..... and it’s imperative that professionals are aware of the finer details before restructuring their clients’ arrangements.

Background

The ATO hasreleased important information detailing interest rates, loan-to-value ratios (LVRs) and other terms that constitute safe harbours for SMSF LRBAs so that arrangements will be taken to be consistent with an arm’s-length dealing. The ATO is officially calling their release a Practical Compliance Guideline.

Broadly speaking, LRBAs consistent with arm’s-length terms should not give rise to non-arm’s-length income (NALI). On the other hand, LRBAs that are not consistent with arm’s-length terms will attract NALI.

It is important to note here that many refer to non-arm’s-length LRBAs as ‘related party’ LRBAs. However, some SMSFs have obtained loans from unrelated parties such as friends that are not related parties that still fall under the ATO’s target of LRBAs that are not on arm’s length terms. Accordingly, in this article we refer to ‘non-bank’ LRBAs.

Accordingly, this ATO Practical Compliance Guideline is critical for:

- SMSF trustees that have already entered into LRBAs as action might be required; and

- SMSF trustees that are considering entering into LRBAs, that are not financed by a bank.

SMSF trustees that have already entered into non-bank LRBAs might need to revise the terms of the loan or take other timely corrective action by 30 June. In view of the ATO safe harbours, we strongly recommend that a review be undertaken of every LRBA that is not financed by a bank as soon as practicable and in any event prior to 30 June.

To the extent that an SMSF has NALI, that income is taxed at a very high rate (47 per cent in the 2016 financial year) even if the fund is in pension mode.

Terms of the safe harbour

The Practical Compliance Guideline states that the ATO:

Will accept that an LRBA structured in accordance with this Guideline is consistent with an arm’s-length dealing and that the NALI provisions do not apply purely because of the terms of the borrowing arrangement.

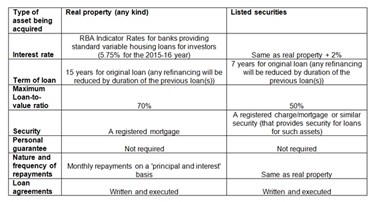

Essentially, the terms are as follows:

The Practical Compliance Guideline also provides further detailed guidance regarding the specifics of setting interest rates, particularly for fixed versus variable loans.

What to do if an existing non-bank LRBA does not meet the safe harbour

Advisers should contact all clients with non-bank LRBAs and tell them to read the Practical Compliance Guideline in full. Naturally, this article is just a summary and does not provide all the detail.

If the existing LRBA does not meet the safe harbours set out above, the Practical Compliance Guideline provides the follow options by 30 June 2016:

- Option 1 — Change the terms so that they are consistent with an arm’s-length dealing by 30 June.

- Option 2 — Bring the LRBA to an end by 30 June.

- Option 3 — Refinance to a commercial lender by 30 June.

The ATO also require all non-bank LRBAs to be put on arm’s-length terms on or before 30 June. This includes, for example, SMSFs being required to pay a full year’s repayments under loans prior to 30 June. This may place many SMSFs under financial stress given that they only have limited time available to come up with substantial cash funding.

Moreover, from 1 July LRBAs covered by the ATO’s safe harbour will need to make regular monthly repayments of principal and interest. As you would be aware, some non-bank LRBAs may have allowed more flexible repayments such as only requiring annual payments and some only required full repayment on finalisation of the loan term.

The closeness of 30 June 2016 cannot be overemphasised. All advisers (and then SMSF trustees) should act immediately as time is needed to obtaining advice, prepare documents and arrange the cash flow to be obtained and transferred before the 30 June deadline. If the 30 June deadline is not practical and is likely to be overshot, then expert advice should be obtained as soon as practical as a special approach to the ATO may be required.

Interesting points to note

Assets not covered by the safe harbours

What should one now make of non-bank LRBAs that are not covered by the safe harbour?

First, the safe harbours in the Practical Compliance Guideline only expressly apply to:

- real property;

- a collection of shares in a stock exchange listed company; and

- a collection of units in a stock exchange listed unit trust.

