As share prices rise, the risk-return trade-off gets tricky

Part of Vanguard's Global Macro Matters research series.

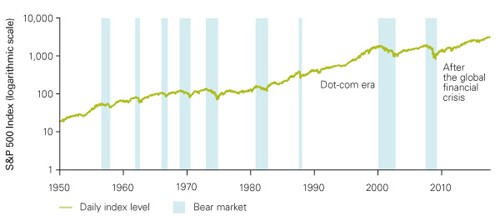

In the eight and a half years since the lows of the global financial crisis, the Standard & Poor's 500 Index has climbed more than 250%, making the current bull market the second strongest – and the second longest – since 1926 (see Figure 1).

The dot-com boom of the 1990s, when the index climbed more than 400% over nine and a half years, holds the record in both categories. This comparison raises inevitable and uncomfortable questions. Can the bull market continue to charge much higher? And, more important, are we in a late-1990s-style bubble, when valuations reached record highs and share prices subsequently plunged by 50%?1

Figure 1. The S&P 500 is in its second-strongest bull market

Notes: Data shown are for the S&P 500 Index from 1 January 1950 through 23 October 2017. "Bear market" is defined as a period with a decline of 20% or more from the previous high. Sources: Vanguard calculations, using data from FactSet and Bloomberg.

Our analysis finds that:

- Traditional valuation metrics, such as CAPE (cyclically adjusted price/earnings ratio), paint an alarming – but incomplete – picture when compared with long-term averages. Vanguard's "fair value" CAPE, a more useful measure for assessing over- or undervaluation than traditional metrics, suggests that while shares are trading above fair value, they aren't yet near the extremes reached in the dot-com high.

- Even so, our five-year outlook for US equities is subdued at best, and the benefits of global diversification are particularly compelling because of better prospects for non-US equity markets. Our simulations show that, under current market conditions, a globally diversified 60% stock/40% bond portfolio may offer return prospects that are on par with an all-US equity portfolio, while having significantly less tail risk.2

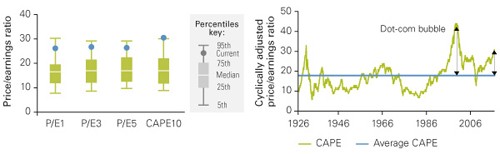

Conventional valuations are unusually high

Price/earnings (P/E) ratios are an important signal to identify periods of equity market overvaluation and even bubbles, when market prices become completely detached from corporate fundamentals such as dividends, book value and earnings. While valuations are not a good market-timing tool, elevated valuations are typically followed by depressed returns over the following decade. After reaching a CAPE multiple of 44x in 2000, the S&P 500 Index returned a cumulative -8% over the subsequent "lost decade."

Whether we use one-, three-, five-, or ten-year average earnings in the denominator, P/E ratios are quite high. The four valuation ratios in Figure 2a are between the 89th and 95th percentiles relative to their historical levels. The CAPE is at the 95th percentile of its historical levels. As Figure 2b shows, it stands at 31x, just below two standard deviations from its long-term average of 18x since 1926. By just about any conventional measure, equities are overvalued.

Figure 2. The S&P 500 Index is unusually high relative to history

Note: Analysis above is for the S&P 500 Index since 1926. Sources: Vanguard calculations, based on Robert Shiller's website, at aida.wss.yale.edu/~shiller/data.htm.

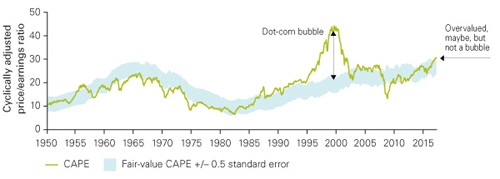

The fair-value CAPE tells a less alarming tale

While the levels in Figures 2a and 2b seem alarming, a straight comparison of CAPE (and other valuation multiples) with their historical averages can be misleading. Such comparisons fail to account for changes in the economy and markets, including inflation levels and interest rates that can influence the fair values for these multiples. For example, a secular decline in interest rates and inflation pushes down the discount rates used in asset-pricing models, thus inflating P/E ratios. In this case, a high CAPE may indicate not overvalued stock prices, but low bond yields. At the 2017 CFA Institute Annual

Conference, professors Robert Shiller, creator of the CAPE, and Jeremy Siegel cited low interest rates as a possible partial explanation for elevated CAPE ratios.

In Vanguard's Economic and Investment Outlook for 2015, we introduced a fair-value CAPE that accounts for current interest rates and inflation levels.3 This fair-value concept provides a more useful time-varying benchmark against which the traditional CAPE ratios can be compared.

