How investing regularly can propel your returns

Even investing small amounts on a regular basis will compound returns over time.

.

Among many other things, the theoretical physicist and Nobel Prize winner Albert Einstein had a strong grasp of mathematics, particularly around the power of compounding interest returns.

“Compound interest is the eighth wonder of the world,” said Einstein. “He who understands it, earns it. He who doesn't, pays it.”

They were wise words, and they equally apply to any investments that receive income returns and allow additional amounts of money to be added on an ongoing basis.

Leveraging the power of compounding is actually at the heart of investing. Put basically, it’s about growing a smaller amount of money into a bigger amount through a process of continual adding over time.

Typically, the more that’s added, and the more frequently it’s added, the larger the growth over the long term.

Your superannuation at work

An easy way to think about compounding is your superannuation. As your employer makes regular contributions into your account, your savings balance will continue to rise over the long term. That’s due to the money being added in from your employer, but it’ also because of the investment returns that you’re earning on your growing super balance.

Making additional personal contributions on top of your employer’s contributions can have an even greater impact on the size of your retirement savings balance over time.

And the same applies to investments outside of super. An initial starting amount of money is likely to compound over time if regular ongoing investments are made that also harness the growth returns from the underlying investments.

Just like your super contributions, investing outside of super should ideally be aligned to a disciplined, non-emotional, approach that’s not affected by what’s happening on financial markets at any point in time.

Compounding case studies

This may all sound very theoretical, so let’s look at some real examples of compounding growth based on the actual returns from two Vanguard managed index funds over the last 10 years.

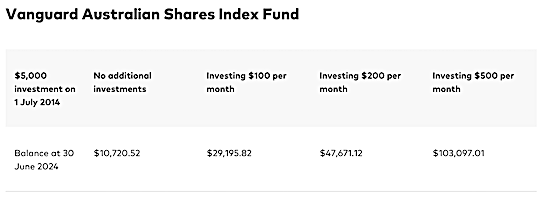

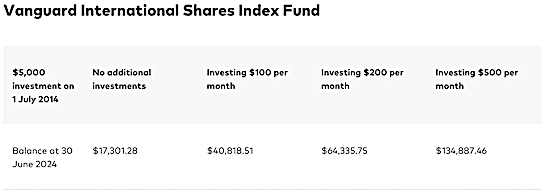

We’ve used the returns from the Vanguard Australian Shares Index Fund (which invests in the top 300 companies on the Australian Securities Exchange) and the Vanguard International Shares Index Fund (which invests in around 1,500 companies across 23 developed markets, excluding Australia).

The final results, as at 30 June 2024, are based on an investor having made a $5,000 starting investment into each fund on 1 July, 2014.

The returns compare someone who didn’t make any additional investments over the 10-year period to people who added either $100 per month, $200 per month, or $500 per month.

All of the end returns assume that each investor chose to reinvest all of the income payments that they received on their investments over the 10 years. That is, rather than taking them as cash payments, they used them to purchase additional units in the same fund.

This is a key aspect of compounding, because following a reinvestment strategy means that the number of fund units owned by investors will continue to multiply over time. Any income payments received will be based on a higher number of owned units.

Source: Vanguard. Investment balances exclude acquisition costs, fees or taxes. The example is illustrative only and is based on the factors stated. Past performance is not a reliable indication of future performance.

The numbers in the table illustrate the power of compounding through a combination of long-term growth, reinvesting income, and making regular ongoing investments.

By making no additional investments on top of the initial starting balance of $5,000 on 1 July 2014, an investor in the Vanguard Australian Shares Index Fund would have more than doubled their investment by 30 June 2024 if they had reinvested all their income payments into buying additional fund units.

Yet, by making additional investments at regular monthly intervals and reinvesting all income received, an investment would have compounded even more.

Investing an extra $100 per month, and reinvesting all income, would have lifted an investor’s balance to $29,195.82 by 30 June 2024. Subtract from, that the $12,000 of extra investments made over the period and an investor would still have gained more than $17,000 as a result of compound growth.

Following the same investing strategy, an investor who invested $200 per month would have more than trebled their initial investment amount. Even after subtracting their $24,000 in regular investments an investor would have gained more than $23,000 over the term.

Someone investing $500 per month, and following the same strategy, would have ended up with more than $100,000 over 10 years. That equates to a total gain of 1,962%.

Of course, to get to that level, they would have needed to invest $60,000 over the period. But that’s still a gain of more than $43,000.

Here’s what the numbers look like for the Vanguard International Shares Index Fund.

Source: Vanguard. Investment balances exclude acquisition costs, fees or taxes. The example is illustrative only and is based on the factors stated. Past performance is not a reliable indication of future performance.

