... do whatever they like and be free from the demands of others – actually focusing on caring for themselves. But this step often means being free from financial worries or concerns and for a large proportion of women, the prospect of a comfortable retirement can seem elusive. Especially when you do the sums.

Source: www.superguru.com.au

The latest Intergenerational Report predicts the number of Australians aged 65 and over is likely to more than double by 2055 compared to today – and there could be as many as 40,000 people aged 100 and over by 2055. There were only 122 Australian

centenarians forty years ago. Both male and female average life expectancies will jump significantly, with males at birth expected to live for 95.1 years and females for 96.6 years. (i)

While the prospect of a longer life is great news, the rub is that we’ll need to find extra money to fund lengthier retirements. Pauline Vamos, CEO of peak superannuation industry association, ASFA, says this issue is particularly important for women, who are expected to live longer, “yet are retiring with around half as much superannuation as men”.

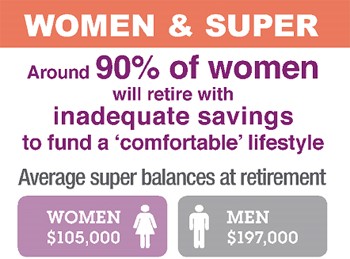

Less superannuation than men

Women retire, on average, with $105,000 in super savings, which is $92,000 less than men, according to ASFA. (ii) More concerning is that 1 in 3 women retire with no superannuation at all. The upshot is that around 90% of women retire with inadequate savings to fund a comfortable retirement. “Adequacy will also be a key factor, which is why we will continue to advocate for the Superannuation Guarantee (SG) to be increased to 12% as soon as possible,” said Ms Vamos.

There are many reasons for the difference in super savings. Not consolidating super accounts, a lack of personal contributions, and even a lack of knowledge about how superannuation works are factors. For many women taking time out of the workforce for children or caring for others, has a massive impact. According to an American research report, (iii) women are likely to take an average of 12 years out of the workforce for family related reasons – and it’s likely the situation is pretty similar in Australia. When women return to the workforce, they often take part-time/low-paid or even free employment for several years to balance having a care-giver role as well.

When women work full-time, their average earnings are often lower than the take home pay of men. As our SG contributions are often linked to our earnings, men generally end up with larger superannuation nest eggs than their female counterparts.

Building a bigger superannuation nest egg

On the plus side, women can take steps to build their retirement funds. For instance, it’s critical to check your super balance regularly, as well as the insurance and investment options to ensure they match your circumstances and future requirements.

If you’ve worked in several jobs, you’re likely to have multiple super accounts and you can save fees by consolidating your super into a good quality, low fee super account. This could save thousands in unnecessary fees, which over time can make a big difference. Also note there is more than $14 billion (iv) in lost super and some of it could be yours. To find lost super, go to www.ato.gov.au/Super and then ‘Find your lost super’ tab.

Some super funds are trying to close the ‘knowledge-gap’ when it comes to retirement savings and what individuals are eligible for. Consider taking advantage of the seminars offered by your super fund. Richard Denniss – Executive director, The Australia Institute, says “another way women can help themselves is to compare and switch funds with the aim of saving on fees: the average Australian spends more on super fees than they do on electricity.” (v)

And for working women backing yourself when it comes to discussing pay and negotiating total remuneration is vital. Being prepared to discuss your remuneration with confidence means making sure you can demonstrate the tangible value you contribute through your role. Never underestimate the lifetime value of earning your full worth.

Whatever your situation, “Those who receive financial advice are more likely to only rely on a part-pension rather than a full pension, ”said Mark Rantall, CEO of the Financial Planning Association of Australia (FPA). “They are more financially secure, have a greater level f standard of living and are able to better manage any longevity risk.”

Doing what you most want in your later years means taking regular, active steps to look after your financial health.

i http://www.treasury.gov.au/PublicationsAndMedia/Publications/2015/2015-Intergenerational-Report

ii http://www.superguru.com.au/super-sorter-power-hour

iii https://www.caregiver.org/women-and-caregiving-facts-and-figures

iv https://www.ato.gov.au/Media-centre/Media-releases/New-statistics-reveal-$14-billion-in-lost-super/

v https://www.wgea.gov.au/sites/default/files/Womens-Super-Summit.pdf

Important note: © AMP Life Limited. This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, AMP does not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, AMP does not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person.

|