Investment and economic outlook, October 2024

.

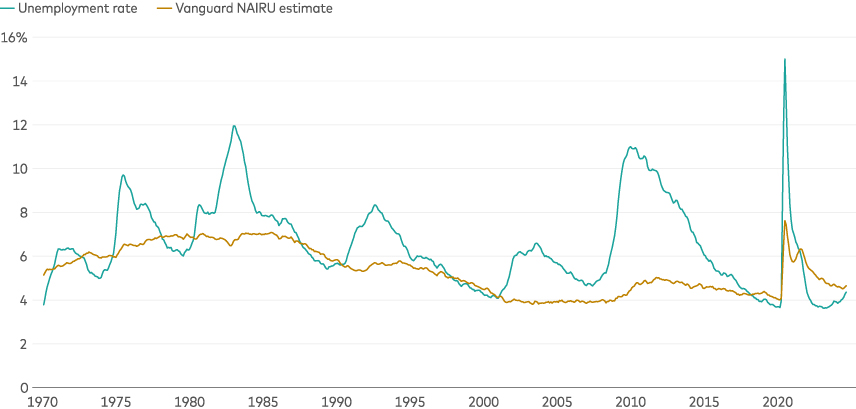

The upturn in U.S. unemployment before the start of the Federal Reserve’s rate-cutting cycle likely reflects a normalised labour market, not one poised for rapid deterioration. The unemployment rate has risen from 3.4% in early 2023 to the low-4% range. It’s now in line with Vanguard’s estimate of the non-accelerating inflation rate of unemployment. NAIRU, as it's known, is the lowest rate of unemployment that wouldn’t be expected to promote inflation.

Key gauge suggests balance in the U.S. labour market

Note: NAIRU is the non-accelerating inflation rate of unemployment.

Sources: based on data from the St. Louis Federal Reserve FRED database through August 31, 2024.

In its hiking cycle that began in March 2022, the Fed raised rates steadily—and, at times, aggressively—through July 2023 to fight inflation propelled to generational highs by supply-and-demand imbalances related to the COVID-19 pandemic. These imbalances were especially noteworthy in the labour market. A worker shortage kept wage pressures high and the unemployment rate well below NAIRU.

In the lead-up to its first rate cut, in September, the Fed expressed confidence that the pace of inflation was moving toward target but indicated some concern about the labour market’s health. The Fed’s dual mandate is to ensure price stability and foster maximum sustainable employment.

“Our NAIRU estimate suggests that the labour market has reached a healthy balance,” said Adam Schickling, a Vanguard senior economist. “While the Fed may favour additional rate cuts to bring the policy rate closer to their estimate of the neutral rate, we don’t expect near-term labour market conditions to prompt an accelerated cutting cycle.” [1]

[1] The neutral rate is a theoretical interest rate that would neither stimulate nor restrict an economy at full employment.

Outlook for financial markets

Our 10-year annualised nominal return and volatility forecasts are shown below. They are based on the 30 June, 2024, running of the Vanguard Capital Markets Model® (VCMM). Equity returns reflect a range of 2 percentage points around the 50th percentile of the distribution of probable outcomes. Fixed income returns reflect a 1-point range around the 50th percentile. More extreme returns are possible.

Australian dollar investors

Australian equities: 4.7%–6.7% (21.7% median volatility)

Global equities ex-Australia (unhedged): 4.3%–6.3% (19.1%)

Australian aggregate bonds: 4.1%–5.1% (5.6%)

Global bonds ex-Australia (hedged): 4.3%–5.3% (4.9%)

Notes: These probabilistic return assumptions depend on current market conditions and, as such, may change over time.

Source: Vanguard Investment Strategy Group.

IMPORTANT: The projections or other information generated by Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modelled asset class. Simulations are as of 31 May, 2024. Results from the model may vary with each use and over time.

Region-by-region outlook

The views below are those of the global economics and markets team of Vanguard Investment Strategy Group as of October 16, 2024.

Australia

The economy is growing at its slowest pace in decades, but inflation that is falling only gradually is likely to keep the central bank from cutting its policy interest rate this year.

We expect:

- The Reserve Bank of Australia (RBA) to remain on hold for the rest of the year before beginning a gradual easing cycle amid an anticipated weakening in both inflation and the labour market.

- That inflation will not fall sustainably to the midpoint of the RBA’s 2%–3% target range until 2025, given low productivity growth and the resulting elevation in unit labour costs. The pace of trimmed mean inflation—a measure of core inflation that excludes items at the extremes—slowed to 3.4% year over year in August.

- Economic growth to slowly start to recover in the second half of 2024, with full-year growth around 1%.

United States

Recent activity supports our view that economic growth is moderating but remains healthy. The Fed appears to have declared victory in its inflation fight, based on its most recent projections for the core Personal Consumption Expenditures (PCE) index. It sees balanced risks to its dual mandate of ensuring price stability and maximum sustainable employment.

We expect:

- Reductions of 0.25 percentage point in the Fed’s target for short-term interest rates at in both November and December 2024. That would leave its policy rate at 4.25%–4.5% at year-end.

