Empowered. Individualised. Measurable.

About AustraliaWide Financial Planning

At AustraliaWide, we specialise in Self-Managed Superannuation advice and our personalised wealth management strategies are all about your lifestyle needs, your future plans and your financial goals, and that makes a big difference.

Empowering our clients with the right information enables them to be actively involved in their financial plans and become equipped to make more informed choices about their future. Navigating the many financial choices and volumes of information on your own, can be daunting.

Our approach is to provide guidance and ensure understanding to give you the confidence and peace of mind that you have the right plan to suit your needs.

Whether you are just starting your wealth accumulation journey, planning for retirement or looking for financial security for your family, at AustraliaWide we are committed to helping you to achieve your goals.

Our Services

- SMSF's

-

Take control of your retirement

We are here to help you meet your obligations and make the most of your superannuation.

- Financial Planning

-

Develop your ideal financial strategy

Our experts can provide strategies to help you manage your affairs and meet your financial goals.

- Retirement Planning

-

Make the lost of your retirement

It's important to consider where you'll get the money you'll need to make it last.

- Superannuation

-

Take an early and active interest

Your super is critical to ensuring the benefits it can offer are maximised by the time you retire.

- Risk Insurance

-

Protect your loved ones

It's essential to choose the insurance strategy that suits your lifestyle.

Latest Financial News

Investment and economic outlook, March 2025

latest forecasts for investment returns and region-by-region economic...

Advisers should be aware of signs of elder abuse in SMSF structures

SMSFs are a structure that can heighten and exacerbate issues around elder abuse, a leader in the aged care...

SMSFs hold record levels of cash and property

SMSFs are holding record levels of cash despite an interest level drop in February, according to AT...

Trustees warned on early access

The ATO has warned trustees they will be held accountable for members who access super without meeting a...

The Largest Empires in the World's History

Check out the Largest Empires in the World's...

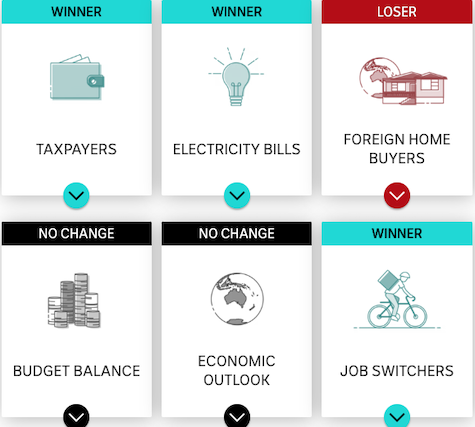

Winners and Losers - Federal Budget 2025-26

Treasurer Jim Chalmers has handed down his fourth federal budget, laying the groundwork for a federal...

All the documents, fact sheets and downloads to do with this year’s 2025-26 Federal Budget

Federal Budget 2025-26 – Papers and Fact...

Building Australia's future and Budget Priorities

Building Australia's future and Budget...

Four SMSF breaches high on the ATO’s radar

The Tax Office is actively targeting SMSF trustees over a range of super breaches. Home ownership is still the...

Client Resources

- Financial Videos

-

Watch our video series to learn more about the value of accounting and taxation experts, how it applies to common life events and how we can help you.

- Useful Links

-

We've compiled a broad range of useful links for your use. These include a various of topics such as taxation, software, Government agencies and media.

- General Calculators

-

Powered by ASIC's MoneySmart, these FREE calculators can help give you direction and motivate you to achieve your financial goals.

Contact Us

Get in Touch

AustraliaWide Financial Planning welcomes your enquiry. To book an appointment or simply ask us a question, fill in your details and we'll be in touch soon!

Office Location

- Level 12, 484 St Kilda Road, Melbourne, VIC, 3004

Office Hours

- Monday to Friday — 9am to 5pm