- Australian home prices are likely to fall by 10% to 15% into 2024 primarily as a result of poor affordability and rising interest rates.

- The negative wealth effect from falling home prices should help limit how much the RBA raises rates.

- A change in Government is unlikely to significantly affect the outlook for home prices, but medium-term price gains are likely to be more constrained as the tailwind from ever lower interest rates comes to an end.

Introduction

House prices always incite a lot of interest in Australia. Until recently it was all about surging prices and ever worsening affordability as prices boomed. But the focus is shifting to the emerging slowdown in the face of rising interest rates. This note provides a Q&A on the main issues.

What is the current state of the property market?

Last year saw national average home prices rise 22%, their fastest 12-month increase since 1989, with gains propelled by record low mortgage rates, home buyer incentives, coronavirus driving a switch in spending to “goods” like housing, recovery from the lockdowns, a lack of supply and a fear of missing out.

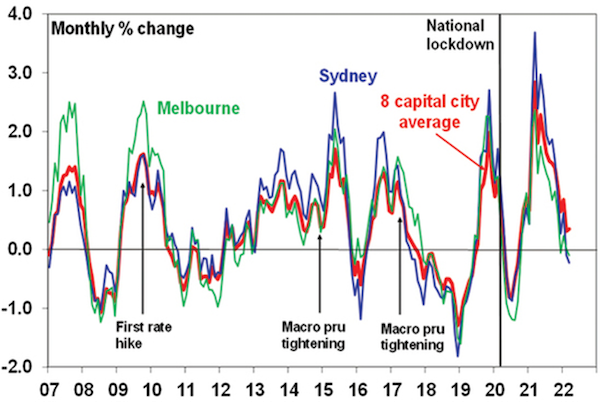

Average capital city home prices

Source: CoreLogic, AMP Capital

However, monthly capital city and national price growth peaked in March last year at 2.8% and has trended down to just 0.3% for capital cities in March this year. The slowing trend since March last year has been led by Sydney and Melbourne, with prices now falling in both cities. But price gains remain very strong in Brisbane and Adelaide with property demand in Brisbane benefitting from strong interstate migration, and these cities seeing less of an affordability constraint and very low listings. Perth is accelerating, helped by its reopening to other states. And regional price growth remains very strong.

What is the outlook for home prices?

National average property prices are likely to peak around mid-year and then enter a cyclical downswing. After 22% growth in national average home prices last year, average home price growth this year is expected to be around 1% and we expect a 5-10% decline in average prices in 2023. Top to bottom the fall in prices into 2024 is likely to be around 10 to 15%, which would take average prices back to the levels of March/April last year.

This is likely to mask a continuing wide divergence. Sydney & Melbourne look like they have already peaked & are likely to see falls at the high end of the range. But Brisbane, Adelaide, Perth & Darwin and regional areas are less constrained by poor affordability and are likely to see shallower falls.

Have home prices fallen before?

A common property myth is that home prices only ever go up and never fall. But a simple look at history tells us this is not so.

- Real house prices in Sydney fell 36% in 1934-35, 32% in 1937-41, 41% in 1942-43, 12% in 1947-48, 14% in 1951-53, 12% in 1961-62 and 22% in 1974-77.

- In nominal terms, CoreLogic data shows that Sydney dwelling prices had top to bottom falls (greater than 5%) of 25% in 1980-83, 10% in 1989-91, 8% in 2004-06, 7% in 2008-09 and 15% in 2017-19.

- Similarly capital city average prices had top to bottom falls (greater than 5%) of 9% in 1982-83, 6% in 1989-91, 8% in 2008-09, 6% in 2010-12 and 10% in 2017-19.

All of the price falls since 1980 were preceded by interest rate hikes or, in 2017-19, by a reduced supply of loans.

What are the key drivers of the current downswing?

The slowdown in property price growth already underway and the likely fall in prices ahead reflects a combination of:

- Poor affordability. Over the last 25 years average capital city dwelling prices rose 358% compared to a 113% rise in wages. So prices rose more than three times that of wages. From their most recent low in September 2020, prices have gone up 20% versus just a 3.7% rise in wages. This has priced more home buyers out of the market.

- Rising fixed mortgage rates. These have nearly doubled from their lows & are still rising, reflecting rising bond yields.

- RBA rate hikes. The RBA is expected to start hiking rates in June likely pushing variable mortgage rates up by nearly 1% by year end and by 1.5% by mid next year. Rough estimates suggest that a 1.5% to 2% rise in mortgage rates would reduce home buyer borrowing power and the ability to pay for a house by 10 to 15%. Note that RBA modelling suggests that a 2% rise in interest rates would lower real house prices by around 15% over a two-year period.

- High inflation is making it even harder to save for a deposit.

- Higher supply in Sydney and Melbourne as a result of vendors seeking to take advantage of high prices and solid construction after two years of zero immigration.

- A rotation in consumer spending back to services as reopening continues which may reduce housing demand.

- And a decline in home buyer confidence.

The major driver is the rise in interest rates. While the property slowdown appears to be starting earlier relative to the timing of RBA rate hikes this cycle, this reflects the bigger role ultra-low fixed rate mortgage lending played this time around in driving the boom. Normally fixed rate lending was around 15% of new home lending, but over the last 18 months or so it was around 40% as borrowers took advantage of sub 2% fixed mortgage rates. But now fixed rates are up sharply which is taking the edge of new buyer demand well ahead of RBA hikes.

Will Australian home prices crash?

