SMSFs go for growth

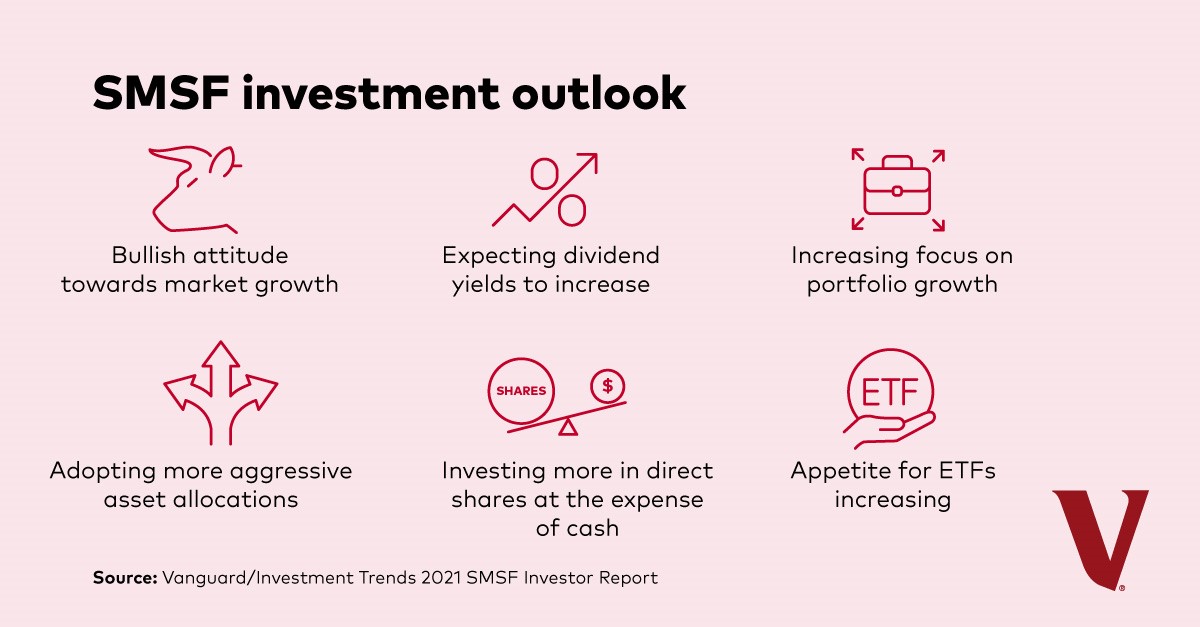

SMSFs are looking to invest more in equities and less in cash in this low-yield environment, according to the Vanguard/Investment Trends 2021 SMSF Investor report released last week.

According to the 2021 Vanguard/Investment Trends SMSF Investor report published last week, SMSF trustees are intending to increase their allocation to equities and decrease their allocation to cash in this current low-rate environment.

Some 49 per cent of SMSFs who want to decrease their cash allocation cited cash as a poor investment considering record low interest rates. Forty per cent also believe they must invest outside of cash to generate a steady income stream, a concern that remains top of mind for SMSFs.

Many SMSFs have traditionally relied on the yield generated from their investments to provide income during retirement. Unfortunately, with interest rates expected to remain low for the next year at least, cash investments are unlikely to produce the desired level of income.

Instead, SMSFs are looking to invest more in equities or income yielding assets like property to make up for the shortfall.

Optimistic about markets

SMSFs' appetite for growth-oriented investments is also returning because of their increasing optimism that markets will experience steady growth as economies recover from the pandemic.

More than 60 per cent of trustees surveyed said they had a positive outlook on Australian shares, and almost 50 per cent said they had a positive outlook on international shares.

This bullish sentiment is also reflected in SMSFs' increased dividend yield expectations for the next 12 months, with their dividend yield expectations recovering to pre-pandemic levels (4.2 per cent in April 2021 vs. 4.3 per cent in April 2019, on average).

Additionally, SMSFs pursuing portfolio growth are also more willing to invest in ETFs and small cap and speculative shares in 2021 than they were in 2020.

The shift in asset allocation to a more aggressive stance is understandable given current market conditions, but SMSFs must consider their risk tolerance and remember the role that defensive assets, like bonds, play in a diversified portfolio before significantly altering their investments.

Recent Vanguard research showed that investors would have to be 100 per cent allocated to equities to produce the dividends needed to support most income requirements. This significantly elevates a SMSF's portfolio risk – buoyed up even higher if they're invested in speculative shares that can experience large price fluctuations.

An alternative investment strategy suited to low-yield environments is a total returns approach, where investors utilise both income and capital growth elements of their portfolio to support their spending needs.

Strong appetite for ESG investing

SMSFs are eager to increase their allocation to ESG investments if it generates positive returns, but there exist several barriers to ESG adoption.

SMSFs' uptake of ESG products is predominantly determined by whether or not they believe ESG investment can deliver comparable returns to incumbent products.

While the majority (54 per cent) of SMSFs surveyed believe returns from ESG investments will be similar to non-ESG investments, 22 per cent believe returns will be worse.

Almost half of SMSFs would only consider ESG investments if they offered better returns, while 39 per cent of trustees are not willing to accept potential lower returns even if the fund generates a positive social or environmental outcome.

There is also a lack of awareness among SMSFs of ESG products, with 21 per cent citing lack of knowledge as a barrier to ESG investing, and 18 per cent citing lack of tools and research to identify and compare ESG products as another.

This year's survey reveals that while there is certainly appetite for ESG investments, the industry still has a way to go to improve SMSFs' awareness and understanding of such products.

SMSF market overview

Total SMSF assets have rebounded to an all-time high of A$787b in March 2021 following COVID-induced losses last year (A$694b in March 2020). The total number of SMSFs also continues to grow, with some 597k SMSFs established as of March 2021, despite the annual rate of establishment at decade lows.

SMSFs trustees are also getting younger, with the average age falling from 48 to 46 years old.

This suggests that SMSFs are now no longer just the realm of older investors. Younger investors are setting up SMSFs with smaller account balances and appreciating more the investment control and return opportunities that SMSFs can offer.

However, 44 per cent of potential SMSF trustees still intend to keep their APRA regulated super fund as contributions are still paid into this account and as a back-up in case they change their mind.

SMSFs and financial advice

COVID uncertainty ignited a significant shift in SMSF attitudes towards financial advice, with more trustees willing to seek professional advice than they did before the pandemic.

This, however, has not translated into increased adoption of advice, as the number of SMSFs using financial planners continue to slide.

Positively, overall satisfaction with financial planners has increased slightly since last year from a composite score of 69 per cent to 71 per cent, particularly when it comes to tax advice or technical expertise.

Written by

Vanguard

20 Jul, 2021