Key points

- The current pullback in shares has been triggered by worries around US inflation, the Fed and rising bond yields but made worse by an unwinding of bets that volatility would continue to fall.

- We may have seen the worst, but it’s too early to say for sure. However, our view remains that it’s just another correction.

- Key things for investors to bear in mind are that: corrections in the order of 5-15% are normal; in the absence of recession, a deep bear market is unlikely; selling shares after a fall just locks in a loss; share pullbacks provide opportunities for investors to pick them up more cheaply; while shares may have fallen, dividends haven’t; and finally, to avoid getting thrown out of a long-term investment strategy it’s best to turn down the noise during times like the present.

Introduction

The pullback in shares seen over the last week or two has seen much coverage and generated much concern. This is understandable given the rapid falls in share markets seen on some days. From their highs to their recent lows, US and Japanese shares have fallen 10%, Eurozone shares have fallen 8%, Chinese shares have fallen 9% and Australian shares have lost 6%. This note looks at the issues for investors and puts the falls into context.

Drivers behind the plunge

There are basically three drivers behind the plunge in share prices. First, the trigger was worries that US inflation would rise faster than expected resulting in more aggressive rate hikes by the US Federal Reserve and higher bond yields. Flowing from this are worries that the Fed might get it wrong and tighten too much causing an economic downturn and that higher bond yields will reduce the relative attractiveness of shares and investments that have benefited from the long period of low interest rates.

Second, after not having had a decent correction since before Donald Trump was elected president and with high and rising levels of investor confidence, the US share market was long overdue a correction, which had left the market vulnerable.

Finally, and related to this, the speed of the pullback is being exaggerated by the unwinding of a large build up of so-called short volatility bets (ie bets that volatility would continue to fall) via exchange traded investment products that made such bets possible. The unwinding of such positions after volatility rose further pushed up volatility indexes like the so-called VIX index and that accelerated the fall in US share prices. Quite why some investors thought volatility would continue to fall when it was already at record lows beats me, but this looks to be another case of financial engineering gone wrong!

With shares having had a roughly 5-10% decline (in fact US share futures had had a 12% fall) from their recent highs to their lows and oversold technically and with the VIX volatility index having spiked to levels usually associated with market bottoms, we may have seen the worst but as always with market pull backs it’s impossible to know for sure particularly with bond yields likely to move still higher over time and if there is further unwinding of short volatility positions to go.

Considerations for investors

Sharp market falls with talk of billions of dollars being wiped off shares are stressful for investors as no one likes to see the value of their investments decline. However, several things are worth bearing in mind:

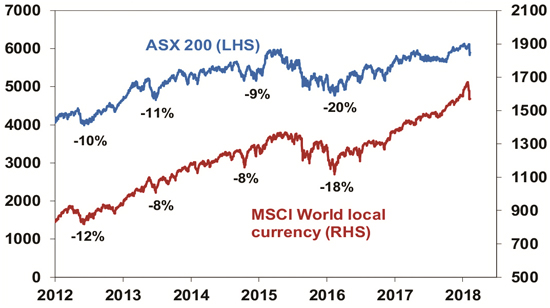

First, periodic corrections in share markets in the order of 5-15% are healthy and normal. For example, during the tech com boom from 1995 to early 2000, the US share market had seven pull backs greater than 5% ranging from 6% up to 19% with an average decline of 10%. During the same period, the Australian share market had eight pullbacks ranging from 5% to 16% with an average of 8%. All against a backdrop of strong returns every year. During the 2003 to 2007 bull market, the Australian share market had five 5% plus corrections ranging from 7% to 12%, again with strong positive returns every year. More recently, the Australian share market had a 10% pullback in 2012, an 11% fall in 2013 (remember the taper tantrum?), an 8% fall in 2014 and a 20% fall between April 2015 and February 2016 all in the context of a gradual rising trend. And it has been similar for global shares, but against a strongly rising trend. See the next chart. In fact, share market corrections are healthy because they help limit a build up in complacency and excessive risk taking.

