- Up to 60 transactions

- Bank statements reconciled

- Preparation & Lodgement of Quarterly BAS

- Profit & Loss Quarterly

- Receipt Bank & Xero Cashbook included

- Cash Accounting

- Year End file for Accountant

Welcome to Benchmark Bookkeeping & Payroll

Welcome to Benchmark Bookkeeping & Payroll

At Benchmark Bookkeeping & Payroll, our guiding business principle is to provide an honest and professional financial advisory service to all our clients.

About Benchmark Bookkeeping & Payroll

Benchmark is the place for all your accounting and payroll needs, backed by qualified and experienced accountants (Johnson & Thompson Accountants). With strategic advice and financial services tailored to your individual needs, Benchmark is here to assist you with each and every business challenge.

Our trusted accountants and bookkeepers specialise in the following:

1) Personal Service – Our friendly staff tailor your advice and services to adhere to what you require.

2) Customer Satisfaction – Business standards in place to ensure deadlines always met and clients always happy.

3) Value for money – Fixed fee pricing available, no hidden charges or surprises and the option to pay monthly with no interest charges.

In summary, providing a high quality, fast and reliable service at a competitive price.

Jan Thompson

B Bus CA / Partner

Adam Johnson

B Bus CA / Partner

Jay Mongan

B Bus CA / Partner

Laura Thew

Bookkeeper

Kylie Hambilton

Bookkeeper

Ian Hoppe

Bookkeeper

Our Services

- Bookkeeping

-

In-house assistance with managing your bookkeeping.

We come to your business, saving you time and money.

- Virtual Bookkeeping

-

Run a paperless office with a virtual bookkeeper.

All of the assistance with all of the freedom.

- Payroll Preparation

-

Don't get lost under the paperwork.

Pay staff, super, organise timesheets and stay compliant with the ATO.

Our Pricing & Packages

- Cashbook

-

Tight budget? Just starting out in business?

Our base compliance package is for small businesses.

- From $176 per month (GST included)

- Bookkeeping Starter

-

For clients wanting everything taken care of.

We've got what's needed to keep the Tax Office off your back.

- From $385 per month (GST included)

- Payroll Preparation

-

Perfect for our clients who simply need payroll help

Let our team help out you and your team.

- From $39.60 per pay period (GST included)

Software Links

Tools & Resources

Latest Accounting News

Why Might a Lease Dispute Occur?

A lease dispute can arise for various reasons during the lease term and even after it...

$20,000 instant asset write-off

This is a great scheme for small businesses and runs until the 30 June...

ASIC have recently issued the new scam warning regarding Bunnings and issuing of investment...

The Largest Empires in the World's History

Check out the Largest Empires in the World's...

All the documents, fact sheets and downloads to do with this year’s 2025-26 Federal Budget

Federal Budget 2025-26 – Papers and Fact...

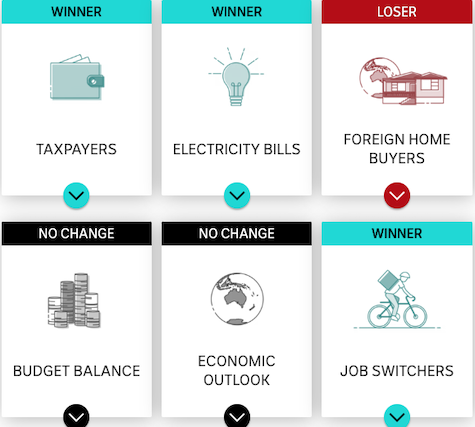

Winners and Losers - Federal Budget 2025-26

Treasurer Jim Chalmers has handed down his fourth federal budget, laying the groundwork for a federal...

Building Australia's future and Budget Priorities

Building Australia's future and Budget...

ATO outlines focus areas for SMSF auditor compliance in 2025

The ATO has issued guidance on what it will focus on regarding auditor compliance for...

Contact Us

Get in Touch

Benchmark Bookkeeping & Payroll welcome your enquiry. To book an appointment or simply ask us a question, fill in your details and we'll be in touch soon!

Office Location

- 41 Crescent Avenue, Taree NSW 2430