- Full-year 2024 economic growth above 2%.

- The year-over-year pace of inflation (core PCE) to rise to 2.8% by year-end because of challenging comparisons with year-earlier data.

- The unemployment rate to end 2024 marginally above its September rate of 4.1%.

United Kingdom

The nation’s budget is set for release October 30. We’re watching for measures that could boost long-term economic growth—and productivity—primarily through greater public and private investment. The U.K. has trailed the rest of the G7 in investment levels for most of the last three decades.

We expect:

- The Bank of England (BOE) to cut its policy interest rate by 0.25 percentage point in both November and December, leaving a year-end bank rate of 4.5%. Further cuts next year likely will drop the rate to 3.5% by year-end 2025.

- Full-year 2024 economic growth of 1%, down from 1.2% in our previous forecast.

- The year-over-year rate of core inflation to end 2024 around 2.8% and to hit the BOE’s 2% target by the second half of 2025.

Euro area

With Germany on the cusp of recession and euro area growth momentum slowing sharply, the European Central Bank trimmed its benchmark interest rate by 0.25 percentage point today (October 17). It was the third such reduction of a cutting cycle that began in June.

We expect:

- Slower third-quarter economic growth, as a two-year manufacturing slump continues, and full-year 2024 growth of 0.6%, down from 0.8% in our previous forecast.

- Another ECB policy rate cut in December, which would leave its deposit facility rate at 3% at year-end.

- The year-over-year pace of core inflation, which excludes food, energy, alcohol, and tobacco prices, to fall to about 2.5% by year-end 2024. It was 2.7% in September. Still-elevated services inflation (3.9% last month), the last significant barrier to lower core inflation, underscores our long-held view that the last mile to lowering inflation to central bank target levels is the most difficult.

Japan

After decades of economic and market stagnation, Japan may be on the path of a sustainable rebound. Japan’s new prime minister, Shigeru Ishiba, appears supportive of a new direction for the Bank of Japan.

We expect:

- Forthcoming inflation data and third-quarter Tankan business survey results could lead the Bank of Japan (BOJ) to raise interest rates in December. An increase in real wages and inflation likely will give policymakers confidence to continue rate hikes in 2025.

- Full-year 2024 economic growth of about 0.2%, slightly above consensus, and a materially stronger 2025.

- A full-year 2024 inflation rate of about 2.5%, above the BOJ’s 2% inflation target.

China

The Ministry of Finance pledged in an October 12 briefing that forthcoming fiscal stimulus would address property market and local government debt challenges. Its failure to specify a headline dollar figure left some observers disappointed.

We expect:

- That meaningful stimulus is forthcoming, in an amount that could exceed China’s government debt limit and would require National People’s Congress (NPC) approval. We expect such specificity to be provided after the NPC’s late-October meeting.

- China will still be able to reach its 5% economic growth target for 2024—provided a sufficiently timely fiscal policy response. Gross domestic product grew just 0.7% in the second quarter compared with the first and 4.7% year over year.

- Headline inflation of 0.8% and core inflation of 1.0% for 2024.

Canada

Monetary policy remains restrictive and more potent than in the United States, and the pace of inflation is falling. We expect:

- The Bank of Canada will reduce its overnight rate target, currently 4.25%, to 4% or 3.75% at year-end.

- Below-trend economic growth of 1.25%–1.5% for the full year of 2024.

- The year-over-year pace of core inflation, which excludes volatile food and energy prices, to end 2024 in the 2.1%–2.4% range.

Emerging markets

Policy interest rates and the pace of inflation are moving in opposite directions in Latin America’s two largest economies.

Rising inflation driven by drought led the central bank of Brazil to raise its policy Selic rate to 10.75% last month. Broad prices rose by 4.42% year over year in September, near the upper end of a 1.5-percentage-point tolerance band around the bank’s 3% inflation target. Another rate hike may occur if inflation persists.

In Mexico, the pace of core inflation fell for a 20th straight month, to 3.91% year over year in September. Banxico, the central bank, cut interest rates last month for the third time this year, to 10.5%. With core inflation falling into Banxico’s target range, we believe additional rate cuts are possible in 2024. Peso depreciation will remain a concern.

Notes: All investing is subject to risk, including the possible loss of the money you invest.

Investments in bonds are subject to interest rate, credit, and inflation risk.

Investments in stocks and bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. These risks are especially high in emerging markets.

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

This article contains certain 'forward looking' statements. Forward looking statements, opinions and estimates provided in this article are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of current market conditions. Forward-looking statements including projections, indications or guidance on future earnings or financial position and estimates are provided as a general guide only and should not be relied upon as an indication or guarantee of future performance. There can be no assurance that actual outcomes will not differ materially from these statements. To the full extent permitted by law, Vanguard Investments Australia Ltd (ABN 72 072 881 086 AFSL 227263) and its directors, officers, employees, advisers, agents and intermediaries disclaim any obligation or undertaking to release any updates or revisions to the information to reflect any change in expectations or assumptions.

© 2024 Vanguard Investments Australia Ltd. All rights reserved.

Vanguard

23 OCT 2024

vanguard.com.au