Corrections are normal - Global and Australian shares

Source: Bloomberg, AMP Capital

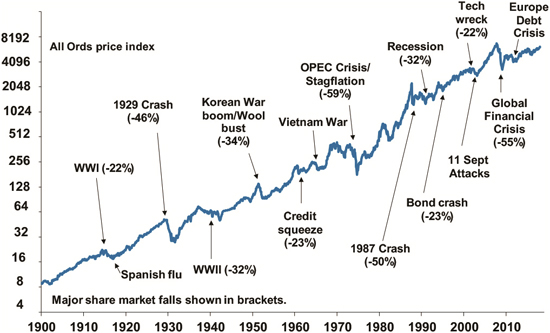

Related to this, shares literally climb a wall of worry over many years with numerous events dragging them down periodically, but with the long-term trend ultimately rising and providing higher returns than other more stable assets. In fact, bouts of volatility are the price we pay for the higher longer-term returns from shares.

Australian shares have climbed a wall of worry

Source: ASX, AMP Capital

Second, the main driver of whether we see a correction (a fall of 5% to 15%) or even a mild bear market (with say a 20% decline that turns around relatively quickly like we saw in 2015-2016) as opposed to a major bear market (like that seen in the global financial crisis (GFC)) is whether we see a recession or not. Our assessment remains that recession is not imminent:

- The post-GFC hangover has only just faded with high levels of business and consumer confidence globally only just starting to help drive stronger consumer spending and business investment.

- While US monetary conditions are tightening they are still easy, and they are still very easy globally and in Australia (with monetary tightening still a fair way off in Europe, Japan and Australia). We are a long way from the sort of monetary tightening that leads into recession.

- Tax cuts and their associated fiscal stimulus will boost US growth in part offsetting Fed rate hikes.

- We have not seen the excesses – in terms of debt growth, overinvestment, capacity constraints and inflation – that normally precede recessions in the US, globally or Australia.

Reflecting this, global earnings growth is likely to remain strong providing strong underlying support for shares.

Third, selling shares or switching to a more conservative investment strategy or superannuation option after a major fall just locks in a loss. With all the talk of billions being wiped off the share market, it may be tempting to sell. But this just turns a paper loss into a real loss with no hope of recovering. The best way to guard against making a decision to sell on the basis of emotion after a sharp fall in markets is to adopt a well thought out, long-term investment strategy and stick to it.

Fourth, when shares and growth assets fall they are cheaper and offer higher long-term return prospects. So the key is to look for opportunities that the pullback provides – shares are cheaper. It’s impossible to time the bottom but one way to do it is to average in over time.

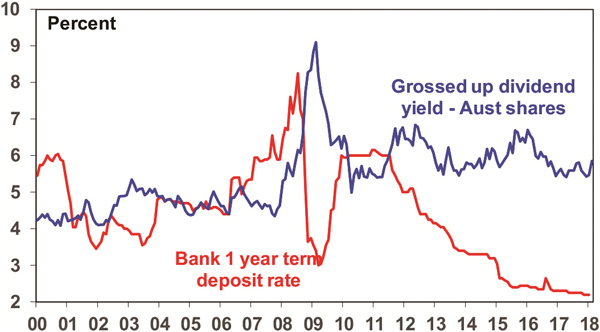

Fifth, while shares may have fallen in value the dividends from the market haven’t. So the income flow you are receiving from a well-diversified portfolio of shares continues to remain attractive, particularly against bank deposits.

Australian shares still offering a much better yield than bank deposits

Source: RBA, Bloomberg, AMP Capital

Sixth, shares and other related assets often bottom at the point of maximum bearishness, ie just when you and everyone else feel most negative towards them. So the trick is to buck the crowd. As Warren Buffett once said: “I will tell you how to become rich…Be fearful when others are greedy. Be greedy when others are fearful.”

Finally, turn down the noise. At times like the present, the flow of negative news reaches fever pitch – and this is being accentuated by the growth of social media. Talk of billions wiped off share markets, record point declines for the Dow Jones index and talk of “crashes” help sell copy and generate clicks and views. But such headlines are often just a distortion. We are never told of the billions that market rebounds and the rising long-term trend in share prices adds to the share market. And as share indices rise in level over time of course given size percentage pullbacks will result in bigger declines in terms of index points. And 4% or so market falls are hardly a “crash”. Moreover, they provide no perspective and only add to the sense of panic. All of this makes it harder to stick to an appropriate long-term strategy let alone see the opportunities that are thrown up. So best to turn down the noise and watch Brady Bunch, 90210 or Gilmore Girls re-runs!

-----------------------------------------------------------------------

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

|