AMP Capital’s Dr Shane Oliver suggests going in with your eyes open.

Reasons to buy off-the-plan

Benefits can exist in buying off-the-plan if you do your homework and are not buying at the top of the market.

First-home buyers can potentially get into the market and for investors it’s not a bad way to build a portfolio, particularly if buying at a discount.

1. Potentially pick up a bargain

To get a bank loan, developers often have to show interest in the property. They also like a degree of certainty before starting the development, and they’ll try selling a number of properties off-the-plan. You may be able to get a good price and may only need a small deposit, like 10% or so. Depending on your lender, you may not need a deposit if you guarantee the property against other assets.

2. First-home buyer advantage

Benefits of buying off-the-plan vary state to state and can depend on whether you’re a first-home buyer. There are stamp duty concessions in most states and if you’re a first-home buyer, you might get a grant if it’s a new development.

3. May be other incentives

Some developers provide short-term rental guarantees to attract buyers. And some allow for custom colour schemes, fixtures, fittings and appliances.

Reasons to think again

It usually means taking more risk than if you buy an established or completed building.

1. Unpleasant surprises

You can’t inspect an off-the-plan property. If something goes wrong during the build—interest rates rise or banks cut back financing—it can create financial problems. Developers can fall over when the market crashes and the building may be completed years later or never get off the ground.

Check your developer:

- has sound financing

- doesn’t have too much short-term debt

- has a good track record.

And assuming the development is finished, it:

- may not be what you thought - and getting the developer to fix defects could be hard

- might be harder to rent despite seemingly attractive short-term rental guarantees.

2. Better return elsewhere?

You may pay more up front for established dwellings, but you’re potentially earning rent from day one. Even when you’re earning rent, the net rental yield can be less than you might imagine once you factor in costs. In late 2014, the typical net rental yield was around 1-2%i.

Like other investments (aside from cash in the bank), you’re likely to be liable for CGT on selling, assuming there’s a profit.

3. Property may fall in value

If not completed for a while after you agree to buy, you risk it being worth less than you agreed to pay for it.

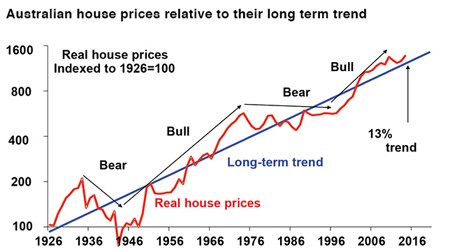

Home prices are rising for many reasons, including low interest rates and greater buyer confidence, plus high demand relative to supply.

Source: ABS, AMP Capital

Although likely to continue rising for a while, there’ll come a time (likely 2015) when the Reserve Bank will start raising interest rates - and this will act as a dampener on the property market.

The past few years saw two significant downturns when home prices fell on average between 5% and 10%— after the GFC and through 2011-12 (Real Estate Institute of Australia; AMP Capital). Riskier developments would have experienced greater falls.

Before buying off-the-plan ask your adviser for help to understand potential benefits and downsides.

Important note: © AMP Life Limited. This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, AMP does not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, AMP does not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person.

|