quarter. However, leading indicators for economic activity, while negative, have improved, suggesting a smaller third-quarter contraction.

- The Bank of Canada (BOC) next meets October 25, and it may choose to hold its overnight rate target steady at 5.0%, as it did in September. A return to growth in the third quarter may prompt hawkish BOC communications.

- The pace of inflation decelerated in September. It would have slowed further if petrol prices had not surged. We expect inflation to moderate this year as the impacts of policy tightening take effect. However, risks from higher shelter costs remain, as higher rates have raised mortgage interest costs and rents remain elevated because of continued housing shortages.

- Canada’s economy added 64,000 jobs in September, and the unemployment rate registered 5.5% for a third straight month after three previous months of increases. The recent upward trend in employment comes alongside Canada’s greatest population growth rate since 1957.

Vanguard’s outlook for financial markets

Our 10-year annualised nominal return and volatility forecasts are shown below. They are based on the June 30, 2023, running of the Vanguard Capital Markets Model® (VCMM). Equity returns reflect a range of 2 percentage points around the 50th percentile of the distribution of probable outcomes. Fixed income returns reflect a 1-point range around the 50th percentile. More extreme returns are possible.

Australian equities: 4.2%–6.2% (21.7% median volatility)

Global ex-Australia equities (unhedged): 4.8%–6.8% (19.4%)

Australian aggregate bonds: 3.8%–4.8% (5.5%)

Global bonds ex-Australia (hedged): 4.0%–5.0% (4.7%)

The projections and other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

Important information

All investing is subject to risk, including the possible loss of the money you invest.

Investments in bonds are subject to interest rate, credit, and inflation risk. Investments in stocks and bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. These risks are especially high in emerging markets.

This article contains certain 'forward looking' statements. Forward looking statements, opinions and estimates provided in this article are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of current market conditions. Forward-looking statements including projections, indications or guidance on future earnings or financial position and estimates are provided as a general guide only and should not be relied upon as an indication or guarantee of future performance. There can be no assurance that actual outcomes will not differ materially from these statements. To the full extent permitted by law, Vanguard Investments Australia Ltd (ABN 72 072 881 086 AFSL 227263) and its directors, officers, employees, advisers, agents and intermediaries disclaim any obligation or undertaking to release any updates or revisions to the information to reflect any change in expectations or assumptions.

Vanguard

October 2023

vanguard.com.au