.

1. Delay deriving assessable income

One effective strategy is to delay deriving your income until after June 30, 2023 by:

a. Delaying the timing of the derivation of Income until after June 30.

b. Timing of raising invoices for incomplete work (Businesses)

This can only be done when this strategy will not adversely affect your cash flow. Please note, not banking amounts received before June 30 until after June 30 does NOT qualify because the income is deemed to have been earned when the money is received, or the goods or services are provided (depending on whether you are on a cash or accruals basis of accounting).

- Cash Basis Income - Some income is taxable on a cash receipts basis rather than on an accrual basis (e.g. rental income or interest income in certain cases).

- Consider delaying your invoices to customers until after July 1, which will push the derivation of the income into the next financial year and defer the tax payable on that income. If you operate on the cash basis of accounting, you simply need to delay receiving the money from your customers until after June 30.

- Lump Sum Amounts - Where a lump sum is likely to be received close to the end of a financial year, you should consider whether this amount (or part thereof) can be delayed or spread over future periods.

2. Bringing forward deductible expenses or losses

Prepayment of Expenses - In some circumstances, Small Businesses (SBE) and individuals who derive passive type income (such as rental income and dividends) should consider pre-paying expenses prior to 30 June 2023. A tax deduction can be brought forward into this financial year for expenses like:

- Employee Superannuation Payments including the 10.5% Superannuation Guarantee Contributions for the June 2023 quarter (any such payment has to be received by the Superannuation Fund by June 30).

- Superannuation for Business Owners, Directors and Associated Persons.

- Wages, bonuses, commissions, and allowances

- Contractor Payments

- Travel and accommodation expenses

- Trade creditors

- Rent for July 2023 (and possibly future additional months)

- Insurances including Income Protection Insurance

- Printing, Stationery and Office Supplies

- Advertising including Directory Listings

- Utility Expenses - Telephone, Electricity & Gas

- Motor Vehicle Expenses - Registration and Insurance

- Accounting Fees

- Subscriptions and Memberships to Professional Associations and Trade Journals

- Repairs and Maintenance to Investment Properties

- Self Education Costs

- Home Office Expenses – deductible gift recipient.

- Donations to Deductible Gift Recipient organizations

- If appropriate, consider prepaying any deductible investment loan interest. This could include interest payments on an investment loan for either an investment or commercial property or an investment portfolio you hold.

A deduction for prepaid expenses will generally be allowed where the payment is made before 30 June 2023 for services to be rendered within a 12-month period.

Capital Gains/Losses

– Note that the contract date (not the settlement date) is often the key sale date for capital gains tax purposes, and when it comes to the sale of an asset that triggers a capital gain or capital loss, you need to consider your overall investment strategy when making the decision to sell. Here are some important points regarding the management of capital gains and capital losses on sale of your assets from a tax planning perspective:

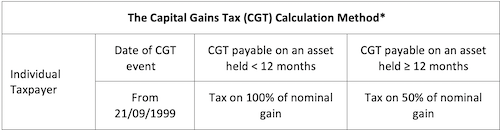

1. If appropriate, consider deferring the sale of an asset with an expected capital gain (and applicable capital gains tax liability) until it has been held for 12 months or longer. By doing so, you could reduce your personal income tax. For example, if you hold an asset for under 12 months, any capital gain you make may be assessed in its entirety upon the sale of that asset.

2. * A capital gain will be assessable in the financial year it is crystallised.

3. If appropriate, consider deferring the sale of an asset with an expected capital gain (and applicable capital gains tax liability) to a future financial year. By doing this, you could help reduce your personal income tax for the current financial year. This could also be of benefit if, for example, you expect that your income will be lower in future financial years compared to the current financial year.

4. If appropriate, consider offsetting a crystallised capital gain with an existing capital loss (carried forward or otherwise) or bringing forward the sale of an asset currently sitting at a loss. By doing this, you could reduce your personal income tax for the current financial year. Note that a capital loss can only be used to offset a capital gain.

Accounts Payable (Creditors)

- If you operate on an accruals basis and services have been provided to your business, ensure that you have an invoice dated June 30, 2023 or before, so you can take up the expense in your accounts for the year ended 30th June 2023.

Obligations that need to be considered in relation to the end of financial year.

If you use a Motor Vehicle in producing your income you may need to:

- Record Motor Vehicle Odometer readings at 30 June 2023

- Prepare a log book for 12 continuous weeks if your existing one is more than 5 years old.

If you are in business or earn your income through a Company or Trust:

Employer Compulsory Superannuation Obligations:

The deadline for employers to pay Superannuation Guarantee Contributions for the 2022/23 financial year is the 28 July 2023. However, if you want to claim a tax deduction in the 2022/23 tax year the super fund (or Small Business Superannuation Clearing House) must receive the contributions by 30 June 2023. Avoid making contributions at the last minute because processing delays could deny you a significant tax deduction in this financial year.

- For Private Company - Div 7A Loans - Business owners who have borrowed funds from their company in prior years must ensure that the appropriate principal and interest loan repayments are made by 30 June 2023.

