But in light of recent volatility on investment markets, you may be thinking, is this the right time to start off?

Taking your first step is often daunting, but the reality is that investment markets have shown consistent growth over many decades.

And what's clear is those investors who stay the course over time, riding through the regular ups and downs of the markets, have a much better chance of achieving investment success than those who try to cherry pick when to buy and sell.

What's more, it's also clear that because the returns from different types of assets always vary from year to year, spreading your money across a broad range of investments will enhance returns and help reduce your overall risk.

The power of compounding returns

Renowned scientist Albert Einstein famously described compound interest as "the eighth wonder of the world".

Which is where starting out early really comes into play. By following a strategy of reinvesting investment distributions such as dividends, and by making additional contributions over a long period of time, the combination of market growth and compounding returns will likely deliver strong results.

In other words, it's about time in the markets rather than timing the markets.

The 2020 Vanguard Index Chart below shows that a $10,000 investment made into Australian shares in 1990 would have achieved an 8.9 per cent total return per annum over 30 years, with the reinvestment of all distributions, and grown to $130,457 by 30 June 2020.

Over the same time frame and using the same strategy, a $10,000 investment into the broad US share market would have delivered a 10.3 per cent per annum return, and now be worth $186,799.

There is no minimum amount that one needs to make as an investment. However, even a low initial balance will grow substantially over time when combined with compounding investment returns.

Make ongoing investments

But imagine how your wealth could grow if you put in even more. An initial contribution combined with a regular investment savings strategy and the reinvestment of distributions will deliver even higher long-term results.

Investing the same amount of money at set intervals over a long period is known as dollar-cost averaging. That means you're averaging out the cost of your investments through incremental investing – regardless of whether market prices are up or down.

The easiest way to illustrate a dollar-cost averaging strategy is to calculate how investment balances can build up over time, using a combination of regular contributions, the reinvestment of distributions and compounding returns.

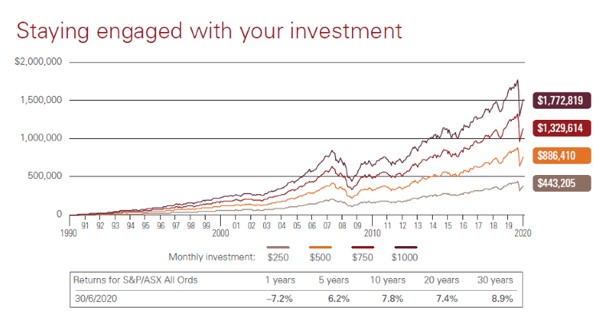

How extra investments add up over time

Source: Andex Charts Pty Ltd. Data based on annualised returns since 1990.

The chart above is based on actual market returns and follows someone who started out investing on 30 June 1990 and who continued making set monthly contributions over the last 30 years.

If they'd stuck to a strategy of investing $250 a month into Australian shares, irrespective of market movements, they would now have a balance of more than $443,000.

If they'd had the financial capacity and discipline to invest $1,000 a month over the same period of time, their balance would now be more than $1.77 million. That's despite the sharp fall in markets in early 2020.

Of course, a more realistic pattern for most people is to increase their investment contributions over time as they earn higher wages and other expenses fall.

The bottom line

If you're just starting out, or quite early on in your investment journey, these are all factors to consider – even if you're many years away from retiring.

Successful investing revolves around having a well-planned and diversified strategy that's aligned to your specific goals, and the discipline and resolve to stay the course, even during the most volatile investment times.

And, make no mistake, the earlier you start off investing the more money you're likely to have to enjoy the things you want to do when you do eventually stop work.

With many of us living longer, having the ability to live a financially comfortable lifestyle without fear of running out of money is definitely a long-term goal worth pursuing.

Tony Kaye

Personal Finance Writer

11 August 2020

vanguardinvestments.com.au

14th-September-2020 |