Retirement used to represent a sharp break with the past—one day you were working full time, the next you were sitting at home with the rest of your life ahead of you. These days, the transition doesn’t have to be quite so abrupt.

Many Australians are keeping themselves active and engaged by continuing for longer in the workforce on a part-time or contractual basis. In fact, more than two

in five Australians who work full time and intend to retire are looking to reduce their hours first.(i)

The good news is that in the few years prior to retirement you can start to draw an income from your retirement nest egg while you continue working and contributing towards your super.

Access your super the smart tax way

If you’ve reached your super ‘preservation age’ (currently 55 but rising to 60), you can take some of your existing super as an income stream to help make your transition to retirement a smooth one.

This is called a transition to retirement (TtR) strategy. And it can be very tax effective.

- You can continue to work and contribute towards your super using tax-effective salary sacrifice contributions.

- You can top up your income with a tax-effective income stream from your retirement account (between 4% and up to 10% of the account balance can be drawn each year).

- And there’s even a way to ‘refresh’ your TtR strategy every year for potentially even more tax benefits.

There are two main ways you can use a TtR strategy.

1. Less work, potentially the same after-tax income

The first option is a TtR strategy that may allow you to cut down your working hours while maintaining the same level of after-tax income.

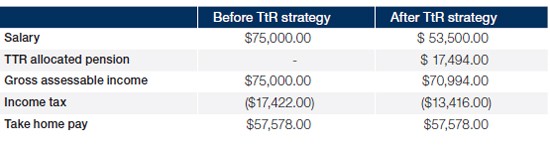

Let’s say you’re over 55, you earn $75,000 a year before tax and you have $250,000 in your super. You want to cut back your working hours, which will reduce your before tax salary from $75,000 to $53,500.

As shown in the table below, by using a TtR strategy, you can maintain your after-tax income, despite reducing your work hours.

But it does come at a price—your super balance may dwindle over time as you draw down your pension payments.

2. Same hours, more super

The other option is a TtR strategy that may allow you to maintain your work hours, but increase your salary sacrifice contributions to super, and supplement your income with a TtR pension so that there is no reduction in your after-tax income.

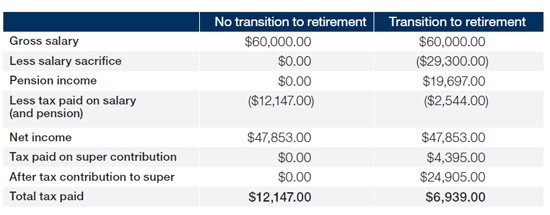

So let’s say you’re over 60, earning $60,000 a year before tax and you have $200,000 in your super, and you choose to use the full amount to start a pension.

As shown in the table below, together with your pension income, you can salary sacrifice $29,300 a year and still receive the same amount of after-tax income in your pocket.

What’s more at the end of the year, you’ve boosted your super by $5,208.

Finding the right balance

A TtR strategy can be an effective way to boost your super savings, but it also has superannuation, taxation and social security implications.

What you need to know

The examples provided are illustrative only and are not an estimate of the income you will receive or fees and costs you will incur. The examples are based on the following assumptions:

- $35,000 p.a. concessional cap for individuals aged 60 and over, and after allowing Superannuation Guarantee contributions of 9.5%, the concessional cap is not exceeded.

- Tax rates for 1 July 2014 have been applied

- Individual earns less than $300,000 pa

i http://www.ausstats.abs.gov.au/ausstats/subscriber.nsf/0/61A0264E827F59C4CA25768E002C8F72/$File/

62380_jul 2008 to jun 2009.pdf

Important note: © AMP Life Limited. This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, AMP does not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, AMP does not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person.

|