US Fed policy: Normalisation begins

Commentary by Vanguard Global Chief Economist Joe Davis.

Figures cited are in Australian dollars, at September 2017 exchange rates.

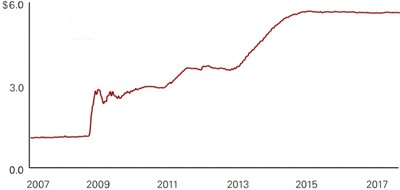

As Vanguard forecast last year, the United States Federal Reserve is entering on "Phase Two" of its path to policy normalisation: the reduction of its balance sheet of about $5.6 trillion in securities (mostly US government bonds) acquired as part of the Fed's economic stimulus efforts during and after the global financial crisis.

Our anticipation that 2017 would mark the transition from Phase One (raising the US federal funds rate, an influence on interest rates worldwide) from 0%–0.25% to 1.00%–1.25%) to Phase Two was based on a view that the US labour market would continue to gradually tighten this year and financial conditions improve, even without a strong rebound in inflation. That outlook has been generally on point.

Shrinking the Fed's balance sheet

Most market observers now anticipate an appropriate, gradual and smooth unwinding of the Fed's balance sheet that is unlikely to give the financial markets pause. I agree with "appropriate" and "gradual." The third adjective, "smooth," is what worries me.

To be fair, the Fed has taken a number of steps to mitigate market impacts:

- A transparent forward-guidance strategy.

- A slow schedule for unwinding – initially by only about $7.5 billion per month of US Treasury notes and $4.9 billion of mortgage-backed securities (MBS). This will eventually rise to about $37.7 billion per month and $24.9 billion per month, respectively, compared with average daily trading volume of almost $625 billion in the Treasury market and almost $250 billion in the MBS market.

- An intent not to sell securities but simply to decrease the amount it reinvests from maturing securities.

- A likelihood of settling on an optimal balance-sheet size that is significantly higher than precrisis levels (we expect it to be in the $3.7–$4.4 trillion range, up from about $995 billion).

Total assets on the Fed's balance sheet

(Figures in trillions of AUD)

Note: Data are from 1 January 2007 through 23 August 2017. Sources: Vanguard and Federal Reserve Bank of St Louis. Figures are at September 2017 currency exchange rates.

Phase Two risks

To be clear, we believe that the Fed's course of action in beginning to taper its balance sheet is appropriate given the state of the US labour market and the strength in financial conditions. But I believe we should all be prepared for a potential uptick in volatility during this monetary policy phase. No major central bank has yet successfully reversed quantitative easing, or QE (the Bank of Japan's balance sheet is higher today than a decade ago), so we shouldn't take for granted that this will be easy and uneventful.

With the balance sheet at an unprecedented size (see chart above), passing this second milestone without materially affecting financial conditions or roiling the markets could well prove a bigger challenge for the Fed than starting to raise rates. Because the Fed's QE programs helped to stimulate asset prices and the search for yield (sometimes clinically referred to as the "portfolio rebalancing effect"), I believe it is reasonable to expect some choppy waters in the months ahead as some of the oxygen is let out of the system.

Where we're headed

The Fed would clearly like to return to more normal monetary policy conditions and has taken pains to lay out how it expects to get there. Phase Two is part of that plan. Most believe that the well-telegraphed tapering of the balance sheet will be a "nonevent." Many economists, including those at the Fed, see Phase Three – resuming the course of rate hikes – occurring as early as December 2017.

Our view is different. For some time, we have felt that Phase Two would be followed by an "extended pause" in rate hikes, leaving short-term rates near 1.25% through the middle of 2018, if not longer. Whether our long-held view proves correct will depend on a range of factors including the pace of future inflation, how quickly the unemployment rate declines below 4% and how supportive financial conditions are to the economic recovery.

Our outlook

The Fed is unlikely to raise the federal funds rate as it begins tapering its balance sheet. Nonetheless, Phase Two should still be viewed as a "tightening" in monetary conditions as it will reduce total Fed balance sheet assets following several rounds of QE. In my mind, QE has been a factor in the strong performance of various investments over the past several years, including equities and bonds. Risk appetites, as measured by cash flows, have been strong across the globe, and investors have been rewarded for bearing that market risk.

But the combination of fully valued asset prices and low levels of market volatility has generally not been indicative of strong future returns. In a future blog, I will address the question of whether (and by how much) the US equity market has become overvalued.

Needless to say, we continue to maintain a guarded market outlook at Vanguard, and we urge investors to stick to their balanced, long-run plan whether or not my worries materialise. Let's hope I am wrong.

Commentary by Vanguard Global Chief Economist Joe Davis.

Figures cited are in Australian dollars, at September 2017 exchange rates.

26 September 2017

Figures cited are in Australian dollars, at September 2017 exchange rates.

26 September 2017