- Trustee Resolutions - ensure that the Trustee Resolutions on how the income from the trust is distributed to the beneficiaries are prepared and signed before June 30, 2023 for all Discretionary (“Family”) Trusts.

- Preparation of Stock Count Working Papers at June 30, 2023.

- Preparation and reconciliation of Employee PAYG Payment Summaries (formerly known as Group Certificates). Note you are not required to supply your employees with payment summaries for amounts you have reported and finalised through Single Touch Payroll.

From 1 July 2023:

The compulsory Super Guarantee Contribution rate increases from 10.5 % to 11% from July 1, 2023.

Company Tax Rates For Small Business

- The company tax rate for base rate entities with less than $50 million turnover was 25% for the 2021/22 year. This rate will remain at 25% for 2022/23 income year. A base rate entity is a company that both has an aggregated turnover less than the aggregated turnover threshold and 80% or less of their assessable income is base rate entity passive income.

-

Other Tax effective Strategies For Businesses

THE FOLLOWING SHOULD ALSO BE CONSIDERED

- Stock Valuation Options - Review your Stock on Hand and Work in Progress listings before June 30 to ensure that it is valued at the lower of Cost or Net Realisable Value. Any stock that is carried at a value higher than you could realise on sale (after all costs associated with the sale) should be written down to that Net Realisable Value in your stock records.

- Write-Off Bad Debts – If you operate on an accruals basis of accounting (as distinct from a cash basis) you should write-off bad debts from your debtors listing before June 30. A bad debt is an amount that is owed to you that you consider is uncollectable or not economically feasible to pursue collection. Unless these debts are physically recorded as a ‘bad debt’ in your system before 30th June 2023, a deduction will not be allowable in the current financial year.

- Repairs and Maintenance Costs – Where possible and cash flow allows, consider bringing these repairs forward to before June 30. If you don’t understand the distinction between a repair and a capital improvement please consult with us because some capital improvements may not be tax-deductible in the current year and could be claimable over a number of years as depreciation.

- Obsolete Plant and Equipment - should be scrapped or decommissioned prior to June 30, 2023 to enable the book value to be claimed as a tax deduction.

- Use of a Bucket Company to receive distributions from your Discretionary Trust

Superannuation Tax Planning Opportunities

INCREASE IN SUPER GUARANTEE CONTRIBUTION RATE. From July 1, 2023 the compulsory Super Guarantee Contribution rate increases from 10.5 % to 11%.

The maximum super contribution base used to determine the maximum limit on any individual employee's earnings base for each quarter of 2022/22 is $58,920 and for 2022/23 is $60,220 per quarter. You do not have to provide the minimum support for the part of earnings above this limit.

CONCESSIONAL CONTRIBUTION CAP OF $27,500 FOR EVERYONE

The tax-deductible superannuation contribution limit or cap is $27,500 for all individuals regardless of their age for the 2022/23 financial year.

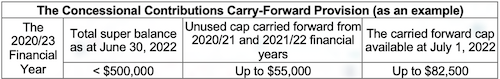

- If eligible and appropriate, consider making the most of your 2022/23 financial year annual concessional contributions cap with a concessional contribution. Note that other contributions such as employer Superannuation Guarantee Contributions (SGC) and salary sacrifice contributions will have already used up part of your concessional contributions cap. If your total superannuation balance as at June 30, 2022 was less than $500,000 you may be in a position to carry-forward unused concessional caps starting from the 2018/19 financial year. Members can access their unused concessional contributions caps on a rolling basis for five years and amounts carried forward that have not been used after five years will expire. The 2019/20 financial year was the first year in which you could access unused concessional contribution and by making a concessional contribution to your super, you could reduce your personal income tax for this financial year and provide for your future retirement.

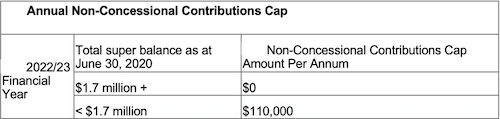

Non-Concessional Contributions Cap

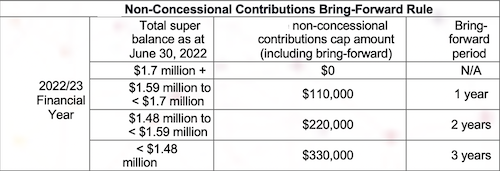

- If eligible and appropriate, consider utilizing all or part of your 2022/23 financial year annual non-concessional contributions cap by making a non-concessional contribution. If you are not currently in a non-concessional contributions bring forward period, consider whether you may be in a position to ‘bring-forward’ your non-concessional contributions caps for the 2023/24 and 2024/25 financial years, and contribute up to $330,000 for the 2022/23 financial year.

- A non-concessional contribution generally refers to an after-tax contribution that isn’t (or can’t be) claimed as a tax deduction by the contributor, e.g. personal contributions not claimed as a tax deduction and spouse contributions (for the recipient).

