Key points

- Shares have had a strong run up from their March lows with US shares now at a record high.

- While shares are vulnerable through the seasonally weak months ahead in the run up to the US election, the positives – including good progress in developing vaccines, the downtrend in the US dollar, signs of recovery and low interest rates – are likely to see shares push higher on a six to 12 month view.

- This is likely to see US shares start to underperform.

Introduction

Share markets have had a spectacular rebound from their March lows. The rebound has been led by the US share market which is up 52% and has just risen above its February record high, making it the fastest recovery after a 30% or more fall on record. Other share markets have lagged but are still well up from their lows. This includes the Australian share market which recently rose to its highest level since early March.

The rebound in share markets

|

Share market

|

% fall from high to March low

|

% rise from March low

|

% distance from high

|

|

US

|

-34

|

+52

|

+0.3

|

|

Eurozone

|

-38

|

+37

|

-15

|

|

Japan

|

-31

|

+38

|

-5

|

|

UK

|

-35

|

+20

|

-22

|

|

Global (MSCI)

|

-33

|

+45

|

-3

|

|

Australia

|

-37

|

+35

|

-15

|

Source: Bloomberg, AMP Capital

A common concern remains that the rebound is irrational. How can shares be so strong when June quarter GDP collapsed - by an average of -10% in developed countries and an estimated -7% in Australia - and coronavirus continues to reap havoc?

But as the investor Sir John Templeton once said: “bull markets are born on pessimism, grow on scepticism, mature on optimism and die of euphoria” and we have certainly seen the run up since March occur against the backdrop of a lot of pessimism. The plunge in shares into March led the coronavirus hit on the way down and surprised many at the severity of the fall and now it’s led on the way up despite lots of worries. It’s also worth noting that shares have spent much of the period since early June rangebound (and apart from the US share market, many still are) and this has helped correct the excessive speed of the run up into June that left shares technically overbought & due for a consolidation or correction.

More fundamentally though, the positives for shares continue to outweigh the negatives. Let’s start with the negatives.

The negatives

Several negatives continue to hang over shares and are often cited as the main reason to expect sharp falls ahead.

- First, coronavirus has yet to come under control globally, particularly in emerging countries, and most developed countries have seen second waves. This poses the threat of a return to debilitating lockdowns and people behaving more cautiously. So far it’s seen the global reopening stall. In Victoria it’s been reversed, which will likely delay the recovery in Australian GDP into the December quarter.

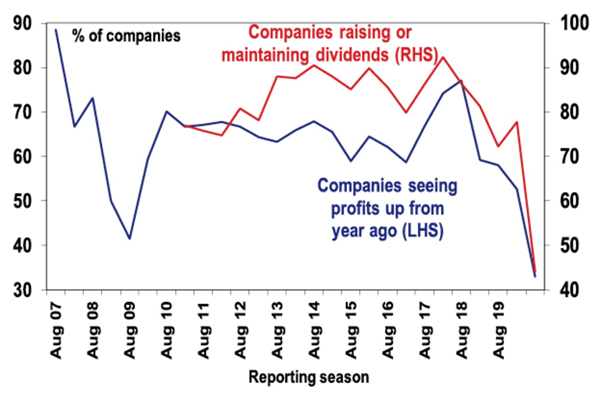

- Second, this is occurring at a time of a massive hit to economic activity and profits, and very high underlying unemployment. The US June quarter earnings reporting season saw earnings fall 32% year on year and 2019-20 earnings in Australia are expected to have fallen 22%, resulting in the worst slump since the 1990s recession, with 67% of companies to have reported June half earnings so far seeing a decline in earnings and 56% cutting dividends.

Proportion of Australian companies seeing profits up and raising or maintaining dividends

Source: AMP Capital

- Third, the recovery going forward may be slow as some things will take longer to recover (eg, travel), some things may never fully come back (eg, a big shift to on-line shopping, working from home, education & health care) and businesses will use the uncertainty to accelerate cost savings. All of which will mean a long tail of unemployment and economic activity below its pre-coronavirus path.

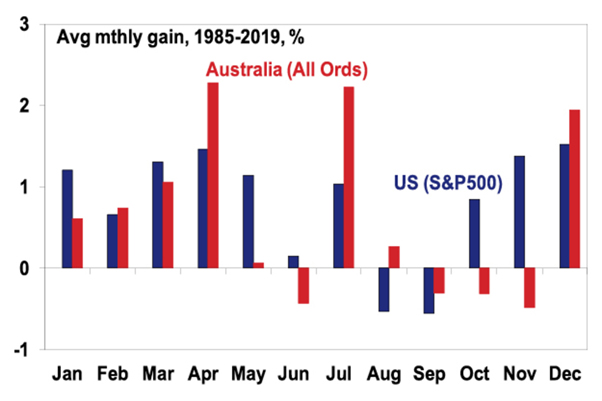

- Fourth, we are now in a seasonally weak time of the year for shares, with August and September being the weakest months of the year on average for US shares. And consistent with this, the recent rise in the US share market to new highs has come on narrow participation amongst stocks suggesting the risk of another short-term correction.

September is often weak for shares

- Fifth, the run up to the US election has the potential to drive increased share market volatility if it looks likely that Biden will win and raise taxes, and if Trump decides he has nothing to lose and ramps up tensions with China & Europe.

- Finally, shares are expensive on traditional metrics like PEs and more esoteric measures like the ratio of share market capitalisation to GDP and the market value of companies relative to the book value of their assets.

The positives

However, there are a bunch of positives providing an offset.

