Key points

- 2021 was again dominated by the coronavirus pandemic, along with concern about higher inflation and monetary tightening but shares, unlisted assets and balanced growth super funds saw strong returns.

- Continuing solid economic growth, rising profits and still easy monetary conditions should result in good overall investment returns in 2022, but they are likely to be more constrained and volatile than in 2021.

- The main things to keep an eye on are: coronavirus; inflation; US politics; China tensions; a possible Russian invasion of Ukraine; inflation; & the Australian election.

2021 – another year of covid

Just as 2020 was dominated by coronavirus so too was 2021. But 2021 turned out to be a far better year for investors. The big negatives of 2021 were of course dominated by coronavirus:

- Coronavirus mutated into more transmissible variants, drove 3 new waves of cases globally, saw more cases & deaths than in 2020 & saw long lockdowns in east coast Australia.

- Inflation in the US and some other countries rose to levels not seen in decades as the pandemic drove a surge in demand for goods, but left supply struggling to keep up.

- Related to this energy prices – notably gas in Europe and coal in China – surged as a result of energy shortages.

- Bond yields surged and many central banks moved to reduce monetary stimulus (by slowing bond buying) and some actually raised interest rates.

- Chinese growth slowed sharply as a result of policy tightening and an associated property downturn.

- Geopolitical tensions continued to simmer – notably between the US and China but also involving Russia & Iran.

- Political uncertainty around the transition of power in the US from President Trump gave way to relative calm with most of the action being in the Democrat party itself.

- And there was plenty to distract long term investors with meme stocks, cryptos and SPACs attempting moon shots and calling into question traditional ways of investing. We have seen it all before though, but cryptos (or rather blockchain) remind us that technology is a regular disruptor, there is lots of spare cash & many are happy to speculate.

However, despite the dominance of coronavirus and other sources of worry and noise there were significant positives:

- Science and medicine started to get the upper hand against coronavirus: vaccines were rolled out with 55% of the global population (75% in developed countries and 79% in Australia) having had a first dose substantially reducing serious illness; and several new treatments further holding out the promise of reducing serious illness from covid.

- This in turn enabled an easing in restrictions (or gradual reopening) albeit it was like 2 steps forward and 1 back.

- Fiscal stimulus, pent up demand and ultra-easy monetary policy helped support household and business spending.

As a result, global GDP is expected to have grown nearly 6% in 2021, in comparison to 2020’s slump of -3%. And in Australia GDP is expected to have risen by 4.5% despite a setback in the September quarter after slumping -2.2% last year. This in turn underpinned strong gains in profits and dividends. As a result, investment markets also performed better than feared, despite covid, higher inflation and higher bond yields.

Investment returns for major asset classes

|

Total return %, pre fees and tax

|

2020 actual

|

2021* actual

|

2022 forecast

|

|

Global shares (in Aust dollars)

|

5.7

|

27.4

|

4.0

|

|

Global shares (in local currency)

|

13.8

|

19.5

|

8.0

|

|

Asian shares (in local currency)

|

22.8

|

-7.6

|

10.0

|

|

Emerging mkt shares (local currency)

|

19.1

|

-1.7

|

10.0

|

|

Australian shares

|

1.4

|

14.1

|

10.0

|

|

Global bonds (hedged into $A)

|

5.1

|

-1.1

|

-2.0

|

|

Australian bonds

|

4.4

|

-3.0

|

-2.0

|

|

Global real estate investment trusts

|

-13.5

|

23.2

|

7.0

|

|

Aust real estate investment trusts

|

-4.6

|

20.3

|

7.0

|

|

Unlisted non-res property, estimate

|

-3.0

|

9.0

|

8.0

|

|

Unlisted infrastructure, estimate

|

-5.0

|

12.0

|

8.0

|

|

Aust residential property, estimate

|

6.0

|

23.0

|

5.0

|

|

Cash

|

0.4

|

0.0

|

0.1

|

|

Avg balanced super fund, ex fees & tax

|

3.6

|

12.2

|

5.8

|

*Year to date to Nov. Source: Thomson Reuters, Morningstar, REIA, AMP Capital

- Global shares had a few pullbacks as a result of covid and inflation fears, but they were relatively mild and stocks were boosted by strong profit growth, low interest rates and optimism vaccines would allow a more sustained reopening.

- However, US shares remained a surprising outperformer and emerging market shares fell, perhaps as payback for strong gains last year and as Chinese growth slowed.

