Owners of properties which are income producing are eligible for significant taxation benefits.

According to Bradley Beer, the Managing Director of BMT Tax Depreciation, research shows that 80% of property investors are failing to take full advantage of property depreciation and are missing out on thousands of dollars in their pockets.

“On average, property investor’s can claim between $5,000 and $10,000 in depreciation deductions in the first financial year,” said Bradley

Despite this, depreciation is often missed because it is a non-cash deduction and an investor does not need to spend money to claim it.

As a building gets older, items wear out - they depreciate. The Australian Taxation Office (ATO) allows property owners to claim this depreciation as a deduction. Investment property owners are entitled to claim depreciation as capital works deductions for the structure of the building (walls, floors, roofs) and for the plant and equipment assets contained within the property.

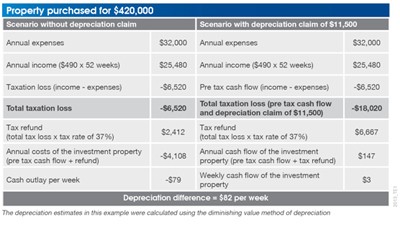

The below example demonstrates how depreciation claims are calculated and how by informing your clients about the difference it makes them, you can help them to boost their cash flow.

Depreciation: An investor profile

An investor has purchased a property for $420,000 and is receiving $490 per week in rent for a total income of $25,480 per annum. The estimated expenses for the property include interest, rates and management fees, which total $32,000 per annum. The following scenario shows the investor’s cash flow with and without depreciation. A typical $420,000 unit will depreciate by around $11,500 in the first full financial year.

In this example, the investor uses property depreciation to go from a negative cash flow scenario, paying out $79 per week, to a positive cash flow scenario, earning $3 per week on the property. By claiming depreciation this investor will save $4,255 for the year.

28th-June-2014 |