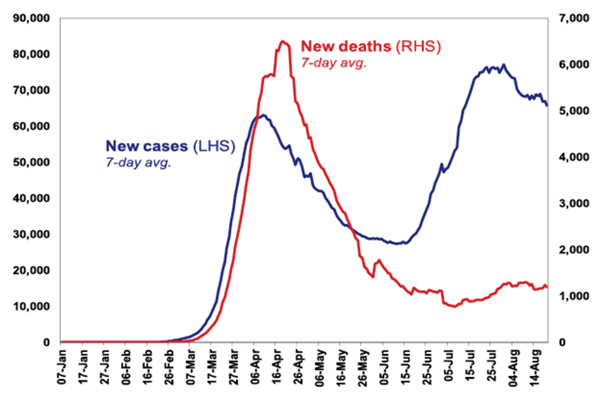

- First, the second wave of new coronavirus cases in developed countries has been far less deadly than the first. This likely reflects more young people being infected, better testing, better protections for older people and better treatments. This in turn has seen most countries avoid a return to a full lockdown and limited the hit to confidence.

Developed countries: New cases & deaths

Source: ourworldindata.org; AMP Capital

A decline in new cases in the US has enabled the recovery there in high-frequency economic indicators like credit card spending and mobility to resume after a pause in July.

- Second, there has been good progress in terms of vaccines and treatments. Several vaccines have seen promising results and are in Phase 3 trials to see if they provide protection. Note though that mass deployment is unlikely till next year & they may not provide complete protection (more like a flu vaccine than a measles vaccine) and may have to be combined with treatments (of which there has also been positive developments with Remdesivir and a steroid).

- Third, easy monetary and fiscal policy is continuing to support economies, incomes and jobs in contrast to the situation when the first wave started in developed countries in late February. This is different to normal recessions where it takes longer for policy makers to swing into action.

- Fourth, the fall in the “safe haven” US dollar and rising commodity prices (with metal prices back to their pre-coronavirus levels) is a sign of global reflation and recovery.

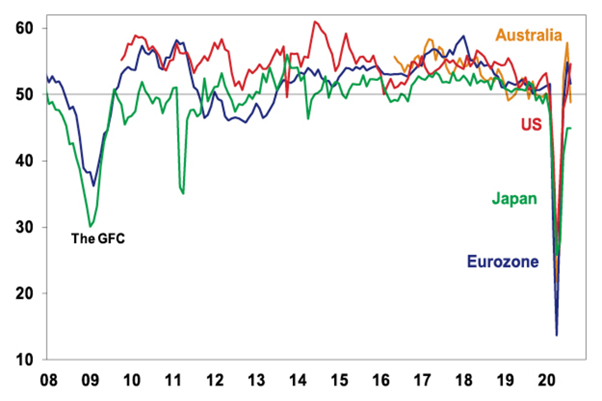

- Fifth, a range of economic indicators have seen a Deep V rebound starting in China and then in developed countries, suggesting significant pent up demand and that people still want to spend. This is most evident in business conditions PMIs. While developed country PMIs were mixed in August (with Australia and Europe down, Japan flat and the US and UK up) they remain consistent with recovery and have enabled share markets to look through the June quarter slump in earnings (which itself has been less bad than feared). On balance we see a gradual economic recovery from here as some things take longer to return to normal.

G3 & Aust composite business conditions PMIs

Source: Bloomberg, AMP Capital

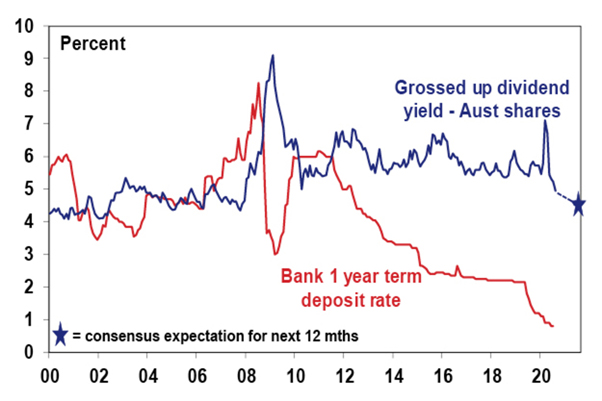

- Sixth, the plunge in interest rates and bond yields have increased the present value of shares, which explains why PE ratios are so high. So shares remain attractive despite lower earnings and pidends because the alternatives like bank deposit rates are even less attractive.

Aust shares still offer an attractive yield versus bank deposits

Source: RBA; Bloomberg, AMP Capital

- Finally, investors are still cautious which is positive from a contrarian perspective. Despite day traders piling into some stocks retail investor sentiment is soft & there has continued to be fund flows out of equities in the US into bonds.

Concluding comment

On balance the positives dominate in our view. Shares remain vulnerable to short-term setbacks given uncertainties around coronavirus, the speed of economic recovery, the US election and US/China tensions. But the positives should keep any pull back to being a correction and on a 6 to 12-month view shares are expected to see reasonable returns.

But will the US share market continue to outperform?

As evident in the first table, US shares have outperformed since the March low. They have also outperformed year to date with US shares up 5.2%, but Eurozone shares down 13%, Japanese shares down 3.1% & Australian shares down 8.5%. The strong outperformance by the US share market reflects its relatively low exposure to cyclical sectors (like manufacturing, materials & financials) that were hit hard by coronavirus and a greater exposure to growth sectors like IT and health that benefit from coronavirus and very low interest rates. As the global economy gradually recovers and interest rates bottom, this will benefit cyclical sectors relative to IT and health which have become expensive and this will likely see US shares underperform relative to non-US shares, including Australian shares.

In terms of the US election, a Trump victory would likely benefit US shares (tax hikes averted) but a Biden victory would benefit non-US shares (more harmonious foreign and trade relations).

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

|