Welcome to Rendall Kelly

Chartered Accountants, Parramatta

Welcome to Rendall Kelly

Chartered Accountants

Parramatta

Rendall Kelly provides advice and a full range of services to individuals and small to medium businesses including accounting, taxation and bookkeeping needs, as well as business strategy and succession planning.

About Rendall Kelly

Rendall Kelly is a firm of Chartered Accountants, able to offer a comprehensive range of services that encompasses all aspects of accounting, taxation, and business services. We specialise in handling small to medium-sized enterprises and high-net-worth individuals.

The partners of Rendall Kelly, Curt Rendall and Rod Kelly, have been in practice together for over 20 years. During that time, they have gained considerable experience in various industries, including Medical, Pharmaceutical, Manufacturing, Retail, Building and Construction, among others.

Our main office is conveniently located in Parramatta. Our clients are located all over New South Wales, interstate and overseas. With today's technology, instant communication with our clients is no problem, regardless of their location in Australia or the world.

Curt Rendall has been actively involved in advising State and Federal Governments in Australia for many years, having held the following positions:

- A member of the Federal Government’s Board of Taxation;

- Deputy Chairman of the Federal Government's New Tax System Advisory Board;

- Member, NSW Government’s Small Business Development Corporation;

- Chairman, Federal Government’s Small Business Consultative Committee;

- Chairman, Chartered Accountants Australia and New Zealand National Small and Medium Enterprise Committee;

- Member, NSW Government’s Small Business Development Corporation;

- Member, Dawson Review into the Competition Provisions of the Trade Practices Act; and

- Associate Commissioner of the Productivity Commission reviewing the Financial Arrangements between Insurance Companies and Smash Repairers.

Curt and Rod lead a dedicated team of professionals who strive to provide their clients with accounting, taxation and business services of the highest quality.

Latest Accounting News

Restructuring Family Businesses: From Partnership to Limited Company

Family businesses form the backbone of the Australian economy, with many starting as simple partnerships...

Choose the right business structure step-by-step guide

Take out the guesswork out of choosing the right structure for your...

ATO’s holiday home owner tax changes spur taxpayers to be ‘wary and proactive’

Following on from the Tax Office’s move to refresh its approach to rental property tax deductions, tax...

Payday Super part 1: understanding the new law

Passage of the Payday Super reforms by parliament this week has cleared the way for employee superannuation to...

A refresher on Medicare levy and Medicare levy surcharge.

The Medicare levy’s a compulsory charge of 2% on taxable income, which helps fund Australia’s public...

Protecting yourself from misinformation

The Australian Taxation Office (ATO) has observed websites attempting to harvest personal information such as...

Super gender gap slowly narrows

The latest Financy Women’s Index (FWX) for the September quarter has shown the superannuation gender gap is...

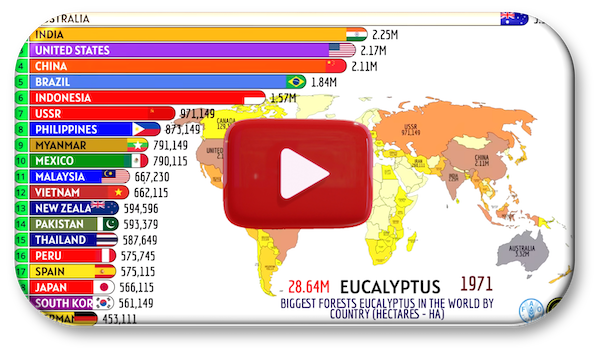

Countries with the largest collection or eucalyptus trees

Check out the countries that have started to grow their eucalyptus tree...

One gap when owning and operating a small business is to get a feel for how you are doing compared to your...

Contact Us

Get in Touch

Rendall Kelly welcomes your enquiry. To book an appointment or simply ask us a question, fill in your details and we'll be in touch soon!

Our Office

- Suite 4 - Level 1, 76 Phillip Street, Parramatta, NSW 2150

- (02) 9687 1899

- (02) 9687 1722

- 9:00am to 5:00pm - Monday to Friday

PO Box

- PO Box 1444, Parramatta NSW 2124