Summary of Superannuation Issues and Recent Changes

.

Concessional contributions cap: The annual concessional contributions cap is currently $27,500 per person effective from 1 July 2021.

Making catch-up concessional contributions: From 1 July 2018, a person with an account balance of less than $500,000 is able to make “catch up” concessional contributions by using any unused portion of their concessional contributions cap from the previous five consecutive years.

Division 293 tax: The income threshold after which an additional 15% of tax (making an effective contributions tax rate of 30%) was imposed on the contributions of “high income” earners is currently $250,000.

Spouse contributions: People who make contributions for their spouse are able to claim a tax offset up to $540 per annum (at the rate of 18% up to a maximum of $3,000) where their spouse earns below $37,000.

Non-concessional Contributions (After Tax Contributions):

- The standard annual non-concessional contributions cap is currently $110,000 effective from 1 July 2021.

- If a member’s super balance is above the superannuation balance cap at 30 June in a year currently $1.7m (increased to $1.9m from 1 July 2023), the member is not eligible to make non-concessional contributions in the following year.

- The three year bring forward rule is applied to enable after tax contributions up to three times the standard annual non-concessional cap, i.e. of contributions of up to $330,000 will be permitted at any time if under age 75.

- If a member’s super balance is close to the balance cap amount at 30 June being $1.7m ($1.9m from 1 July 2023) the member is only able to bring forward the $110,000 annual cap for the number of years that would take the member’s balance to the cap amount.

Individuals with super balances at or above the balance cap are only able to increase their overall super balance via concessional contributions and investment growth.

PENSIONS

Retirement phase transfer limits: From 1 July 2017, the total amount a member can “transfer into the retirement phase” was limited to $1,600,000. This was increased to $1,700,000 from 1 July 2021 and to $1,900,000 from 1 July 2023. Earnings arising from a pension account, which cause the account to exceed the cap, may be retained in the “retirement phase” account, but pension payments deducted cannot be replenished. Given this, a strategy of taking out only the minimum amount from pension accounts with supplementary additional amounts being withdrawn from accumulation accounts or withdrawn as commutations from the “retirement phase” accounts should be considered.

MARKET VALUATONS AS AT END OF FINANCIAL YEAR

Current market valuations of all assets were required to be incorporated into the Financial Statements. Valuations for listed investments are readily available. Valuation of unlisted investments, including property investments are required to be arranged as at 30 June 2023, and for following years.

In respect of property investments, the ATO valuation guidelines are not definitive, however it is recommended that at least two valuations from a real estate agent or one from an independent sworn valuer is obtained.

EVENT BASED REPORTING FOR SMSF’S

Self-managed super funds (SMSFs) are subject to a reporting regime relating to the transfer balance cap and event-based reporting framework.

The transfer balance account report (TBAR) is a separate form from the SMSF annual return (SAR). The TBAR enables the ATO to record and track an individual's balance for both their transfer balance cap and total superannuation balance cap.

From 1 July 2023, TBAR’s are required to be lodged for all Funds on a quarterly basis.

RECENT CHANGES TO SUPERANNAUTION

No Work Test

If you are under age 75, from 1 July 2022 you do not have to satisfy the work test in

order to make or receive non-concessional super contributions and salary sacrificed

contributions.

Super Guarantee increase

The rate of super guarantee payable by employers increases from 10.5% to 11.0% of employee wages from 1 July 2023.

Downsize your home and add to your super

From 1 January 2023, people aged 55 or over can make contributions into their super account of up to $300,000 ($600,000 for a couple) using the proceeds from the sale of their main residence. Although these ‘downsizer’ contributions are considered non-concessional (after-tax) contributions, they are in addition to any voluntary contributions made under the current non-concessional contributions cap ($110,000 in 2022/23).

Covid-19 Superannuation Changes

Pension Reductions

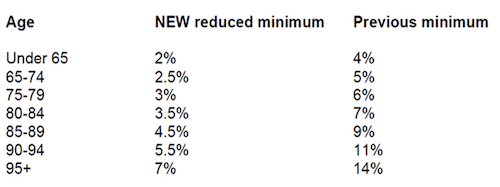

There is currently a reduction to minimum pension payments for the 2020/21, 2021/22 and

2022/23 financial years, of 50%, reducing minimum percentages to :

SMSF Investment Strategies

The ATO’s requirements

The guidance and requirements from the ATO are summarized as follows:

Extent of Diversification

The ATO have advised that trustees should consider including in the strategy the extent to which the fund investments are diverse and the risks which could apply from a lack of diversification.

Tailored and specific

The ATO has advised that an investment strategy permitting a range of investments, for all investment categories, of 0-100 % would generally not be acceptable, as it would indicate a lack of proper consideration by the trustee.

They advise that the trustees should consider the personal circumstances of each member and explain how the investment strategy meets the retirement objectives of each member.

Investment strategy compliance

To ensure a fund’s investment strategy meets the requirements of the ATO, it is

recommended that the trustee :

- have a current investment strategy in place;

- review it regularly (at least annually), and in doing so :

- document the personal circumstances of the members including their ages,

- retirement plans, likely future contributions and employment status;

- SUP795830

- consider the likely risk and return of the assets invested in;

- consider the liquidity and cash-flow requirements of the fund;

- consider the ability of the trustee to discharge the liabilities of the fund;

- consider the degree of diversification of the assets invested in; and

- consider whether insurance should be held for the members.

Proposed Super Changes

Pay Day Superannuation

It has been announced that from 1 July 2026, employers will be required to pay their employees’ super at the same time as their salary and wages.

The start date will provide employers, super funds, payroll providers and other parts of the superannuation system with sufficient time to prepare for the change. This measure is not yet law.

Additional 15% tax on earnings where member balances are in excess of $3m.

The proposal is effectively an additional 15% tax on “earnings” on balances (excluding the first $3m), calculated as described below. It is proposed that tax will be able to paid by the Fund, or by the member personally.

The proposed method of calculation is controversial as it includes taxing unrealised capital gains and a negative result is only available to be carried forward.

The proposed start date is 1 July, 2025, and after the next deferral election, so there’s a lot of water to go under the bridge.

Based upon published information, the tax calculation methodology is summarised as follows :

- Closing member balances (CMB) + any withdrawals for the year – any net contributions for year, less opening balance (OB) = earnings (E).

- Percentage of earnings (POE) = CMB less $3m/CMB

- Tax = POE * E * 15%.