Welcome to Sullivans Accountants

Trusted Small Business Specialists and Tax Advisors for Companies, Trusts, SMSF's and Individuals

Welcome to Sullivans Accountants

Sullivans Accountants pride themselves on tailor-made solutions and ensuring understanding for all clients.

About Sullivans Accountants

Let our friendly staff take the time to properly understand your accounting and taxation needs.

Our mission as small business specialists is to provide education and understanding, so you’re supported in making big decisions.

We are dedicated to providing small businesses and individuals with the highest level of professional service which is personalised, prompt, flexible, and cost-effective. We constantly keep abreast of the ever-changing business climate in order to provide a service which is practical and current with today’s trends. We work closely with you to develop individual solutions to your varied needs, taking care of your financial well-being.

Whether you are starting a new business or are an emerging start-up, entrepreneur or established small business, we are here to support you with expert advice on tax compliance, wealth management and strategy for business growth. For more than 20 years, Sullivans Accountants have been providing Australians with taxation & accounting advice to support and grow their business as many clients consider us to be an extension of their team.

We go beyond just accounting and business services, providing advice, through our trusted partners, about estate planning, lending and finance, managing risk insurance, and setting up a self-managed super fund. We are here to help eliminate complex and time consuming tax and accounting processes, so you can focus on your business.

Sullivans Accountants go further…

- Tailor made strategies for your businesses

- Tools and ideas for business and investment growth

- Strategic tax planning

- Managing financial risk

- Assist you to think outside the box

- Investing surplus cash flow to build wealth

- Focusing on asset protection regarding your businesses and investments

Ask yourself these questions:

- Are your affairs structured in the most effective way?

- Do you plan ahead for your tax?

- Do you have a structured plan and strategy for business growth?

- How does your business compare with others in the same industry?

- How would your business cope with a tax audit?

Taxation Services

Accounting Services

Self Managed Super Funds (SMSF)

Sullivans work through trusted partners to assist our clients in the area of SMSFs.

A SMSF might not be suitable to everyone's needs, please ensure you seek professional advice.

Estate Planning

Estate Planning is so much more than a will — it's about providing peace of mind and ensuring your loved ones are provided for.

Your estate is made up of everything you own. This includes your home, property, furniture, car, personal possessions, business, investments, superannuation and bank accounts. Firstly, having a legally valid will is extremely important, as without one it is called 'dying intestate'.

This can be costly and create added stress for loved ones at an already difficult time. You may think that having a current will outlines what will happen to your estate should you die or become unable to manage your affairs. Unfortunately, for those with more complex financial structures this may not be the case at all.

Testamentary trusts are created by a will to provide a greater level of control and flexibility over the distribution of assets.

There may be significant tax advantages by using testamentary trusts. Testamentary trusts are an effective estate planning tool. The main benefits of testamentary trusts are their ability to protect assets and to reduce tax paid by the next generations from income earned from an inheritance. We work extremely closely with tax lawyers on how to tailor make a testamentary trust for your needs.

To make sure your affairs are in order an Estate Plan will:

- provide for and protect loved ones with specific needs, including children

- ensure your children’s inheritance receives increased protection if a relationship breaks down

- ensure you receive professional advice on how to structure your assets to gain available tax advantages

- ensure your wishes are recorded in legally binding documents including your will, free from ambiguity

- provide you with peace of mind knowing, should you die or be unable to legally manage your affairs, that they will be managed by someone you trust

- ensure non-estate assets such as jointly held assets, family trusts, super funds and private companies are also documented as it may not be possible to deal with them in your will.

Contact us today to discuss how we can work together: (02) 9664 2000 or email us at info@sullivan.com.au

Latest Accounting News

Why Might a Lease Dispute Occur?

A lease dispute can arise for various reasons during the lease term and even after it...

$20,000 instant asset write-off

This is a great scheme for small businesses and runs until the 30 June...

ASIC have recently issued the new scam warning regarding Bunnings and issuing of investment...

The Largest Empires in the World's History

Check out the Largest Empires in the World's...

All the documents, fact sheets and downloads to do with this year’s 2025-26 Federal Budget

Federal Budget 2025-26 – Papers and Fact...

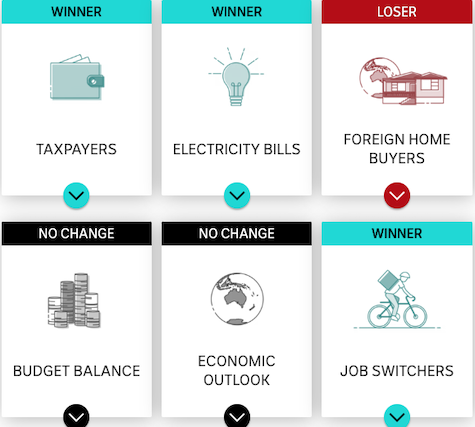

Winners and Losers - Federal Budget 2025-26

Treasurer Jim Chalmers has handed down his fourth federal budget, laying the groundwork for a federal election...

Building Australia's future and Budget Priorities

Building Australia's future and Budget...

ATO outlines focus areas for SMSF auditor compliance in 2025

The ATO has issued guidance on what it will focus on regarding auditor compliance for...

Client Resources

Contact Us

Get in Touch

Sullivans Accounting welcomes your enquiry. To book an appointment or simply ask us a question, fill in your details and we'll be in touch soon!

Office Location

- 8 Havelock Avenue, Coogee NSW 2034