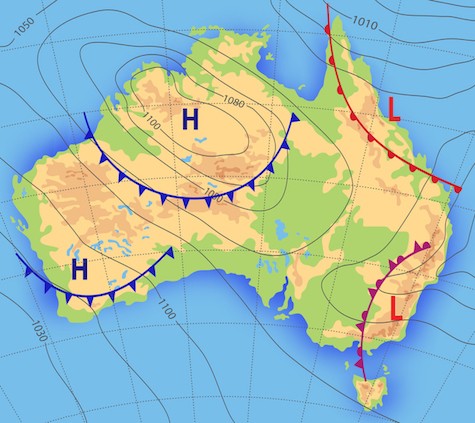

Investment forecasts, just like weather forecasts are just that – projections of what might happen on the future, based on past patterns calculated alongside all possible factors that might help provide an estimation of what might occur in the short term. If you’ve ever relied on a weather forecast to help plan a significant event or even your daily life, you would be well aware that even the best weather apps are rarely 100% accurate and sometimes just get it downright wrong.

Which is why most of us, already used to the psychological perception that weather forecasts are mostly inaccurate, simply use them to help inform but not entirely drive our decision making. The same should be said for investment outlooks. And yet, it is not always so. As humans it is inevitable for our brains to crave certainty, and when it comes to money and our investment portfolios, the last thing we want is to not know what might happen.

But as the last two years have demonstrated in spades, uncertainty is here to stay. And with that in mind, as we look hopefully towards 2022, now is probably a good time to re-evaluate your investment portfolio and figure out if your risk profile and investment objectives have changed. And if they have, to assess if your asset allocation and investment strategy are still applicable, in your investment time frame.

Against a backdrop of heightened uncertainty, and in recognition of how quickly forecasts can change, Vanguard’s annual economic and market outlook sets out our baseline scenario for the year ahead. The analysis also lays out potential risk scenarios – both upside and downside that investors should be mindful of, and the signposts to watch out for in each of these scenarios. Our main message for investors who do not have a strong conviction of how the future will pan out, is that a globally diversified balanced portfolio will serve you best in unpredictable times.

Global economic outlook

In our baseline reflation scenario, the global economy is expected to continue its recovery in 2022, albeit at a slower place, regardless of supply-chain dynamics. In the US and Euro region, growth is expected to normalise to 4%, while in the UK, growth is anticipated at about 5.5%. In China, growth is projected to fall to about 5%. By contrast, in Australia, a slightly more positive picture off the back of a lacklustre 2021 is expected, with stronger growth of 4.5% expected for 2022, thanks to an accelerated vaccination roll-out.

That said, the outlook – just as with weather forecasting – has risks embedded, and our report highlights the potential risk factors that could shift the dial to the other side. In addition to ongoing health risks coming from potential virus mutations like Omicron, we highlight risks coming from persistent labour shortages, elevated inflation and potential policy missteps. In particular, the outlook for policy will be especially crucial in 2022 as support and stimulus packages enacted to combat the pandemic driven downturn are gradually removed. The timing, pace and magnitude of stimulus removal could pose a new challenge for policymakers and a new risk to financial markets.

Unwinding of monetary policy

Inflation continues to be a media buzzword this year, worrying not just economists and policymakers. Persistently elevated inflation may force policymakers to tighten faster, earlier and much more than expected. In the US, we expect the Federal Reserve to raise rates to at least 2.5% by the end of the cycle, higher than what most in the market are pricing in. Meanwhile in Australia, a surge in inflation expectations could lead the RBA to hike interest rates earlier than expected, despite our expectation that rates will remain on hold for 2022 given sticky wage dynamics.

Importantly, while the prospect of modestly higher inflation and rates may lead some to question the benefit of bonds in an investment portfolio, our research nonetheless finds that the diversification benefits delivered by this asset class are still relevant.

Overvalued equities

Vanguard’s Capital Markets Model® has for several years now, cautioned that US equities have never been more overvalued since the dot-com bubble era, and are approaching “stretched” territory, driven by valuation expansion, not increased profit. Thus the overall outlook for 2022 remains in guarded territory and investors, particularly those in the US, should brace for a lower-return decade. Australian equities are similarly stretched, though to a lesser extent, hence our 10 year annualised returns for the local market are expected to be around 2 percentage points lower than our outlook last year, in the range of 3.5-5.5%.

Diversify to benefit

Despite the outlook for Australia looking relatively moderate, it does spell opportunities for Australian investors who allocate a portion of their portfolios to global assets. It also underscores the value of building a broadly diversified investment portfolio – gains from one investment market could help balance out another investment market’s losses, resulting in a portfolio that is less vulnerable to the impact of significant swings in performance.

The last 24 months have rewarded those who remained invested in the financial markets despite the challenging environment and troubling headlines. It would only seem prudent to continue holding on to this discipline and long-term focus for the years ahead.

Vanguard

01 Feb, 2022

vanguard.com.au

24th-February-2022 |