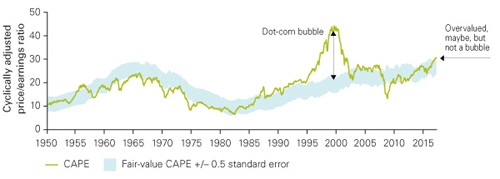

Figure 3 plots the Shiller CAPE versus our fair-value model since the 1950s. In the late 1990s, the difference between these two would have suggested a bubble. Today, the CAPE is approaching historical highs, it's only marginally higher than our estimate of its fair value. In other words, the

market, going by the fair-value CAPE, is approaching overvalued territory – but it is not grossly overvalued, as it would be in a bubble.4

Figure 3. The Shiller CAPE is approaching overvalued territory

Notes: Fair-value CAPE is based on a statistical model that corrects CAPE measures for the level of inflation expectations and for lower interest rates. The statistical model specification is a three-variable vector error correction (VEC), including equity-earnings yields (S&P 500 Index), ten-year trailing inflation, and ten-year US Treasury yields estimated over the period from January 1940 to September 2017. For details, see Vanguard's Economic and Investment Outlook. Sources: Vanguard calculations, based on Robert Shiller's website, at aida.wss.yale.edu/~shiller/data.htm; the US Bureau of Labour Statistics; and the Federal Reserve Board.

Implications of high US equity prices, low yields

Even if comparisons with the late-1990s share market bubble are too extreme, our analysis suggests that US equity returns during the next five to ten years will be subdued at best. Today, the always-compelling case for global diversification is particularly strong. Consider the results from our Vanguard Capital Markets Model (VCMM) simulations:

- US equity seems set for lower returns and a higher risk of loss. As illustrated in Figure 4, our five-year US equity return simulations show roughly a one-in-three chance of surpassing a 5% annualised return. The probability of a 10% or worse decline in any given year is 69%, which is high relative to the historical probability (42%).

- Global diversification improves outlook. Relative to US equity, global equity (60% US equity/40% global ex-US equity) offers better potential for return with slightly lower odds of a 10% or worse decline in any given year. Investors with no allocation to global equity can benefit by diversifying globally.

- Global bonds enhance diversification, limit tail risk. A global balanced 60% stock/40% bond portfolio has similar potential for return as US equities, with much lower downside risk. Although global bonds are likely to have muted returns themselves, low correlation with equities provides a ballast during times of equity market turmoil, making diversification the only free lunch.

Figure 4. The benefits of global diversification are more compelling than usual

Notes: Summary statistics of 10,000 VCMM simulations for projected five-year annualised nominal returns as of September 2017 in US dollars before costs. Historical probabilities are probabilities of a 10% or worse decline in any given year for rolling five-year periods and are calculated from 1960 onward based on calendar-year returns. The global equity portfolio is 60% US equity and 40% global ex-US equity. The global bond portfolio is 70% US bonds and 30% global ex-US bonds. Balanced portfolios include global equity and global bonds. For VCMM details, see Vanguard Global Capital Markets Model.2

Investing is always a balancing act between return objectives and risk preferences. Given current valuations, risky portfolios appear to offer low return with even-higher-than-usual odds of loss, while a global balanced 60% stock/40% bond portfolio offers an unusually compelling trade-off. The next few years could be challenging for investors, who may have to navigate an environment with low returns and a compressed equity risk premium.

Decisions around saving more or spending less will be as important as staying diversified and controlling costs. Adhering to investment principles such as long-term focus, disciplined asset allocation, and periodic portfolio rebalancing will be more crucial than ever before.

Research & Commentary

vanguard.com.au

-----------------------------------------------------------------------------------------------

1 The CAPE ratio rose more than three standard deviations above its long-term average in the late 1990s and early 2000s, and thus the period can be considered extremely overvalued or a bubble.

2 Joseph Davis, Roger Aliaga-Díaz, Harshdeep Ahluwalia, Frank Polanco, and Christos Tasopoulos, 2014. Vanguard Global Capital Markets Model. Valley Forge, Pa.: The Vanguard Group.

3 Joseph Davis, Roger Aliaga-Díaz, Andrew Patterson, and Harshdeep Ahluwalia, December 2014. Vanguard's Economic and Investment Outlook. Valley Forge, Pennsylvania: The Vanguard Group.

4 One important point to keep in mind is that as the depressed company earnings of the 2008-2009 global financial crisis begin to roll out of the ten-year moving average calculation next year, the Shiller CAPE could fall slightly (to around 28x, assuming current prices and earnings don't change much).