- Australian shares underperformed with tensions with China not helping – but they actually did better than we expected.

- Government bonds had poor returns as yields rose as central banks moved towards the easy money exits.

- Real estate investment trusts had spectacular rebounds following last year’s hit to property space demand and rents.

- Unlisted property & infrastructure returns rebounded.

- Home prices surged thanks to ultra-low rates, incentives and FOMO. That said, monthly price gains have slowed.

- Cash and bank term deposit returns were poor.

- After rising to our end 2021 forecast of $US0.80 in February the $A fell as the iron ore price fell, the Fed became more hawkish and China tensions persisted.

- Due to solid share and property returns offsetting soft returns from bonds and cash, balanced super funds have seen strong returns – providing payback for a weak 2020.

2022 – from pandemic to endemic

First the bad news: uncertainty over covid remains high and a new variant (Omicron or another) could cause an upset; inflationary pressures will be high for a while; the Fed is expected to raise rates three times; the RBA is expected to start hiking in November taking the cash rate to 0.5% by year end as the conditions for higher rates (inflation sustained in the target range, full employment & a 3% pace in wages) are likely to have been met; and political risk may have more impact.

In terms of politics: the mid-term elections in the US will likely see the Democrats lose control of Congress; French and Australian elections have potential to cause volatility (although Macron is ahead in France and the policy differences between the Government and ALP in Australia are minor compared to 2019); and tensions with China (over Taiwan), Russia (with a risk that it undertakes an invasion of southern Ukraine) and Iran (over its nuclear ambitions) are likely.

However, there is good reason for optimism about continuing economic recovery in the year ahead. First, while coronavirus remains a threat it appears to be having a far less negative impact on economies as vaccines and treatments get the upper hand. While uncertainty remains around Omicron and booster vaccines may need to be tweaked – it appears to be more transmissible but less deadly and if this is confirmed and if it comes to dominate other variants it could help hasten a progression to learning to live with coronavirus like the flu.

Second, excess savings of around $US2.3trn in the US and $250bn in Australia will provide an ongoing boost to spending.

Third, while monetary policy will start to tighten it will still be easy. Some easing in inflationary pressure as production increases and consumer demand swings back to services will provide central banks with breathing space and rate hikes in Europe and Japan are still years away. It’s usually only when monetary policy becomes tight that it ends the economic cycle and the bull market in shares and that’s a fair way off.

Fourth, inventories are low and will need to be rebuilt which will provide a boost to production.

Fifth, positive wealth effects from the rise in share and home prices will help boost consumer spending.

Sixth, the Chinese Government looks to be becoming more focussed on boosting growth, so more policy easing is likely.

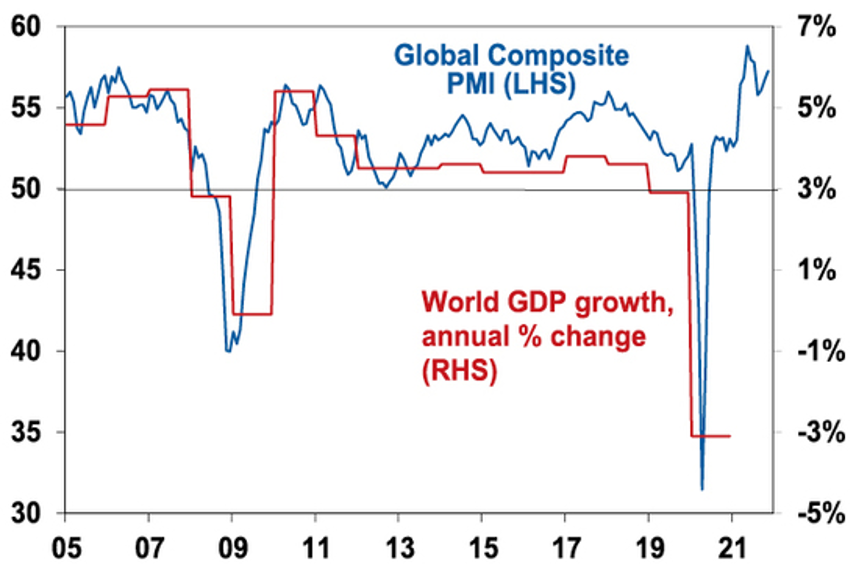

Finally, while business surveys are down from their highs, they remain strong consistent with good growth.

