... in the direction house prices actually move in:

the Australian Bureau of Statistics. So despite the criticisms of this

series-that it's based on detached dwellings only, based on median sales data,

too infrequent, not adjusted for "hedonic" differences between houses, etc.,

it's the only one I trust.

Chris Vedelago

had a very nice piece about how confusing the various commercial house price

statistics are:

The Real Estate Institute of Victoria said the city's

median house price rose 0.9 per cent in the March quarter. Except that,

according to RP Data-Rismark, it fell 1 per cent. Australian Property Monitors,

which is owned by Fairfax, believes prices rose 1.6 per cent in the three-month

period. Residex, on the other hand, estimates values fell 1.9 per cent... ("Confused

about the market? We all are", The Age April 29)

I'm happy to

ignore these numbers-and even more so the spin doctoring that goes with them.

The ABS numbers are in, and they show a 1.1% national fall over the March

quarter. Sydney house prices fell 1.8% according to the ABS, whereas Australian

Property Monitor alleged they rose 1.4%-the latter being the basis for Andrew

"Always Look On the Bright Side" Wilson's latest piece "Confidence rises as

prices bounce back" (SMH April 28). Yeah, right.

Australian

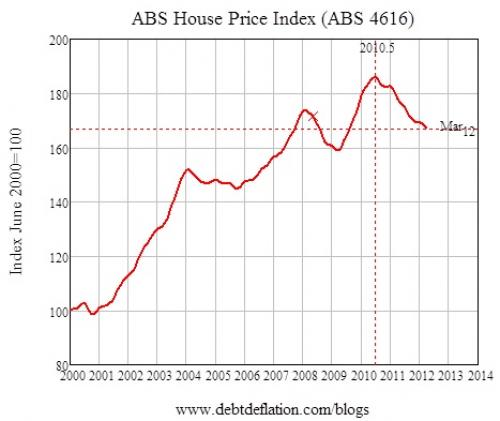

House prices have now fallen 6.1% from their peak, and have been falling for 21

months, which is the longest downturn in nominal prices ever recorded by the

ABS-the previous longest being the 12 months from the beginning of the GFC

(which was terminated by my favourite government policy of all time, the First

Home Vendors Boost).

Figure 1: Nominal house prices have

fallen 6.1% since June 2010

I'm sure the

usual spruikers will come out with why this is now the bottom, and it's a good

time to buy, and there wasn't an Australian house price bubble, and the

shortage will drive up prices, and... So let's put the current data in the

context of the bursting of acknowledged overseas house price bubbles.

Firstly the inflation

adjusted data: in real terms, house prices have now fallen 10% from their June

2010 peak, and are back to a level they first reached in late 2007.

Figure 2: Real house prices have fallen

10% since June 2010

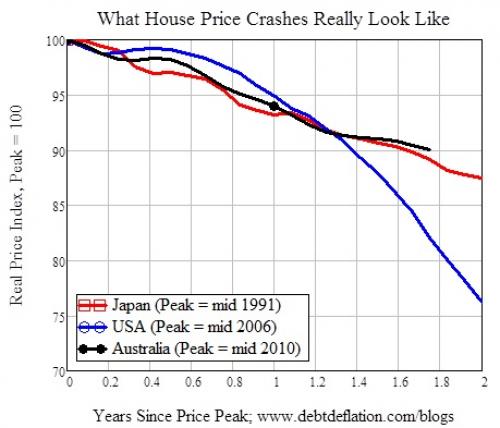

Now let's

compare the Australian experience to date with the Japanese and US

experiences-where no-one, not even Alan Greenspan, denies that there was a

housing bubble. The Japanese bubble peaked in June 1991; the US bubble

peaked in in May 2006; and Australian house prices peaked in June 2010. Figure

3 shows the three declines from the peak, and while the Australian experience

so far is clearly better than the USA's, it's only a whisker better

than the Japanese experience to the same date after the peak.

Figure 3: Comparing Japanese, US and

Australian house prices from their peaks

Anyone who

takes comfort from that should also consider the longer term perspective-see

Figure 4.

Figure 4: The long term picture for Japan and the USA

The motive

force behind Australia's

bubble was the same as in the USA

and Japan:

accelerating debt drove rising house prices during the boom. Now in both those

countries, decelerating debt is driving house prices down. The same pattern

applies in Australia-see

Figure 5.

Figure 5: Mortgage acceleration drives

change in house prices

Don't take

heart from the uptick in acceleration at the end of the series there: for that

to be sustained into the future, ultimately Australian mortgage debt would need

to start rising (compared to GDP). But mortgage debt grew more rapidly here and

reached a higher peak than in the USA (see Figure 6); the odds that

it will rise again are slim.

Figure 6: Australian mortgage debt

exceeded the USA's

And even though

the actual level of mortgage debt is still rising, it's doing so at the slowest

rate ever recorded by the RBA (see Figure 7).

Figure 7: Annual growth in mortgage debt

(with series break in 1991)

The odds are

that the rate of decline will accelerate in the next year-since as Leith van

Onselen pointed out yesterday, many Baby Boomers are relying on rising house

prices to secure their retirements. Now that house prices are falling, and have

been doing so for almost 2 years, many of these Boomers-74% of whom earn less

than $80,000 a year, with the average investor losing over $9,000 a year on

these "investments"-could decide to get out rather than continue to absorb

losses. The unwinding of their leveraged positions could push mortgage growth

below zero, and of course accelerate the house price fall.

Steve Keen is

an economist and author. For more commentary on Australia's debt crisis read DebtWatch

Source: thebull.com.au - for more articles

like this go to The Bull's website

12th-June-2012 |