Welcome to Stapleton Tax & Accounting

ACCOUNTANTS, TAX AGENTS & BUSINESS CONSULTANTS

Boronia, Victoria

Welcome to Stapleton Tax & Accounting

ACCOUNTANTS, TAX AGENTS & BUSINESS CONSULTANTS

Boronia, Victoria

Stapleton Tax & Accounting provides professional advice and a full range of accounting, taxation and bookkeeping services to individuals and businesses.

Welcome

THE STAPLETON TEAM

Malcolm Harris— Business Co-owner

Malcolm is a registered Tax Agent, qualified accountant and Member of the Institute of Public Accountants (MIPA) and has worked within Stapleton Tax & Accounting since 1997. Malcolm’s years of tax and accounting experience and expertise enables him to lead the tax and accounting business.

Aaron Cattle— Business Co-owner

Aaron is a registered Tax Agent, qualified accountant and Fellow of the Institute of Public Accountants (FIPA) who joined the team in 2012. Aaron commenced in the taxation and accounting industry in 1999, and has extensive experience in business advisory services, management accounting and taxation over a wide range of client types and industries.

Our Services

Through our variety of service capabilities we ensure clients not only meet their statutory, taxation and compliance requirements but we also assist clients in obtaining their goals and objectives, whether it be profitability or peace of mind.

With our considerable business, taxation and accounting experience, allow us to assist you in making your way in the business mine-field. We can provide comprehensive advice and assist you to get your business going where you want it to be.

Latest Accounting News

Why Might a Lease Dispute Occur?

A lease dispute can arise for various reasons during the lease term and even after it...

$20,000 instant asset write-off

This is a great scheme for small businesses and runs until the 30 June...

ASIC have recently issued the new scam warning regarding Bunnings and issuing of investment...

The Largest Empires in the World's History

Check out the Largest Empires in the World's...

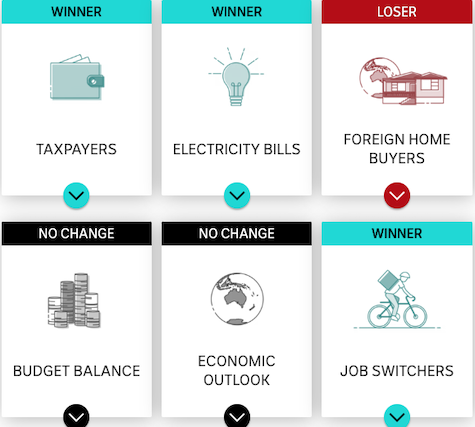

All the documents, fact sheets and downloads to do with this year’s 2025-26 Federal Budget

Federal Budget 2025-26 – Papers and Fact...

Winners and Losers - Federal Budget 2025-26

Treasurer Jim Chalmers has handed down his fourth federal budget, laying the groundwork for a federal...

Building Australia's future and Budget Priorities

Building Australia's future and Budget...

ATO outlines focus areas for SMSF auditor compliance in 2025

The ATO has issued guidance on what it will focus on regarding auditor compliance for...

Tools & Resources

Contact Us

Get in Touch

Stapleton Tax & Accounting welcomes your enquiry. To book an appointment or simply ask us a question, fill in your details and we'll be in touch soon!

Our Office

- Suite C, 6 – 8 Floriston Road, Boronia VIC 3155

- (03) 9760 7800

- (03) 9760 7860

- 9:00am to 5:00pm - Monday to Friday

PO Box

- PO Box 485, Boronia VIC 3155