Global Composite PMI vs World GDP

Source: Bloomberg, IMF, AMP Capital

Overall global growth is likely to be around 5%, down from 2021 but still strong. In Australia, recovery from the recent lockdowns supported by excess saving, strong business investment & high confidence levels suggest growth of around 5.5%. This is likely to support profit growth albeit at a slower pace than in 2021.

Implications for investors

Still solid economic growth, rising profits and still easy monetary conditions should result in good overall investment returns in 2022 but they are likely to be more constrained and volatile.

- Global shares are expected to return around 8% but expect to see the long-awaited rotation away from growth & tech heavy US shares to more cyclical markets in Europe, Japan & emerging countries. Inflation, the start of Fed rate hikes, the US mid-term elections & China/Russia/Iran tensions are likely to result in a more volatile ride than 2021. Mid-term election years normally see below average returns in US shares and since 1950, have seen an average top-to-bottom drawdown of 17%, usually followed by a stronger rebound.

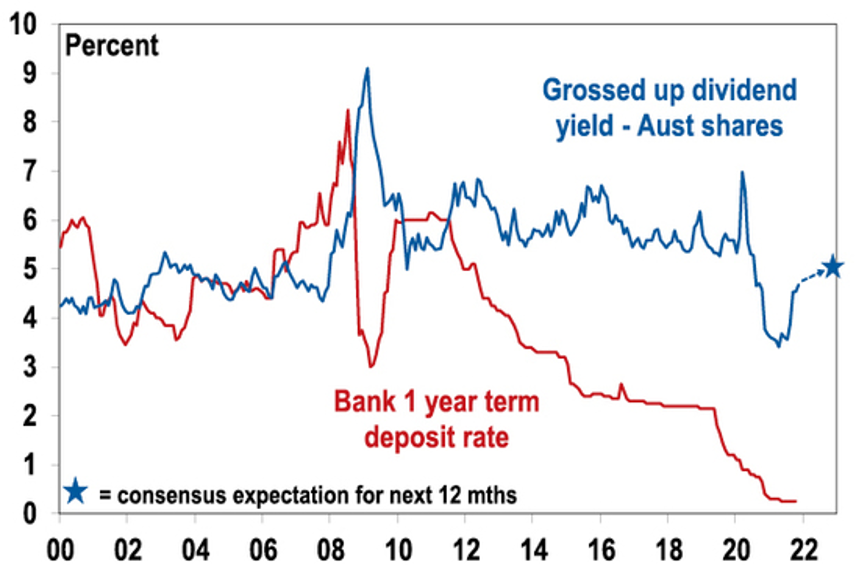

- Australian shares are likely to outperform (at last) helped by stronger economic growth than in other developed countries, leverage to the global cyclical recovery and as investors continue to search for yield in the face of near zero deposit rates but a grossed-up dividend yield of around 5%. Expect the ASX 200 to end 2021 back around 7,800.

Australian shares offer a very attractive yield versus bank deposits

Source: Bloomberg, AMP Capital

- Still very low yields & a capital loss from a rise in yields are likely to again result in negative returns from bonds.

- Unlisted commercial property may see some weakness in retail and office returns, but industrial is likely to be strong. Unlisted infrastructure is expected to see solid returns.

- Australian home price gains are likely to slow with prices falling later in the year as poor affordability, rising fixed rates, higher interest rate serviceability buffers, reduced home buyer incentives and rising listings impact.

- Cash and bank deposits are likely to provide very poor returns, given the ultra-low cash rate of just 0.1%.

- Although the $A could fall further in response to coronavirus and Fed tightening, a rising trend is likely over the next 12 months helped by still strong commodity prices and a decline in the $US, probably taking it to around $US0.80.

What to watch?

The main things to keep an eye on in 2022 are as follows:

- Coronavirus – new variants could set back the recovery.

- Inflation – if it continues to rise and long-term inflation expectations rise, central banks will have to tighten aggressively putting pressure on asset valuations.

- US politics – political polarisation is likely to return to the fore in the US posing the risk of a deeper than normal mid-term correction in shares. However, US political gridlock is usually good for shares.

- China issues are likely to continue – with the main risks around its property sector and Taiwan.

- Russia – a Ukraine invasion could add to EU energy issues.

- The Australian election – but if the policy differences remain minor a change in government would have little impact.

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

|