- The advantage of making the maximum tax-deductible superannuation contribution before June 30, 2023 is that superannuation contributions are taxed at between 15% and 30%, compared to personal tax rates of between 32.5% and 45% (plus 2% Medicare levy) for an individual taxpayer earning over $45,000. Typically, self-employed individuals and those who earn their income primarily from passive sources like investments make their super contributions close to the end of the financial year to claim a tax deduction. However, individuals who are employees may also use this strategy and those who might want to take advantage of this opportunity would typically include individuals:

- who work for an employer that does not permit salary sacrifice,

- who work for an employer that does enable salary sacrifice (but it is not disadvantageous due to a reduction in entitlements), and

- who are salary sacrificing but want to make a top-up contribution to utilise their full concessional contributions cap.

GOVERNMENT CO-CONTRIBUTION TO YOUR SUPERANNUATION

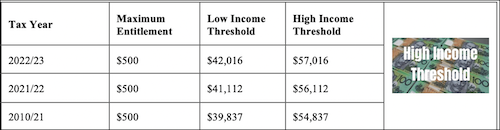

The Government co-contribution is designed to boost the superannuation savings of low and middle-income earners who earn at least 10% of their income from employment or running a business. If your income is within the thresholds listed in the table below and you make a ‘non-concessional contribution’ to your superannuation, you may be eligible for a Government co-contribution of up to $500. To be eligible you must be under 71 years of age as at June 30, 2022. In 2022/23, the maximum co-contribution is available if you contribute $1,000 and earn $42,016 or less. A lower amount may be received if you contribute less than $1,000 and/or earn between $42,016 and $57,016.

SALARY SACRIFICE TO SUPERANNUATION

If your marginal tax rate is 19% or more, salary sacrificing can be an effective way to boost your superannuation and also reduce your tax. By putting pre-tax salary into superannuation instead of having it taxed at your marginal tax rate you may save tax. This can be particularly beneficial for employees approaching retirement age.

Immediate Write-Off for Individuals Small Business Assets

Temporary Full Expensing allows businesses to claim an immediate deduction for the business portion of the cost of an asset being eligible plant, equipment and motor vehicles in the year it is first used or installed ready for use for a taxable purpose. For the 2022-23 income year, a business can claim an immediate deduction for the business portion of the cost of:

- Eligible new assets first held, first used or installed and ready for use for a taxable purpose between 7.30pm AEDT on 6 October 2020 and 30 June 2023.

- Eligible second-hand assets for businesses with aggregated turnover under $50 million - eligible depreciating assets using the simplified depreciation rules (only for small businesses with aggregated turnover of less than $10 million and less than $2 million for previous income years) and the balance of their small business pool.

If you are a small business entity that chooses to use the simplified depreciation rules, temporary full expensing rules apply with some modifications.

You cannot opt out of temporary full expensing for assets that the simplified depreciation rules apply to. You must immediately deduct the business portion of the asset’s cost for assets you start to hold, and first use (or have installed ready for use) for a taxable purpose from 7.30pm (AEDT) on 6 October 2020 to 30 June 2023. You don’t add these assets to your small business pool.

You may also deduct the balance of the small business pool at the end of an income year ending between 6 October 2020 and 30 June 2023.

Here are some key points to consider:

- For the instant asset write-off the asset can be new or second-hand.

- To be eligible, the asset must be purchased by a business turning over less than $50m or $500 million after 12th March 2020.

- The amount must be under $150,000 (depending on date of purchase – it could be $30K or $25K or $20K) exclusive of GST (i.e. $165,000, $33K, $27.5K or $22K including GST)

- If you borrow to purchase the asset, the asset is still eligible.

- The asset must be installed and ready to use by the deadline.

- To claim the write off on a motor vehicle you will need to have a valid log book and claim only that percentage of the cost as an immediate write off.

- If you purchase a car for your business, the instant asset write-off is limited to the business portion of the car limit of $64,741 for the 2022/23 income tax year.

- Any attempt to manipulate invoices etc. will attract the ATO's use of the anti-avoidance rules, thereby eliminating the write off.

- If your business has a small profit or even a loss, the write off will be of little or no benefit in the current year (losses are not refundable but can be carried forward to the next year).

- Building structural improvements are not eligible for the instant write-off.

- If your business is not a ‘Small Business Entity’ you will need to depreciate all assets purchased over $1,000. Any assets purchased for $1,000 or less can be written off immediately.

Accelerated Depreciation Deductions

Newly-acquired depreciating assets valued at more than $30,000 (or $150,000 post 12th March 2020) and not applied to the instant asset write-off deduction can be added to the general business pool. As part of the backing business incentive, an accelerated depreciation deduction of 57.5 percent for the business portion of the new depreciating asset applies for the cost of an asset on installation from 12th March 2020 to 30th June 2023 and existing depreciation rules apply (15 per cent for the first year and 30 per cent for subsequent years) to the balance of the asset’s cost and for subsequent years. There is no limit to the cost of a qualifying depreciating asset eligible for this concession, but the asset must be new and not second-hand.

29th-June-2023 |