For example, if an SMSF trustee has borrowed from a non-bank to acquire units in a specific class of units in certain Vanguard managed funds, what action should the SMSF trustee take? Many think of such an investment as being tantamount to a listed security, but technically it’s not.

Perhaps somewhat more controversially, what to do if an SMSF trustee has borrowed to acquire units in a related trust such as a reg 13.22C/div 13.3A unit trust?

Given there is no safe harbour available, the ATO’s comments from December 2014 are more important than ever, namely:

To be able to demonstrate that NALI does not arise, a fund trustee entering into an LRBA with a related-party borrower should obtain and keep documentation that enables them to establish that the terms of the loan, taken together, and the ongoing operation of the loan are consistent with what an arm’s-length lender dealing at arm’s length would accept in relation to the particular borrowing by the fund trustee.

Therefore, the onus is on the SMSF trustee to obtain sufficient and appropriate evidence to support the arm’s-length nature of the terms of their LRBA. This may be difficult where there is no readily available market information and quotes and proposals from third parties and other sources may need to be researched and documented.

Indeed, some may not wish to continue with a non-bank lender and may prefer to refinance with a bank.

Actually calculating the loan-to-value ratio

How is the LVR calculated? More specifically, is the ‘value’ of the real property its value excluding GST, stamp duty and other similar costs? In the absence of ATO clarification, the conservative approach is to assume that the answer is 'yes'.

The ATO requires the market value to be established at the time of the relevant loan. Thus, the market value of the asset will generally be at the time of refinancing or if there is no refinancing at the date of the original loan.

Multiple assets for one loan

The Practical Compliance Guideline reinforces that it is possible to have multiple loans to acquire one asset. More specifically, it states:

If more than one loan is taken out in respect of the acquisition of the asset, the total amount of all those loans must not exceed [for real property] 70 per cent of the asset’s market value [or 50 per cent for listed securities].

What does ‘real property’ mean?

The Practical Compliance Guideline refers to real property. At first, it seems to cover all real property, referring to ‘real property, whether that property is residential or commercial premises (including property used for primary production activities)’.

However, there are a lot of ambiguous assets, which might be seen as real property or might not, such as:

- A tenants in common interest in real estate — technically, this is real property but the ATO do not expressly mention a non-bank lending to an SMSF to acquire a, for example, 50 per cent tenants in common interest in a house using a 70 per cent LVR and a 5.75 per cent interest rate.

- Life interests in real estate or listed shares/units — technically this is real property, but similar to tenants in common we doubt whether the ATO would be comfortable with an SMSF using these safe harbours to acquire such an asset.

- Shares in a real estate company — there exists ‘company title’ whereby a property does not have a plan of subdivision per se but rather comprises a number of apartments and a company owns all the property and by buying, for example, all of the C class shares the owner of the shares has exclusive possession to apartment number 3. Technically, such shares are not real property. However, there are certain areas of the laws that essentially allows them to be treated as real property (such as the CGT main residence exemption). The conservative position would be to treat such shares in a real estate company as not constituting real estate for the safe harbour relief and apply to the ATO for SMSF specific advice.

Don’t interpret the safe harbours for something they are not

The safe harbours do not state that just because the terms in the Practical Compliance Guideline are satisfied NALI can never occur. Rather, they have the following more restrained comment ‘an LRBA structured in accordance with this Guideline is consistent with an arm’s-length dealing and that the NALI provisions do not apply purely because of the terms of the borrowing arrangement’ (emphasis added). For example, if an SMSF acquires an asset for a non-market value from a related party, NALI could apply (refer Darrelen Pty Ltd v Commissioner of Taxation [2010] FCAFC 35).

Conclusions

The safe harbours are critically important. They are a practical solution and the ATO should be commended accordingly for its positive manner in managing these non-bank LRBAs.

All non-bank LRBAs should be reviewed and appropriate taken by 30 June.

Columnist: Daniel Butler, director, DBA Lawyers and Bryce Figot, director, DBA Lawyers

Wednesday 6 April 2016

SMSFadviser.com.au

6th-May-2016 |