While the numbers in the international fund are substantially higher, reflecting the stronger average returns on overseas share markets over the last decade, they similarly illustrate the power of compounding growth.

A $5,000 starting investment in this fund with no additional investments, apart from reinvesting income payments, would have more than trebled. And the final balance numbers at 30 June 2024 would have been much higher, based on the size of additional monthly investments.

Of course, lower or higher amounts of regular investments over time would have produced the same outcome. That is, they would have continued to compound.

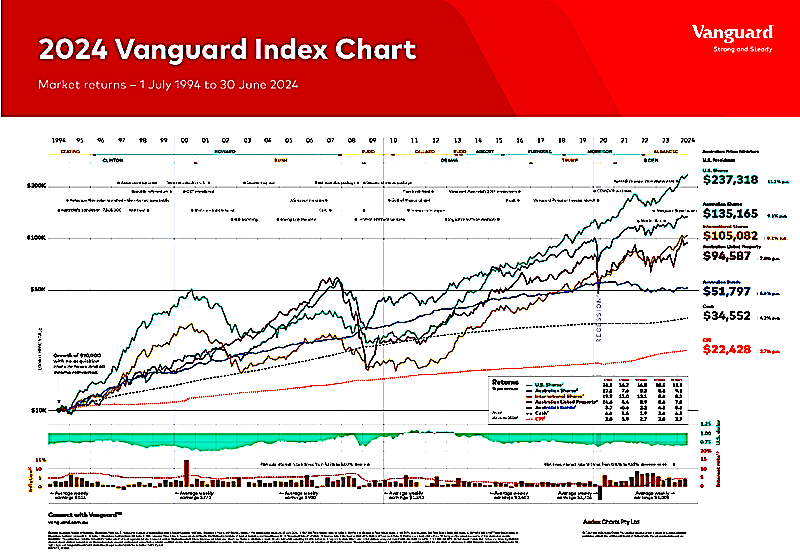

You can click

here to view a larger version or download the latest Vanguard Index Chart.

Sticking to a plan

Investment markets, particularly equities markets, can be volatile at times. When share markets fall, the value of most share investments also fall. As such, shares tend to be regarded as higher risk than investments that are not subject to rapid daily price movements, and are better suited to investors who have a higher risk/return profile.

Yet, it’s also fair to say that the long-term upward trend on global share markets has regularly produced higher investment returns over identical time periods than lower-risk assets such as bonds and cash.

Just like with your super contributions, investing outside of super should ideally be aligned to a disciplined, non-emotional, approach that’s not affected by what’s happening on financial markets at any point in time.

Making regular investments, and reinvesting income, can really add up over time.

They’re a powerful combination in helping you to focus on achieving your investment goals, ideally through an appropriately diversified portfolio, to give you the best chance of investment success over the long term.

Important Information

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) (VIA) is the product issuer and operator of Vanguard Personal Investor and Vanguard ETFs and managed funds. Vanguard Super Pty Ltd (ABN 73 643 614 386 / AFS Licence 526270) (the Trustee) is the trustee and product issuer of Vanguard Super (ABN 27 923 449 966).

The Trustee has contracted with VIA to provide some services for Vanguard Super. Any general advice is provided by VIA. The Trustee and VIA are both wholly owned subsidiaries of The Vanguard Group, Inc (collectively, “Vanguard”).

We have not taken your objectives, financial situation or needs into account when preparing this article so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for the product before making any investment decision. Before you make any financial decision regarding the product, you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard's financial products can be obtained on our website free of charge, which includes a description of who the financial product is appropriate for. You should refer to the TMD of the product before making any investment decisions. You can access our Investor Directed Portfolio Service (IDPS) Guide, Product Disclosure Statements (PDS), Prospectus and TMD at vanguard.com.au and Vanguard Super SaveSmart and TMD at vanguard.com.au/super or by calling 1300 655 101. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance.

An investment in the Vanguard Australian Shares Index Fund and Vanguard International Shares Index Fund is subject to investment and other known and unknown risks, some of which are beyond the control of VIA, including possible delays in repayment and loss of income and principal invested. Please see the risks section of the Product Disclosure Statement (“PDS”) for the Vanguard Australian Shares Index Fund and Vanguard International Shares Index Fund for further details. Neither Vanguard Investments Australia Ltd (ABN 72 072 881 086 AFSL 227263) nor its related entities, directors or officers give any guarantee as to the success of the Vanguard Australian Shares Index Fund and Vanguard International Shares Index Fund, amount or timing of distributions, capital growth or taxation consequences of investing in the Vanguard Australian Shares Index Fund and Vanguard International Shares Index Fund.

This article was prepared in good faith and we accept no liability for any errors or omissions.

© 2024 Vanguard Investments Australia Ltd. All rights reserved.

Tony Kaye

August 2024

vanguard.com.au