About TK Accounting & Advisory

We are more than just Tax Compliance Accountants.

What makes my firm unique?

You work with me and just me. Personalised and custom-made solutions just for You, provided in a clear, simple and concise way. I am certainly more than just a Tax Compliance Accountant!

Bringing SIMPLE & RELATIONSHIPS back!

Have you left your accountants office and thought what was that all about?

We try to break things up into everyday English and explain things simply – I am a firm believer that there are no stupid questions just meaningless explanations.

What now? Does your accountant or advisor offer personalised and tailor-made solutions?

Does your accountant under promise and over deliver?

Does your accountant or advisor explain things in plain English?

Is your accountant looking to build a long term relationship and experienced enough to carry out what they promise?

If you’ve answered No to any of these questions, then I dare you to reach out and make contact with me for my initial obligation free catch-up – the coffee is on me – what are you waiting for?

Meet our director

Tony Kolker

Director & Accountant

Tony is a Certified Practising Accountant (CPA) with over 25 years’ experience in the tax, SMSF Audit and accounting & business advisory space.Tony is a member of CPA Australia, a Registered Tax Agent and an SMSF Auditor. Tony completed his Bachelor of Commerce at Curtin University and has further developed skills in business advisory, business valuations, and virtual CFO services.

Tony specialises in providing hands-on business advisory, accounting, SMSF and taxation services to clients across a wide range of industries. He specialises in providing advice and support to assist clients in achieving their goals and is seen as their “Trusted Advisor”.

Tony works closely and builds strong long-lasting relationships with his clients which helps him get an in depth understanding of their specific requirements and allows him to provide accurate and timely advice. Clients appreciate Tony’s open and honest approach as he will always simply tell them as he sees it with a focus on solutions.

Our Services

Latest Accounting News

Why Might a Lease Dispute Occur?

A lease dispute can arise for various reasons during the lease term and even after it...

$20,000 instant asset write-off

This is a great scheme for small businesses and runs until the 30 June...

ASIC have recently issued the new scam warning regarding Bunnings and issuing of investment...

The Largest Empires in the World's History

Check out the Largest Empires in the World's...

All the documents, fact sheets and downloads to do with this year’s 2025-26 Federal Budget

Federal Budget 2025-26 – Papers and Fact...

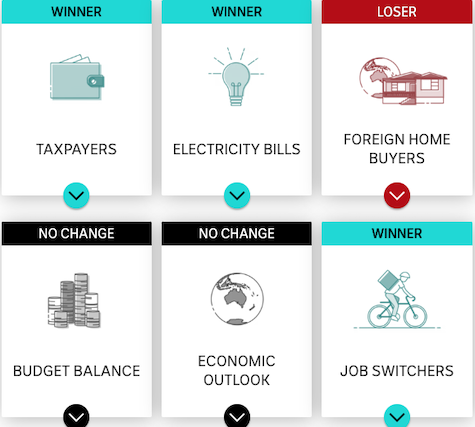

Winners and Losers - Federal Budget 2025-26

Treasurer Jim Chalmers has handed down his fourth federal budget, laying the groundwork for a federal election...

Building Australia's future and Budget Priorities

Building Australia's future and Budget...

ATO outlines focus areas for SMSF auditor compliance in 2025

The ATO has issued guidance on what it will focus on regarding auditor compliance for...

Tools & Resources

Contact Us

Get in Touch

TK Accounting & Advisory welcome your enquiry. To book an appointment or simply ask us a question, fill in your details and we'll be in touch soon!

Postal Address

- PO Box 1223, Booragoon WA 6954