.

U.S. consumers in aggregate remained financially healthy entering 2024. That’s the conclusion of new research, which highlights wealth effects, accumulated savings, and normalising credit usage as sources of strength. Our findings suggest that if consumers don’t stoke continued U.S. economic growth, they will at least mitigate downward pressure in the event of a U.S. recession.

Among the key findings of the research, led by Bob Behal of our Fixed Income Group and Josh Hirt of our Investment Strategy Group: real estate values have driven atypical wealth gains across income distributions since the onset of the COVID-19 pandemic, and distress in lending markets is largely confined to the least creditworthy borrowers who drive the least amount of spending.

Sources: calculations using data as of December 31, 2023, from the Federal Reserve Bank of New York and Equifax.

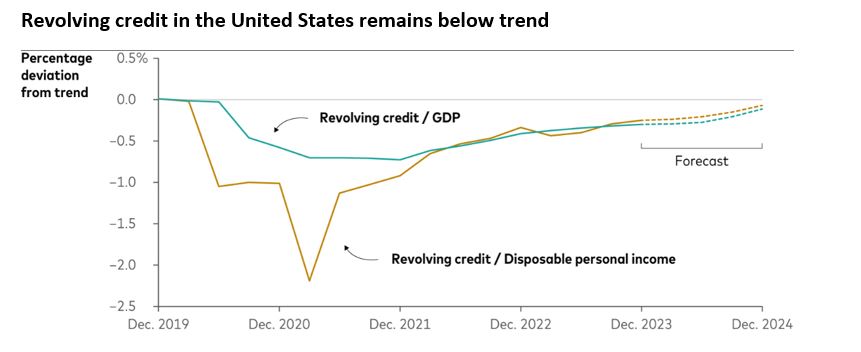

The chart above shows that, as a proportion of both gross domestic product (GDP) and disposable personal income, revolving credit such as credit card debt and home equity loans remains below its pre-pandemic trend and is likely to normalise only in the fourth quarter of 2024. The likely upshot? More room to run for the U.S. consumer.

Vanguard’s outlook for financial markets

Our 10-year annualised nominal return and volatility forecasts are shown below. Equity returns reflect a range of 2 percentage points around the 50th percentile of the distribution of probable outcomes. Fixed income returns reflect a 1-point range around the 50th percentile. More extreme returns are possible.

Australian dollar investors

- Australian equities: 4.3%–6.3% (21.7% median volatility)

- Global equities ex-Australia (unhedged): 4.9%–6.9% (19.4%)

- Australian aggregate bonds: 3.7%–4.7% (5.5%)

- Global bonds ex-Australia (hedged): 3.9%–4.9% (4.8%)

Notes: These probabilistic return assumptions depend on current market conditions and, as such, may change over time.

Source: Investment Strategy Group as at 14 February 2024.

Region-by-region outlook

Australia

Leading indicators suggest that resilient but subdued economic conditions will prevail early in 2024, with a gradual acceleration in the first half supported by rising real household incomes, a reflating housing market, and firming business investment.

- We expect both growth and inflation to be weaker than consensus as restrictive monetary policy takes hold. In our base case, the cash rate of the Reserve Bank of Australia is at its peak for the cycle, at 4.35%. We believe the RBA will start to cut interest rates only late in 2024.

- Forecasts a year-end 2024 cash rate of 3.85% (down from the current 4.35%), and that the rate will eventually settle in the 3%–4% range, in line with our assessment of the neutral rate, the theoretical rate that would neither stimulate nor restrict an economy.

- We expect real (inflation-adjusted) economic growth of 0.75%–1.25% for all of 2024. Having benefited from elevated commodities export prices, monetary policy less restrictive than that of other developed markets, and supportive fiscal policy, Australia has high odds of avoiding recession this year, even if only narrowly.

- We expect the unemployment rate, which touched 50-year lows after the pandemic, to rise throughout 2024 to about 4.6% as financial conditions continue to tighten. Unemployment stood at 3.9% in December.

United States

Recent growth and labour market data suggest the U.S. economy remains robust as debate continues over the timing of potential cuts in the Federal Reserve’s target for short-term interest rates. Inflation continues to ebb, but remains alert to risks posed by still-strong wage growth.

- The U.S. economy created 353,000 jobs in January, nearly double the consensus estimate, and revisions to November and December data lifted the average monthly jobs gain over the past three months to 289,000. Geographic and industry trends suggest an improvement in labor market momentum, raising the odds that the unemployment rate will not rise as high as our year-end forecast of 4.8%.

- We continue to expect shelter inflation—an amalgamation of, for renters, rents plus utility payments, and the cost if homeowners rented similar houses—to moderate by mid-2024 and further progress toward the Fed’s broader 2% inflation target. Sticky services inflation will remain a headwind.

- For 2024, we foresee real (inflation-adjusted) economic growth of 0.25%–0.75%. However, the economy appears to be starting the year strong. A real-time estimate is tracking first-quarter growth at a nearly 3% annualised pace.

China

High-frequency housing and auto sales data as well as data from purchasing managers’ indexes suggest that weak economic growth has carried into the new year. As a structural property downturn drags on the economy, private demand and business confidence remain subdued. The government has responded with broad but incremental stimulus measures, including support for the ailing housing and equity markets.

