The recent equity market correction has raised concerns about the risk of a US recession.

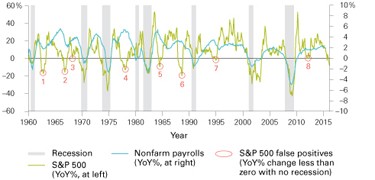

However, global equity market corrections tend to produce false recession signals, and we believe the current market volatility was such an occurrence. History shows a mixed track record for the market in predicting recessions, with as many hits as misses since 1960.

US equity market's mixed track record of forecasting recessions

Comparing yearly S&P 500 Index returns with actual US recessions

Notes: The National Bureau of Economic Research defines a recession as "a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP [gross domestic product, real income, employment, industrial production and wholesale-retail sales" (2016; available on www.nber.org/cycles.html). YoY = year over year.

Sources: Calculations by The Vanguard Group, Inc., based on data from US Bureau of Labor Statistics household surveys (1960 - 2015), NBER and Standard & Poor's.

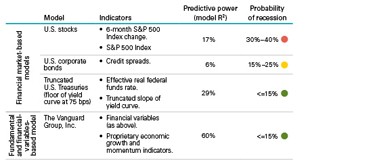

Yield curve is still a reliable indicator

Perhaps the best-known market-based indicator for predicting downturns is the slope of the US

Treasury yield curve (that is, the yield spread between long-term and short-term Treasuries). Past US recessions have been preceded by a significant "flattening" of the yield curve, in some cases as early as 18 months before the recession begins.

Contrary to conventional wisdom, it is the "flattening" of the yield curve itself, rather than its inversion, that is most predictive of a recession. With short-term rates near 0%, the 10-year Treasury yield would need to drop below 1% to signal a forthcoming recession, or well below current yield levels.

Overall, financial markets-based models tend to assign higher probabilities of recession, but have much lower predictive power than macro fundamental models such as Vanguard's.

A mixed bag for market-based forecasts; macro fundamental models are more reliable

Estimated ability of various models to predict a US recession over six months ended August 2016

Notes: Figure based on results of probit model accounting for credit default spread (AAA interest rates minus Baa interest rates), yield curve (10-year Treasury yield minus 3-month T-bill yield), proprietary economic growth and momentum indicators as included in Vanguard's leading economic indicators (VLEI). The VLEI comprises more than 70 economic indicators covering all sectors of the real US economy, such as manufacturing, housing, and trade; hard indicators including sales and profits; and soft indicators such as surveys and market sentiment. The model is specifically designed to anticipate turning points in the business cycle and slowdowns in payroll growth.

Sources: The Vanguard Group, Inc. calculations, based on data from Federal Reserve Bank of St. Louis, Moody's Analytics Data Buffet, Moody's Investors Service, NBER, Standard & Poor's, Thomson Reuters Datastream and US

Board of Governors of the Federal Reserve System.

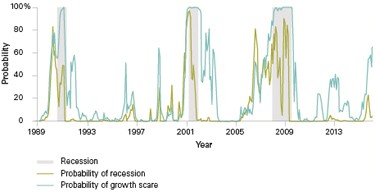

A US 'growth scare' is likely, but not a recession

The Vanguard Group, Inc.'s recession model (see Figure 2) combines financial variables with proprietary leading economic indicators, a coverage that tends to produce a more reliable signal. Today, The Vanguard Group, Inc.'s model puts the probability of an outright US recession over the next six months at roughly 10%. This outlook is less bearish than is indicated by the financial markets, given the underlying momentum in the labour market. Our model does detect elevated odds of a "growth scare" - a slowdown in job growth - later in 2016.

This is one of the reasons we anticipate the US Federal Reserve to raise rates to 1% this year and then pause as the pace of US job growth cools. This view is not currently priced in by the US bond market, which sees little if any further tightening in 2016.

Odds of a US recession remain low

The Vanguard Group, Inc. model estimates are based on both fundamental and market variables

Notes: Figure based on results of probit model accounting for credit default spread (AAA interest rates minus Baa interest rates), yield curve (10-year Treasury yield minus 3-month T-bill yield), proprietary economic growth and momentum indicators as included in The Vanguard Group Inc.'s leading economic indicators (VLEI), and results of S&P 500 Index. Recession is as defined by NBER (see Notes to first Figure 1); we define "growth scare" as a fall in monthly nonfarm payrolls below 50,000. Estimates based on data from January 1982 through January 2016.

Sources: Calculations by The Vanguard Group, Inc., based on data from Federal Reserve Bank of St. Louis, Moody's Analytics Data Buffet, Moody's Investors Service, NBER, Standard & Poor's, Thomson Reuters Datastream and US Board of Governors of the Federal Reserve System.

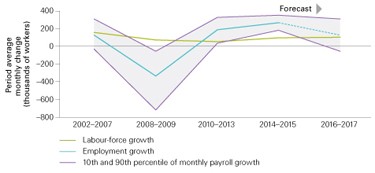

Growth scare par for the course?

As the US labour market closes in on full employment, we expect the pace of job growth to slow and approach demographic trends of approximately 150,000 or fewer jobs per month. If this view is correct, we would anticipate some weaker-than-consensus jobs reports in 2016. We would see such short-term deviations as par for the course as the economy returns to lower trend job growth, rather than a sign of an imminent recession.

Market volatility will surely increase, should such events unfold, but our baseline view remains that the US economy is unlikely to break and fall into recession in 2016.

Convergence towards trend labour-force growth will not be linear

Notes: Data cover 2002 - 2017. Labour-force growth represents historical average monthly change in labour force; 2016 - 2017 period represents a projection using population growth estimates and assumes constant participation rates within age cohorts. Employment growth is assumed to return to trend in labor force growth over 2016 - 2017.

Sources: Calculations by The Vanguard Group, Inc., based on data from Congressional Budget Office, US Bureau of Economic Analysis, US Bureau of Labor Statistics and Moody's Analytics Data Buffet.

Vanguard | 11 April 2016

|