Welcome to SBS Advisory

Think Outside the Box

Accounting is so much more than dealing with historical information and forms.

Welcome

SBS Advisory dates back to 1980. As a Certified Practicing Accountants (CPA’s) firm located on the southside of Brisbane, we pride ourselves on supplying the full range of business and personal accounting, taxation and advisory needs to a diverse range of clients in various industries.

The Principal of the firm is Darryl Stout FCPA. Darryl is a Fellow member of CPA Australia and a registered tax agent. He has worked for Coopers & Lybrand (now known as PricewaterhouseCoopers) and Hungerford’s (now known as KPMG Australia).

We aim to maintain long term relationships with all of our clients built on mutual understanding, trust, confidentiality as well as upholding the professional standards of CPA Australia and Tax Practitioners Board.

Our goal is to provide a proactive approach to our services, by not only utilising our extensive knowledge and experience but also offering referral free recommendations to our trusted network of affiliated advisors eg. solicitors, financial planners.

For sound business, taxation or financial advice, allow us to assist you to do what you want, when you want and in the manner that you want

Our Services

Keeping you up to date on various matters that could impact you.

Latest News

Why Might a Lease Dispute Occur?

A lease dispute can arise for various reasons during the lease term and even after it ends....

$20,000 instant asset write-off

This is a great scheme for small businesses and runs until the 30 June 2025....

ASIC have recently issued the new scam warning regarding Bunnings and issuing of investment bonds....

The Largest Empires in the World's History

Check out the Largest Empires in the World's History...

All the documents, fact sheets and downloads to do with this year’s 2025-26 Federal Budget

Federal Budget 2025-26 – Papers and Fact Sheets ...

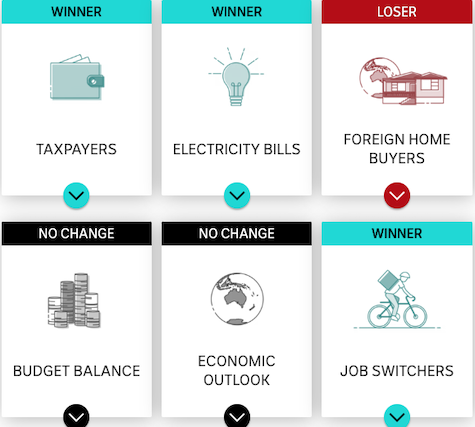

Winners and Losers - Federal Budget 2025-26

Treasurer Jim Chalmers has handed down his fourth federal budget, laying the groundwork for a federal election campaign that could be called within days....

Building Australia's future and Budget Priorities

Building Australia's future and Budget Priorities ...

ATO outlines focus areas for SMSF auditor compliance in 2025

The ATO has issued guidance on what it will focus on regarding auditor compliance for 2025. ...