- China’s economy is increasingly reliant on government support, with the public share of total fixed investment at a 12-year high, but we don’t anticipate large-scale stimulus. With economic growth below potential and continued deflationary pressure, more concrete and decisive policy support may be needed for China to achieve its anticipated growth target of “around 5%.”

- We continue to expect consumer prices to rise by 1%–1.5% in 2024. Pro-growth measures could help stimulate prices. But we expect any reflation to be modest, below the central bank’s 3% inflation target. Consumer prices fell on a year-over-year basis for a fourth consecutive month in January, while producer prices have fallen 16 months in a row.

- To mitigate deflationary pressure, we expect the People’s Bank of China to ease its policy rate from 2.5% to 2.2% in 2024, as well as to cut banks’ reserve requirement ratios.

Euro area

We believe the Governing Council of the European Central Bank (ECB) will look to first-quarter inflation and wage data, the latter of which will be available only in late spring, to confirm that it can sustainably return inflation to the ECB’s 2% target. That would allow the ECB to initiate a rate-cutting cycle with its June 6 policy announcement, with 25-basis-point cuts potentially at each of its final five policy meetings of the year.

- Amid moderating inflation and wage gains, we have revised our outlook for ECB policy rates. We foresee the ECB cutting its deposit facility rate by 100 to 150 basis points (1 to 1.5 percentage points) in 2024 to a year-end range of 2.5%–3%. That’s greater than the 75 basis points of rate cuts we foresaw in our economic and market outlook for 2024.

- We expect headline inflation to reach the ECB’s 2% target by September 2024 and core inflation, which excludes volatile food, energy, alcohol, and tobacco prices, to reach target by December 2024.

- We forecast real (inflation-adjusted) economic growth of 0.5%–1% in 2024 and continue to expect that any recession will be mild.

- We don’t believe the euro area will enjoy a “painless disinflation.” We anticipate a softening labor market as economic activity falls below its potential amid restrictive monetary and fiscal policy. We expect the unemployment rate to rise to an above-consensus range of 7%–7.5% in 2024, up from 6.4% in December.

United Kingdom

The U.K. economy may have fallen into a technical recession, marked by two consecutive quarters of declining activity, in the second half of 2023. But high-frequency indicators suggest that a modest return to growth, around 0.1%–0.3%, may be underway in the first quarter.

- For all of 2024, we foresee below-trend economic growth of 0.5%–1% from the effects of contractionary monetary and fiscal policy. But recent easing in financial conditions, particularly mortgage rates, should relieve pressure on households and pose an upside risk to our forecast.

- In our base case, we foresee a first policy rate cut by the Bank of England in August, and a total of 100 basis points—or 1 percentage point—of cuts in 2024. The current bank rate is 5.25%.

- We have trimmed our forecast for year-end 2024 core inflation—which excludes volatile food, energy, alcohol, and tobacco prices—from 2.8% to 2.6%.

- We foresee the unemployment rate rising to 4.5%–5% over the course of 2024 amid restrictive monetary and fiscal policy. It was 3.8% in the October–December period.

Emerging markets

Emerging-market central banks were ahead of their developed-market counterparts in raising policy interest rates during the latest hiking cycle. Now, with inflation slowing, interest rates becoming more restrictive, and growth concerns rising, emerging-market central banks are leading the cutting cycle. Examples of banks that have lowered their policy rates include Banco Central do Brasil, Banco Central de Chile, and the Czech National Bank.

- Banco de México (Banxico), meanwhile, left its target for the overnight interbank rate unchanged at 11.25% for a seventh consecutive policy meeting this month. Banxico noted that core inflation has decelerated but remains high. It also stated that expectations for headline inflation for year-end 2024 had increased, while expectations for longer-term inflation remained stable but above Banxico’s 3% inflation target.

- Foreseeing full-year 2024 economic growth of 1.5%–2%, core inflation falling to 3.6%–3.8% by year-end, and the overnight interbank rate being cut to 9%–9.5% by year-end.

Canada

Canada’s economy contracted in the third quarter compared with the second, but it avoided falling into a technical recession because second-quarter economic activity was revised from negative to positive.

- We foresee Canada falling into a mild recession early in 2024, with recovery later in the year in response to expected monetary policy rate cuts. We expect full-year 2024 economic growth of about 1%.

- We forecast that core inflation will fall to 2%–2.5% on a year-over-year basis, within the central bank’s target range, by the end of 2024, with house prices moderating in response to declining affordability. The latest reading was 3.4% for December.

- We expect the unemployment rate to rise to the 6%–6.5% range in 2024 amid weak economic growth. In January, it was 5.7%.

- We foresee the Bank of Canada leading a developed markets rate-cutting cycle as inflation eases and the economy contracts. We anticipate cuts to the overnight rate of 2 to 2.5 percentage points, to a range of 2.5%–3%, by the end of 2024.

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

This article contains certain 'forward looking' statements. Forward looking statements, opinions and estimates provided in this article are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of current market conditions. Forward-looking statements including projections, indications or guidance on future earnings or financial position and estimates are provided as a general guide only and should not be relied upon as an indication or guarantee of future performance. There can be no assurance that actual outcomes will not differ materially from these statements. To the full extent permitted by law, Vanguard Investments Australia Ltd (ABN 72 072 881 086 AFSL 227263) and its directors, officers, employees, advisers, agents and intermediaries disclaim any obligation or undertaking to release any updates or revisions to the information to reflect any change in expectations or assumptions.

February 2024

Vanguard

vanguard.com.au

18th-March-2024 |