House price crash calls have been a dime a dozen over the last two decades, only to see the boom roll on after periodic dips. So, the experience since the early 2000s warns against getting too bearish. Some would see a 15% fall in prices as a crash, but I take it to mean prices falling 25% or so. Our assessment is that while a crash is possible, it is unlikely unless we see very aggressive rate hikes – say taking the cash rate to 4 or 5% - or much higher unemployment, driving a sharp rise in defaults and forced property sales. Several factors argue against a crash:

- RBA analysis suggests the “majority of households are well placed to manage higher…loan payments” and that for example just over 40% of variable rate borrowers would see no increase in monthly payments from a 2% mortgage rate rise as they are already paying in excess of the minimum.

- The RBA will only raise rates as far as necessary to cool inflation. It knows that high household debt levels compared to the past mean that the household sector is more sensitive to higher rates and therefore it won’t need to raise rates as much as in the past to cool spending and, hence, inflation. So, it won’t be on autopilot mindlessly hiking and crashing the property market and economy in the process.

- Very low rental property vacancy rates suggest that the underlying property market remains tight.

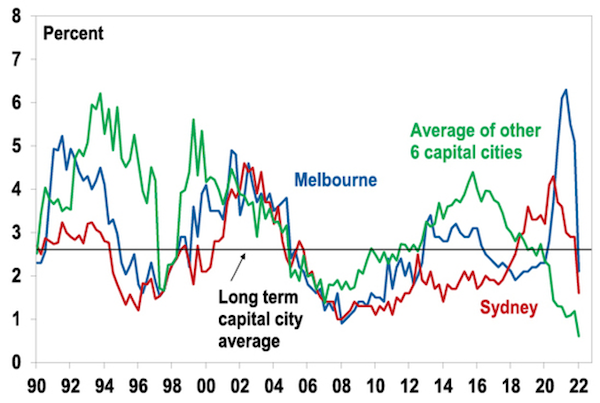

Residential vacancy rates

Source: REIA, Domain (for last observation), AMP

- The increase in home deposit schemes and rising immigration will help place a floor on housing demand.

However, the risk of a crash cannot be ignored given the high level of household debt and that it’s been more than 11 years since the last rate hike in Australia, meaning many current borrowers have never seen a tightening cycle.

What will be the impact on the economy?

The housing downturn will affect the economy via negative wealth effects on consumer spending (ie, wealth goes down, we feel poorer, we spend less) and a slowing in housing construction. The former was a significant drag on the economy in the 2017-19 period when a 10% fall in average home prices contributed to a significant slowing in consumer spending.

What will it mean for interest rates?

In a way the negative wealth effect of falling home prices means that the slowing housing cycle will do some of the RBA’s work for it, which means there is a good chance that it will pause tightening next year (at around 1.5% for the cash rate) – which in turn should limit the fall in house prices to 10 to 15%.

Are we near the end of the 25 year home price boom?

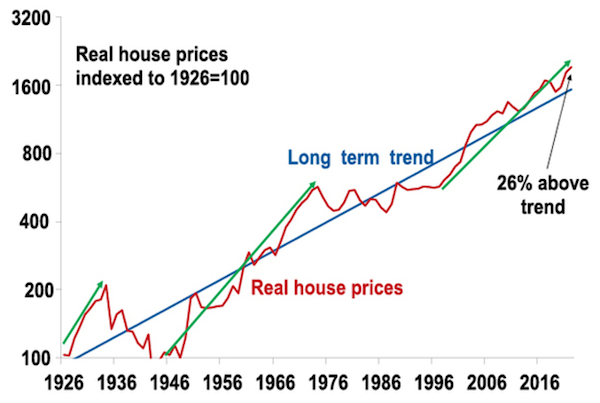

The past 100 years has seen 3 major long-term booms in Australian home prices – in the late 1920s, the post WW2 period and since the late 1990s. These are highlighted with green arrows in the next chart that shows real house prices back to 1926. The boom over the last 25 years has largely been driven by the shift from high interest rates to low interest rates and a surge in population relative to housing supply.

Aust house prices relative to their long term trend

Source: ABS, AMP

At present the unfolding property downswing looks like just another cyclical downswing. But the 25-year bull market is likely to come under pressure in the years ahead.

- First the 30-year declining trend in mortgage rates from 17% in 1989 to 2% last year - which has enabled new buyers to progressively borrow more, and hence pay more for property, is now likely over.

- Second, “work from home” & the associated shift to regions may take some pressure off capital city prices.

What to do to permanently improve affordability?

My shopping list on this front includes:

- Measures to boost new supply - relaxing land use rules, releasing land faster and speeding up approval processes.

- Matching the level of immigration in a post pandemic world to the ability of the property market to supply housing.

- Encouraging greater decentralisation – the work from home phenomenon shows this is possible but it should be helped along with appropriate infrastructure and housing supply.

- Tax reform to replace stamp duty with land tax (making it easier for empty nesters to downsize) & cutting the capital gains tax discount (to remove a pro-speculation distortion).

Neither side of politics is offering a serious effort on this front.

Would a change of Government impact the outlook?

It’s doubtful. Unlike in 2019 when the ALP’s policy was to limit negative gearing and raise capital gains tax, which modelling indicated could reduce property prices by 2% to 9%, this time around the policy differences with respect to property between the ALP and the Coalition are minor. Out of interest, using CoreLogic data since 1980 capital city property prices have risen 6.6%pa under Coalition governments and 5.2%pa under Labor. But the dominant influence has been the economic cycle and interest rates, as policies with respect to housing have not been particularly different (excepting the brief removal then return of negative gearing in 1985 and 1987).

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

|