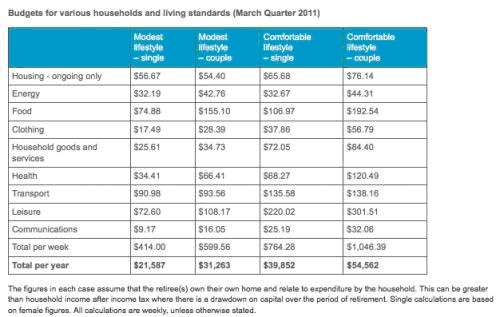

If you sit down with a financial planner to discuss your retirement, they'll ask you how much money you intend to live on each year. The reason financial advisers like to figure this out early is because this amount is then used to estimate your retirement lump sum, or your saving goal prior to retirement. Clearly, some people will live entirely on their savings while others will be supported by the full or part-age pension. The Association of Superannuation Funds Of Australia, ASFA, regularly updates a guide that you can use to estimate the amount of money needed to live a comfortable or modest retirement. The guide is updated quarterly to incorporate rising prices for food and utilities, as well as changing lifestyle expectations and spending habits. The budget incorporates costs for communications, health, energy, clothing, household goods and services, recreation and travel. According to the ASFA Retirement Standard a couple looking to achieve a ‘comfortable' retirement will need around $54,562 a year to fund it, while a more modest lifestyle will cost about $31,263 a year. For singles, a comfortable lifestyle will cost approximately $39,852 and $21,587 each year for a more modest lifestyle. The table below summarises the weekly costs for housing, energy, food, clothing and so forth and then provides a yearly figure. As is probably true for most Australians, the biggest costs tend to be transport (or maintaining a car), food and then leisure. A more detailed table that runs over individual costs for such things as memberships, dinners out, computer and telecommunication costs can be downloaded here. You could use this more detailed form to more accurately estimate your own costs in retirement.

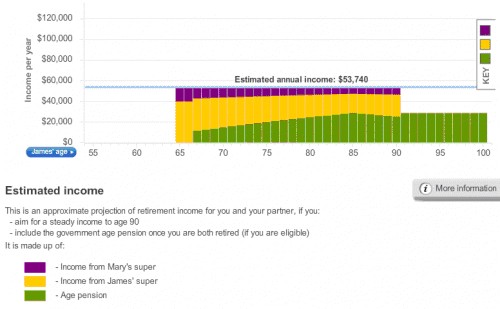

Clearly, if you've been living on a generous salary for years it may be a little daunting to contemplate a lifestyle funded on just $55,000 a year. As a rule of thumb, if you want to maintain the same lifestyle as that enjoyed during your working life, you'll require between 60 and 65 per cent of your pre-retirement income as a minimum. That means someone on $140,000 a year will require between $84,000 and $91,000 a year to continue a similar standard of living. Many retirees underestimate the amount of money they'll need during retirement. Although it's true that some expenses disappear upon retirement, such as work clothes, commuting costs and so forth, other expenses quickly take their place such as golf memberships, caravan trips and car repairs. Many retirees find themselves actually spending as much, if not slightly more, during retirement as more free time is enjoyed shopping and eating out. Also, the earlier you retire, the more income you'll need, and those who can't access the age pension due to high income or assets will also need to accumulate a larger lump sum. Indeed, there are many factors to take into consideration when coming up with a savings goal for retirement. As a very rough estimate, many financial planners say that pre-retirees need to save at least $700,000 to live fairly comfortably in retirement without the help of the Age Pension, or around $550,000 if they intend to access the Age Pension as well. If we use the ASFA Retirement Standard's benchmark figure of $54,000 a year for a comfortable retirement, then a couple would have to save at least $800,000 if they're not eligible for the Age Pension. ASIC created a handy retirement calculator that can be freely and easily accessed via their web. Rather than using rough estimates, you're much better off plugging your personal details into such calculators to get a feel for the variables that affect retirement planning such as investment returns, whether or not you own your own home and rising prices. As an example, let's plug in the figures for John and Mary, age 50, who both intend to retire at age 65. John earns $90,000 a year and currently has $150,000 in super, and Mary earns $55,000 and has $100,000 in super. John also salary sacrifices $1000 a fortnight into his super fund. The couple own their own home. As you can see from ASIC's figures in the chart below, John and Mary are on schedule to have around $53,740 in yearly income, which should last them from age 65 to past age 90.

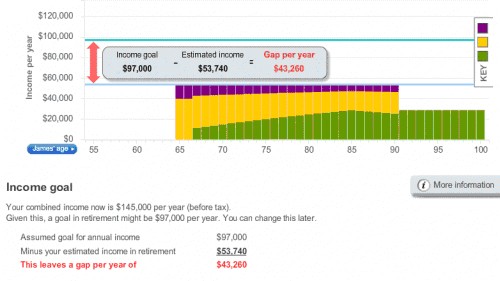

Given the couple's combined income is currently $145,000, the calculator suggests a retirement goal of $97,000 a year, rather than $53,740, to live a similar standard of living. To achieve this end, the couple need to accumulate an additional $43,260 as you can see from the chart below.

The calculator suggests options to achieve a retirement goal of $97,000 a year, such as contributing more to super via salary sacrifice, reducing investment fees on super funds, increasing the risk profile of investments within the fund and working longer. By Staff Journalist | 5.10.2011 By http://www.thebull.com.au/ - for more articles like this go to The Bull's website Australia's pre-eminent news and investing site for investors and traders, covering shares, superannuation, property, financial planning strategies and more.

19th-November-2011 |