Economic slowdown drives mixed reporting season

Many Australian companies are still battling economic crosswinds and headwinds.

.

Hundreds of companies listed on the Australian Securities Exchange (ASX) have just finished announcing their financial results from the full and half-year period to 30 June, 2024.

And the results were compelling, because they showed how different companies were able to deal with the economic crosswinds and headwinds that have been whipped up around them from the combination of rising inflation and higher interest rates.

For many companies, subdued consumer demand (reflecting reduced discretionary spending) resulted in weaker sales and operating margins, and ultimately lower earnings, in the last financial year. It was a similar scenario for many mining companies contending with depressed commodity prices and lower demand.

But other companies were actually able to thrive during the conditions. They reported stronger earnings due to higher demand for their products and services, which led to increased cash flows and profit margins.

Some companies were able to announce higher dividend payouts, but at the cost of using more of their profits to do so.

On aggregate results were weaker than expected, with earnings down 4.4% in the last financial year.

Among Australia’s top 200 companies, 16% missed earnings expectations for the 2023-24 financial year and also had consensus earnings downgrades for the 2024-25 financial year.

Understandably, given the current economic conditions, many companies provided cautious outlooks on the year ahead.

🚩Vanguard believes that if inflation returns to more sustainable levels, Australia’s slow growth will open the door to monetary policy easing.

Joining the economic dots

The latest corporate reporting season officially ended on 30 August, and last week the domestic economic data largely underpinning those results was released by the Australian Bureau of Statistics (ABS).

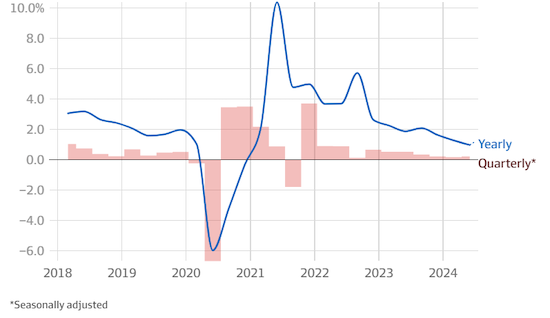

The ABS data showed the Australian economy had grown by a modest 0.2% over the three months to 30 June, and to 1.5% over the full 2023-24 financial year.

While this was the eleventh consecutive quarter of GDP growth, it was the sixth consecutive quarter of GDP per capita falls.

Real GDP growth

Expenditure-based

Source: Australian Bureau of Statistics, Bloomberg

While the ABS data showed that underlying inflation had continued to fall over the June quarter, the annual inflation rate was 3.8% higher than at the end of the June quarter of 2023.

“Excluding the COVID-19 pandemic period, annual financial year economic growth was the lowest since 1991-92 - the year that included the gradual recovery from the 1991 recession,” the ABS noted.

Spending on many discretionary categories fell in the June quarter. The strongest detractor from growth was transport services, particularly reduced air travel.

Furnishings and household equipment rose by 4% as households took advantage of end-of-year sales. This was partly offset by a 1% fall in food sales with households spending less on groceries.

Vanguard Senior Economist, Grant Feng, says lacklustre GDP growth suggests that restrictive monetary policy has curbed demand. However, the supply side has been weak too, which has discounted the impact of demand on inflation.

Yet Feng says low productivity growth has kept unit labour costs growing at a rate well above that which is consistent with the 2%–3% inflation target set by the Reserve Bank of Australia (RBA).

As such, the RBA may be one of the last developed markets central banks to ease monetary policy.

Vanguard believes that if inflation returns to more sustainable levels, Australia’s slow growth will open the door to monetary policy easing.

“Despite sticky inflation, we don’t foresee a rate hike by the RBA, whose dual mandate is to promote price stability and economic growth” Feng adds.

Important information and general advice warning

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer and the Operator of Vanguard Personal Investor. We have not taken your objectives, financial situation or needs into account when preparing this article so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for any financial product we make available before making any investment decision. Before you make any financial decision regarding Vanguard products, you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard's financial products can be obtained at vanguard.com.au free of charge and include a description of who the financial product is appropriate for. You should refer to the TMD before making any investment decisions. You can access our IDPS Guide, PDSs, Prospectus and TMDs at vanguard.com.au or by calling 1300 655 101. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This article was prepared in good faith and we accept no liability for any errors or omissions.

© 2024 Vanguard Investments Australia Ltd. All rights reserved.

September 2024

Tony Kaye, Senior Personal Finance Writer

vanguard.com.au